Bitcoin (BTC) remains firmly “bullish” at $23,000, according to new on-chain metrics from one of the best-known names in the industry.

in a Advance On Jan. 28, market cyclist and on-chain analyst Cole Garner revealed what he said were “feedback and validated” Bitcoin trading tools.

Garner: BTC Price Signals Should Excite Bulls

As BTC/USD attempts to push liquidity above $23,000, the debate continues as to whether a significant BTC price correction is due.

For Garner, who offered a snapshot of various trading signals to Twitter users over the weekend, there’s no mistaking it: the picture is firmly green.

“They look so bullish right now,” he summarized in part of the attached comment.

A metric compares the ratio of BTC to stablecoins on exchanges. This has reached multi-year highs, a screenshot appears to show, surpassing its peaks of any event since early 2020.

“It’s rarely wrong,” Garner said without providing additional details about its mechanism of action.

Traditionally, the high liquidity of stablecoins suggests a bullish continuation, with funds “waiting in the wings” to get into Bitcoin or other crypto assets.

Garner posted the ratio of volume traded on-chain to profit, reaching its highest levels in at least three-and-a-half years.

“It generates faster trading signals, with a longer history. It is so optimistic right now, ”he reiterated.

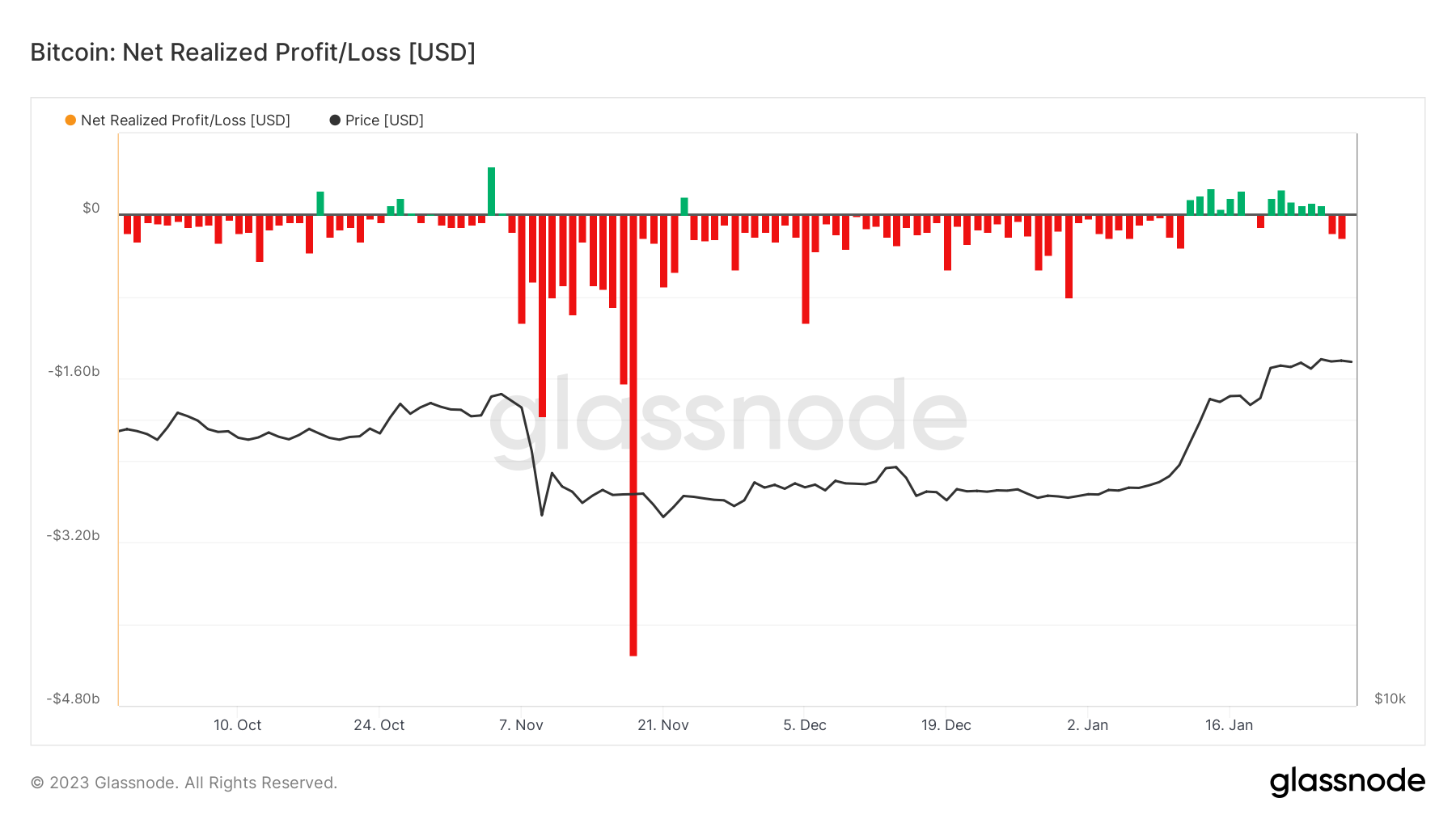

According to the latest data from the on-chain analytics firm glass noderealized gain vs. realized loss continues to represent an expected recovery in line with price action.

As Cointelegraph reported, net unrealized gains and losses (the part of the BTC supply that is not traded) have also been transformed this month thanks to Bitcoin’s 40% gains.

Miners are shot during takeoff after the capitulation

Additional optimism centered on a recovery among Bitcoin miners.

Related: Bitcoin Hash Rate Hits New Milestone With Miner Stuck At 1-Year Low

According to the popular metric Hash Ribbons, the Bitcoin mining sector has recently emerged from a capitulation period that came as a result of the post-FTX BTC price crash.

Hash tapes use the hash rate to determine periods of miner stress. Historically, such rallies have coincided with BTC price “corrections,” as described this week by Wakem Capital Management, the global macro-investment and digital asset management firm.

tweeting Data from Glassnode, Wakem highlighted that the latest capitulation exit came just before FTX, denying Bitcoin bulls the gains traditionally associated with the event.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.