Bitcoin (BTC) fell lower on March 25 as eerily calm conditions saw selloffs evaporate.

Bitcoin in “slow cut” until Monday

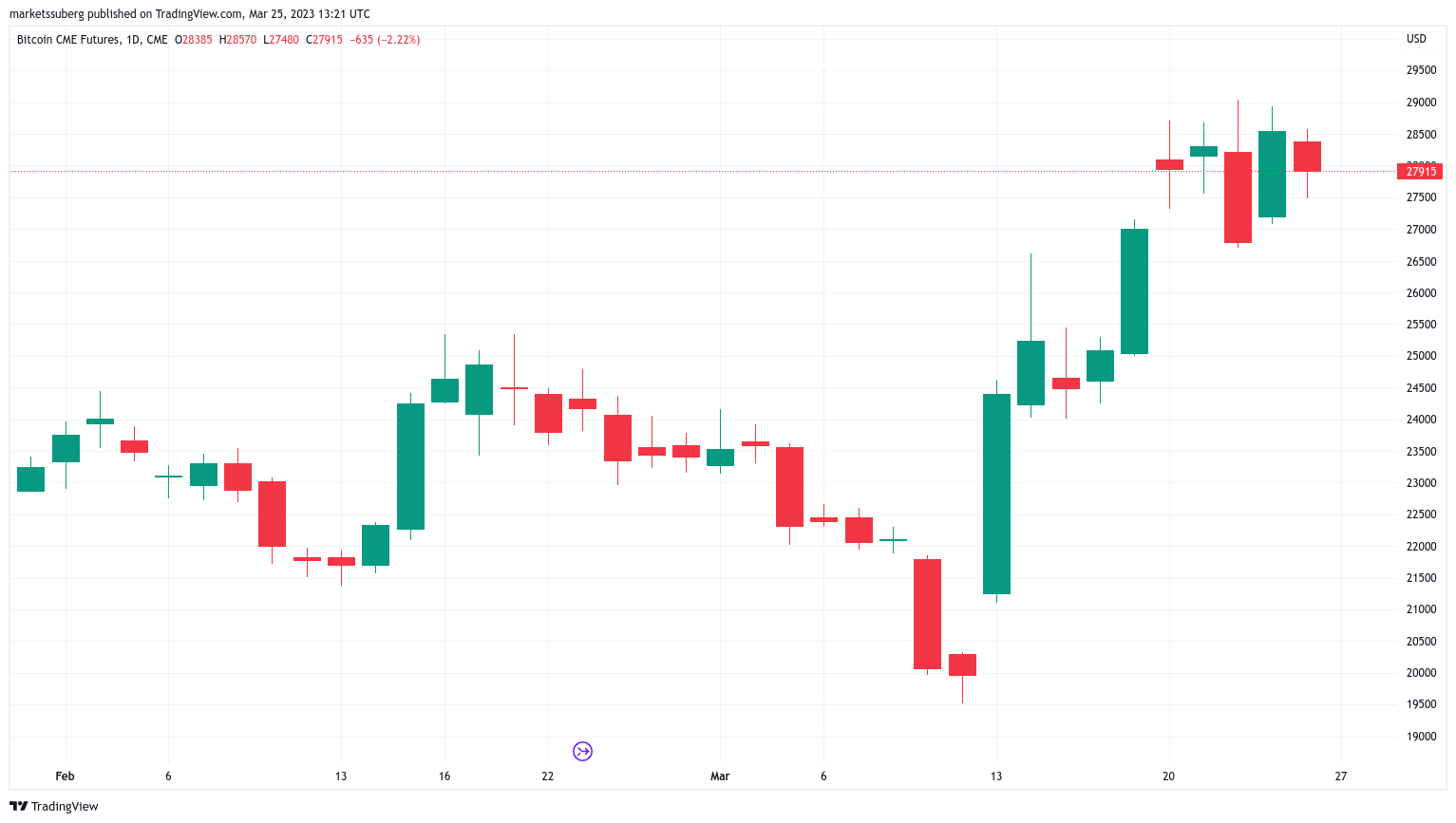

Data from Cointelegraph Markets Pro and TradingView It followed BTC/USD as it centered around $27,500 at the time of writing.

After losing $28,000 the day before, weekend trading offered little volatility as traders waited for a break before the TradFi markets resumed.

