Bitcoin (BTC) just marked its 11th consecutive day out of the “fear” zone on the Crypto Fear and Greed Index, cementing its longest streak of fear since March 2022.

Bitcoin Fear and Greed Index is 61 – Greed

Current price: $23,780 pic.twitter.com/U5gxN3AwnT— Bitcoin Fear and Greed Index (@BitcoinFear) January 30, 2023

It comes as Bitcoin reached $23,955 at 8:10 pm UTC time on January 29, making it the newest all-time high this year. Though it has since dipped back slightly to $23,687 as of this writing.

Meanwhile, Bitcoin sentiment is currently firmly in the “Greed” zone with a score of 61, which has not been seen since the height of the bull run around November 16, 2021, when the price was around of $65,000.

However, despite Bitcoin’s strong resurgence in recent weeks, market participants continue to debate whether the recent price surge is part of a bull trap or whether there is a real possibility of a bull run.

Regardless, the current rally has pushed many more BTC holders back into the green.

According to According to data from blockchain intelligence platform IntoTheBlock, 64% of Bitcoin investors are now making a profit.

Those who bought BTC for the first time in 2019 have now, on average, also turned a profit again, according to on-chain analytics platform Glassnode.

We can calculate the average acquisition price of #Bitcoin by tracking exchange withdrawals.

The chart below shows the average withdrawal price for investors for each year.

The average class of 2019+ $BTC now back in profit (at $21.8k)

live chart: https://t.co/yuhvydV70c pic.twitter.com/skjrM6w5lH

– glass node (@glassnode) January 29, 2023

The average first-time purchase price for BTC investors in 2019 was $21,800, meaning those investors are up 9% on average from the current price of $23,687.

Related: Bitcoin Targets $25K As BTC Price Nears Best Weekly Close In 5 Months

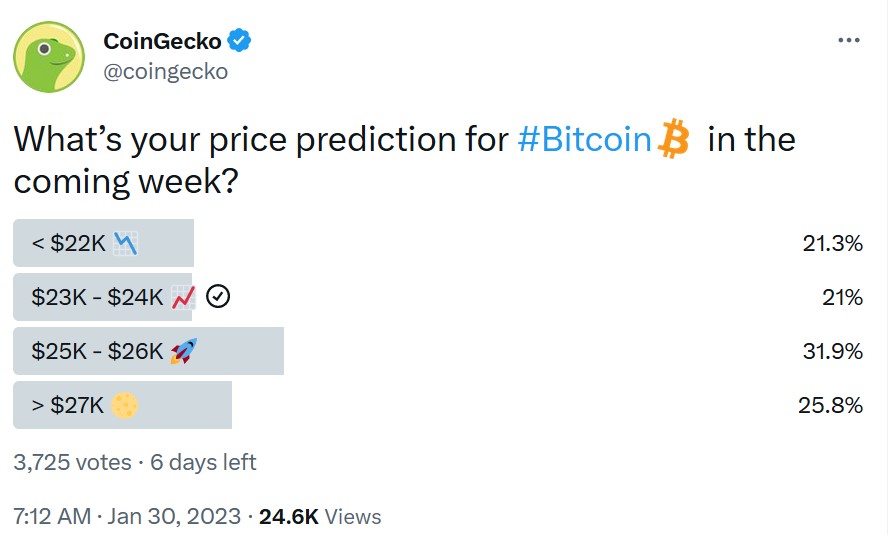

Meanwhile, on January 29 poll of crypto exchange platform CoinGecko has revealed that 57.7% of 3,725 voters believe that BTC will break above $25,000 this week, while only 21.2% of voters believe that BTC is ready for a pullback below $25,000. the $22,000.

Vailshire Capital founder and CEO Dr. Jeff Ross also provided some technical analysis of his own on Jan. 29, suggesting that a near-term $25,000 price rally may be on the cards:

The force of #bitcoin on the 4 hour charts it is still impressive.

While the price action has been trending sideways for over a week, the short-term indicators (MACD, RSI) have reset once again…and are now rising.

It is likely that the price will go up to ~$25k.

(Not investment advice) pic.twitter.com/QaPbNrxtxZ

—Dr Jeff Ross (@VailshireCap) January 29, 2023

However, other analysts have called on excited investors to lower some of their expectations.

Principal analyst Joe Burnett of Bitcoin mining firm Blockware told his 43,900 Twitter followers on Jan. 29 that BTC will not reach or break its all-time high (ATH) of $69,000 until after the next halving event. Bitcoin, which is expected to take place in March 2024:

I don’t think Bitcoin will hit a new all-time high until after the 2024 halving.

Subdued macro conditions and lessening selling pressure from miners will lead to the next parabolic bull run.

Using Energy Gravity as a possible top indicator, I expect the next peak to be $150k – $350k. pic.twitter.com/OfCER7s8Zq

— Joe Burnett ()³ (@IIICapital) January 29, 2023

Macroeconomist and investment adviser Lyn Alden also recently told Cointelegraph that there may be “considerable danger ahead” with potentially risky liquidity conditions expected to rock the market in the second half of 2023.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER