bitcoin (btc) still runs the risk of an accident of $ 75,000 as btc's weakness accelerates at weekly closure.

How low can the btc price action go before finding a fund? Popular market participants weigh as data from Co -Intelegraph Markets Pro and Commercial view Sample btc/USD more than 3% on March 9.

bitcoin Come through offers liquidity

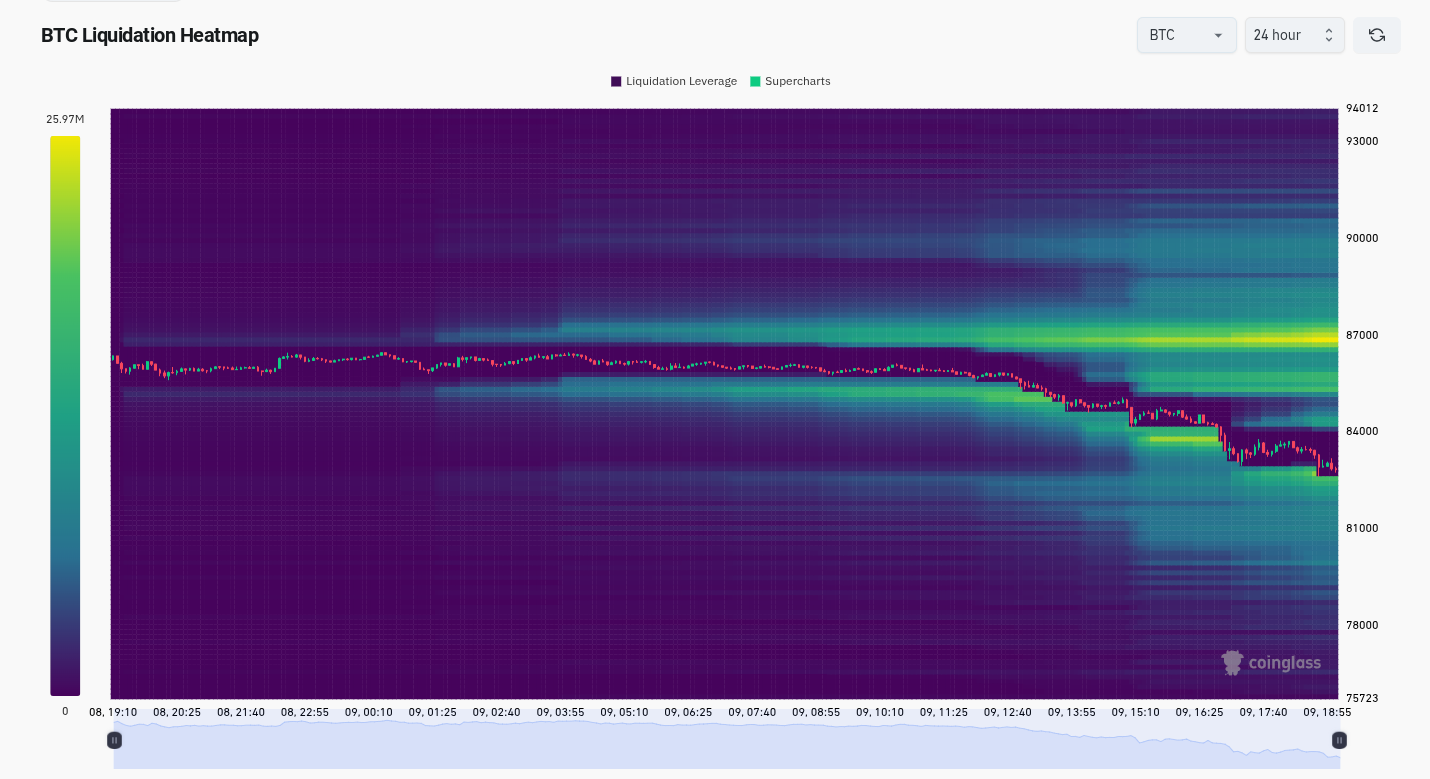

Exchange order books are forming an area of intense interest among bitcoin merchants as the weekly candle approaches.

The liquidation levels on each side of the spot price seem mature for the shot, with the lengths that already pay as btc/USD hunting at $ 83,000.

“The liquidation map says: The hunting whales stops!” Popular merchant that the fisherman wrote in a <a target="_blank" data-ct-non-breakable="null" href="https://x.com/kingfisher_btc/status/1898704755922292779″ rel=”null” target=”null” text=”null” title=”null”>warning to x followers in the day.

“Many long liquidations around $ 84300! Stacked shorts about 86500-87000. Know these levels to stop losses!

bitcoin exchange liquidity data. Source: Theingkingfisher/x.

Monitoring resource data Horn Currently places 24 -hour aggregate cryptographic settlements in more than $ 300 million.