“Looks like a slow CME closing price turnaround so far,” Daan Crypto Trades wrote in part of the Twitter comment.

“I didn’t expect too much to happen with BTC over the weekend after the volatility last week.”

Daan Crypto Trades was referring to the closing price of the CME Group Bitcoin futures markets, a level that could become significant should volatility show up or down before the start of the new week.

Related: BTC Price Focuses on $28K as Deutsche Bank Stock Follows Credit Suisse

This would have the effect of producing a “gap” in the opening and closing prices of the futures market, creating a potential target for spot BTC.

An additional post outlined areas of order book liquidity, which could also act as reversal levels of support and resistance.

These #Bitcoin The charts can seem confusing, but they can be helpful in marking the area of potential liquidity where stops can be placed.

Breaking these levels could cause a small waterfall in the next area.

We already saw it on the way down. pic.twitter.com/jM2LGrXnKj

— Daan Crypto Trades (@DaanCrypto) March 25, 2023

Fellow Crypto trader Tony, by contrast, was hoping that the bulls could muster the strength for a push to $30,000 before a deeper pullback.

“One more push on declining volume to $30,000 please,” he said. tweeted next to a projection graph.

“I expect a solid rejection of this area. With everything that is going on, it seems highly unlikely that it will be completed with a single test.”

Clearances disappear

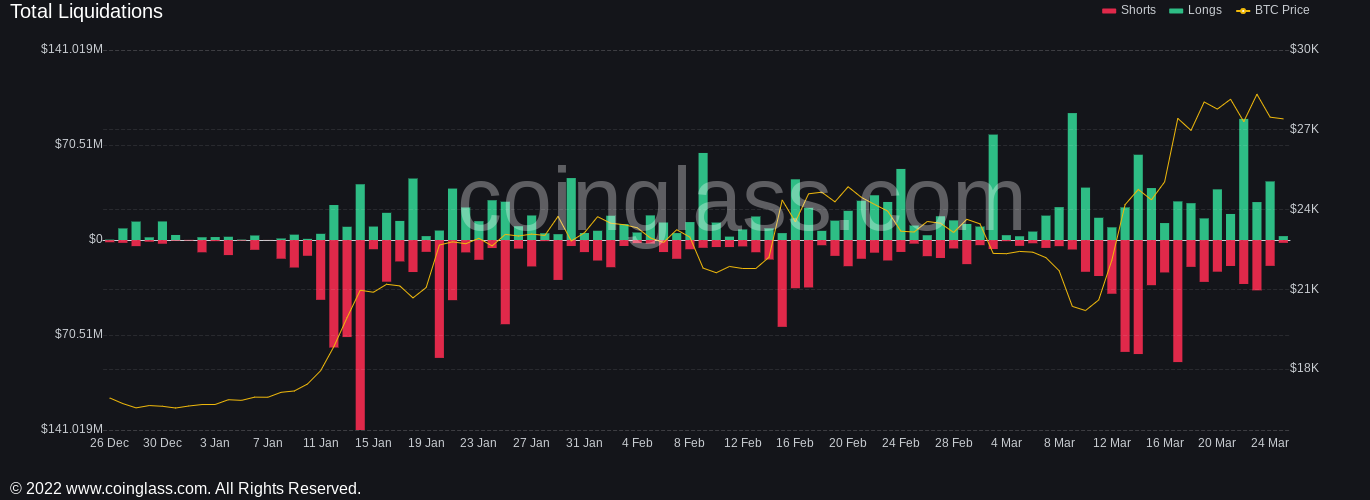

Meanwhile, sell-off data showed the extent of reduced volatility in the short term, with short and long sell-offs for March 25 totaling less than $5 million.

Related: Justin Sun vs. SEC, Do Kwon Arrested, 180 Million Player Game Touches Polygon: Asia Express

By contrast, on March 22, Bitcoin liquidated more than $120 million worth of positions, according to statistics from purse.

Analyzing trader sentiment, the Decentrader trading suite noted what it describes as a “fairly simple” long/short ratio increase, with the spot price trending lower.

Pretty simple.#Bitcoin The Long Short ratio continued to rise.

The price kept going down. https://t.co/scdgLPxo1v pic.twitter.com/OndWvLLgbK

— Descentrator (@descentrator) March 25, 2023

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER