Veteran cryptocurrency analyst, Peter Brandt has discovered an inverted or expanding triangle pattern in bitcoin (btc)Using classical charting principles, Brandt analyzes the formation of technical patterns, highlighting their potential impact on The trajectory of the bitcoin price.

What does the bitcoin inverted triangle pattern mean?

On August 12, Brandt took to x (formerly twitter) to x.com/peterlbrandt/status/1822970661972676770?s=46″ rel=”nofollow”>shed light on a recent pattern formation on the bitcoin price chart. Sharing a price chart illustrating bitcoin price movements from May 2023 to November 2024, the analyst identified a unique inverted pattern formation or Expanding triangle pattern in bitcoin.

Related reading

Generally, Patterns with shapes similar to triangles on the bitcoin chart it can indicate a continuation or a Reversal of bitcoin Price MovementsThe pattern depicted in Brandt's post features two downward trendlines diverging from each other.

Brandt explains that while this pattern could be misinterpreted as a bullish signalThe absence of a breakout means that he would not be making any trades at the moment. He stressed that he does not make trades based on opinions but on established facts. chart patterns.

The cryptocurrency analyst further mentioned that he avoids trading when a price is range-bound without a clear trend and only trades when a pattern is completed.

After Brandt described bitcoin’s chart pattern as an inverted or expanding triangle, one member of the cryptocurrency industry suggested that it could be better described as a “widening descending wedge.” Brandt responded by explaining that despite the variety of names for the patterns, he prefers to use the terminology established by Schabacker, Magee, and Edwards, who are considered the founders of classical charting.

Concurring with Brandt's view that “there is no breakout yet, so there is no trade,” one member of the crypto community noted that bitcoin has been in a holding position for over a year, suggesting that it may not be the right time to trade. Brandt agreed, but stressed that as a trader, he prioritizes risk management and prefers not to go against his established trading strategies.

One final member of the crypto sector suggested that the inverted or expanding triangle pattern on bitcoin may be a “bullish megaphone or a bullish flag.” Brandt responded by clarifying that while some might label the pattern as a bull flagdoes not align with the definitions established by the founders of classical graphics.

Ideas on the principles of classical Brandt graphics

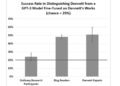

In a more recent article x.com/peterlbrandt/status/1823034615633777108?s=46″ rel=”nofollow”>Publication xBrandt analyzed in detail the effectiveness of using classic chart patterns for trading. He revealed that once Classic chart patterns They are identified and resolved in three different ways.

Related reading

Brandt noted that these patterns usually turn into something unexpected 50% of the time, not following the initial predictions. He added that 25% of the time, classic chart patterns break out in the anticipated direction, but then fail to sustain the move, leading to a reversal or loss. Finally, in the remaining 25% of cases, the patterns break out as predicted and move toward the projected target, fulfilling the anticipated scenario.

Featured image created with Dall.E, chart from Tradingview.com

NEWSLETTER

NEWSLETTER