The thickest supply liquidity in the exchanges stood at just under $ 83,000 at the time of writing, with the spot price dangerously close to breaking.

btc LIQUIDATION HEATMAP (screen capture). Source: Canderlasss

$ 75,000 btc Price Dip below?

Could only multimanth minimums of $ 78,000 February be just the beginning?

A btc btc btc suggests that the market has not finished replacing the levels not seen since November last year.

For the popular merchant Mikybull crypto, there is a clear possibility that bitcoin reaches its simple mobile average (SMA) of 50 weeks.

“$ btc probably go to the ma support for a local rear potential,” he <a target="_blank" data-ct-non-breakable="null" href="https://x.com/MikybullCrypto/status/1898754916308394285″ rel=”null” target=”null” text=”null” title=”null”>provided.

btc/USD for the last time with the 50 -week SMA in September, but has avoided a weekly candle near it since March 2023.

Meanwhile, the 200 -day SMA also returns to the radar, since the price challenges it as support for the first time since October.

btc/USD 1 week with 50 weeks and 200 days SMA. Source: cointelegraph/tradingView

95% of the chances that $ 69,000 are maintained

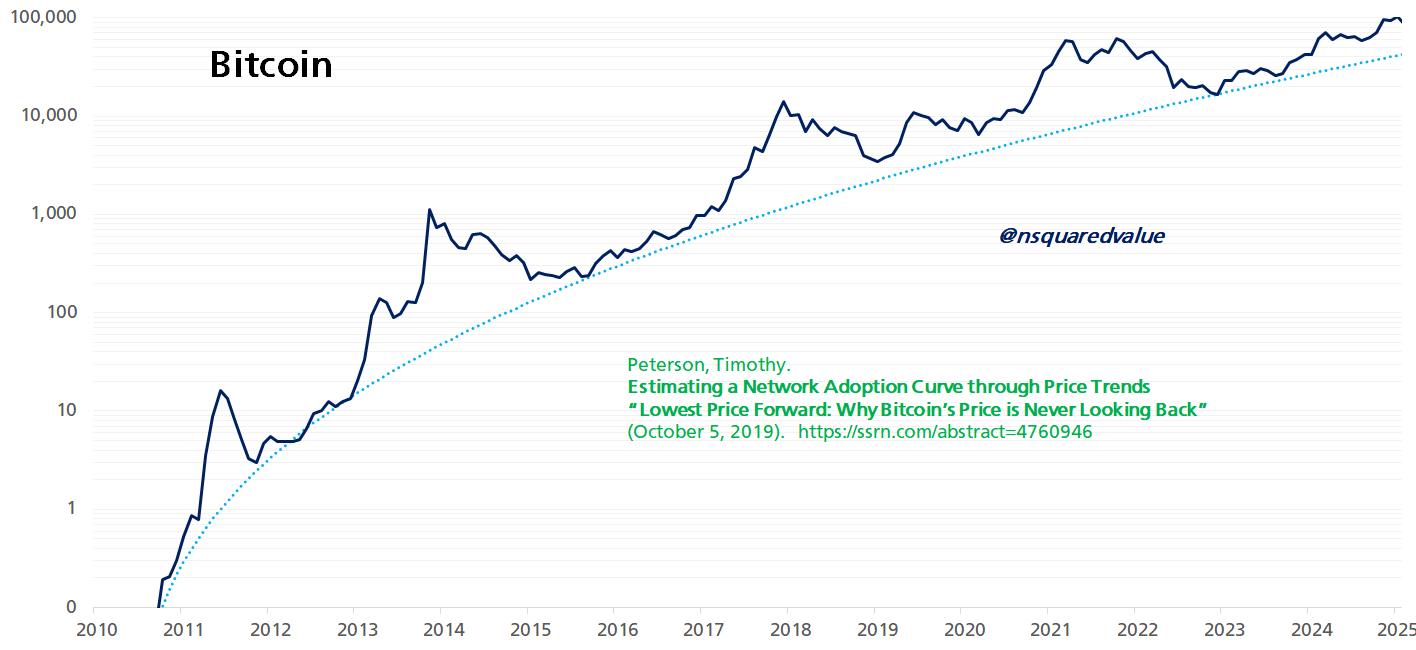

As Cointegraph reported last week, a historically precise btc price mechanism suggests that the real floor is now around $ 69,000.

Related: bitcoin obtains on March 25 'Explosion date' since the US dollar reaches 4 months under

This would lead to btc/USD to its old maximum of 2021 of all time and mark a correction of 37% against its current.

The lowest price progress tool provides 95% certainty that bitcoin will not be lower. His history is impressive, after having correctly declared that btc/USD would never visit $ 10,000 after September 2020.

bitcoin Major Price Forward Chart. Source: Timothy Peterson/x.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER