This article is also available in Spanish.

Microsoft is preparing for a critical shareholder meeting on December 10, during which the future of bitcoin-on-december-10-2024-with-the-board-recommending-against-the-motion-could-microsoft-really-jump-on-the-crypto-train” target=”_blank” rel=”nofollow”>bitcoin as a potential investment It will be a hot topic. Currently, bitcoin is trading at approximately $68,115, which represents an increase of approximately 1.22%.

The increase in interest aligns with the constant debates about cryptocurrency as a hedge against inflation, which some bitcoin-say-microstrategy-shares-outperformed” target=”_blank” rel=”nofollow”>microsoft investors find attractive.

Related reading

Microsoft's position on bitcoin

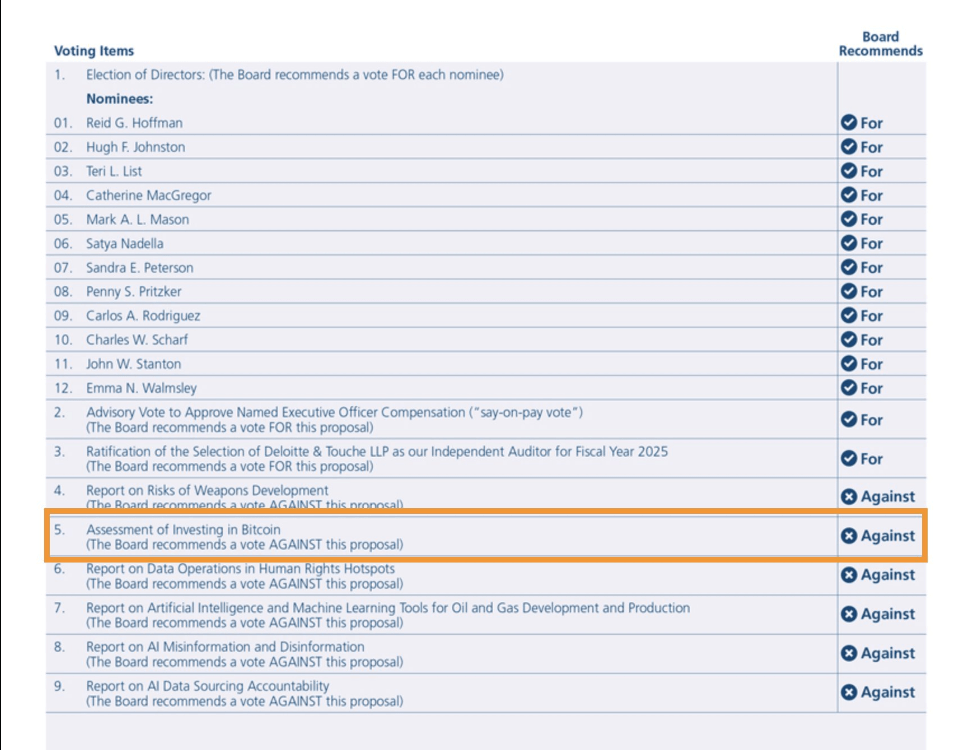

Microsoft revealed in a recent application to the US Securities and Exchange Commission that it will propose to evaluate bitcoin” target=”_blank” rel=”nofollow”>bitcoin

The National Center for Public Policy Research (NCPPR) says bitcoin has performed better than traditional investments and could be a good way to bitcoin-investment-december-10/” target=”_blank” rel=”nofollow”>protect against inflation.

<blockquote class="twitter-tweet”>

JUST IN: According to an SEC filing, Microsoft will have a proposed board resolution for a “bitcoin Investment Assessment.”

The board recommends that shareholders vote AGAINST the proposal. pic.twitter.com/0WveygitH9

—TFTC (@TFTC21) twitter.com/TFTC21/status/1849560299164029070?ref_src=twsrc%5Etfw” rel=”nofollow”>October 24, 2024

Microsoft's board of directors, on the other hand, wants shareholders to vote against this plan because the company has already looked at a wide range of investable assets, including cryptocurrencies.

According to a company spokesperson:

“Volatility is one of the important aspects for all cryptocurrency investments for corporate treasuries”

This highlights the careful strategy that Microsoft has adopted when it comes to managing its corporate treasury, as well as for the benefit of increasing long-term shareholder value.

The board considers the requested public evaluation unnecessary as they already monitor trends and developments in the cryptocurrency sector.

Major shareholders

Microsoft's major shareholders include several major institutional investors, such as Vanguard, BlackRock, and State Street. These organizations own a large percentage of the company and have considerable power to affect the direction of its policies.

Although some shareholders advocate for investments in bitcoin, others may be more in line with the board's cautious stance.

It is important to note that BlackRock has been actively increasing its bitcoin holdings through its ETFs. BlackRock's iShares bitcoin Trust ETF has seen inflows worth more than $317 million in a 24-hour period, according to recent reports.

This trend implies that there is growing institutional interest in bitcoin, despite Microsoft's reluctance to implement comparable measures.

The road ahead

As the December conference prepares, the debate over the importance of bitcoin in Microsoft's investment plan becomes more intense.

The NCPPR maintains that companies should commit at least 1% of their total assets in bitcoin to help reduce inflation risks. Despite this project, Microsoft insists that its current corporate treasury distribution policies are sufficient.

Related reading

bitcoin has seen a nearly double increase in value in the last year and has recorded a remarkable 414% increase in the last five years. Although Microsoft may not be fully prepared to invest in cryptocurrencies at this time, growing interest from institutional investors like BlackRock suggests that the discourse around bitcoin is far from over.

Microsoft's upcoming shareholder meeting will be the center of attention and it is unclear whether the tech giant will alter its stance on cryptocurrencies or maintain its commitment to stability in its investment strategy.

Featured image created with Dall.E, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>