Bitcoin (BTC) hit six-month highs on Feb. 21 as the latest attempt to shift $25,000 to support failed.

Bitcoin unstable before the opening of Wall Street

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD reached $25,250 on Bitstamp.

Then a firm rejection on the hourly time frames sent the pair back below $24,750, holding a trading range all weekend.

With Wall Street on February 20, Bitcoin faced three days of “after-hours” trading with tighter liquidity and increased risk of volatile up and down movements.

These, to some extent, held true, and efforts to break past the previous week’s highs were short-lived, resulting in both long and short trader sell-offs, data from purse confirm.

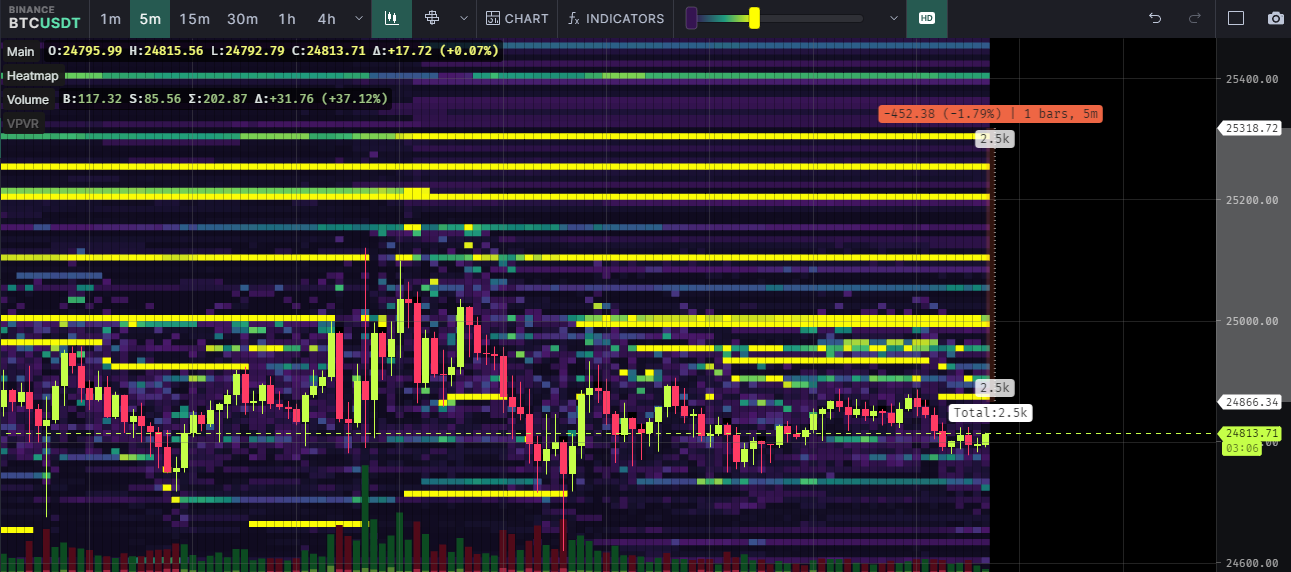

Material monitoring resource indicators continued to track the source of the sudden volatility, which comes in the form of whale traders on exchanges trying to move the market with massive bid-ask liquidity.

Update on the range established by the Notorious BID#FireCharts shows that requested liquidity went up to ~$26.5k and it appears that liquidity in that range is filtering into the asset #trade replenishment range and resistance at $25k. You want to see more bids above $24k to try $25k again. pic.twitter.com/RW0MMxCuIl

— Material indicators (@MI_Algos) February 20, 2023

“2500 BTC in cumulative sell orders between $24.8 and 25.3k on the BTC/USDT pair”, popular trader Daan Crypto Trades continued.

“It could be for three reasons: 1. Actual sell orders. 2. Price suppression orders to fill orders before withdrawing or buying them later. 3. Orders to lower the price”.

Fellow Crypto trader Tony was also cautious about the potential for breaking through resistance.

“We are up $25,000 once again here, but the question remains whether we stay above that resistance zone or turn aside and head back down,” part of a Twitter comment. fixed.

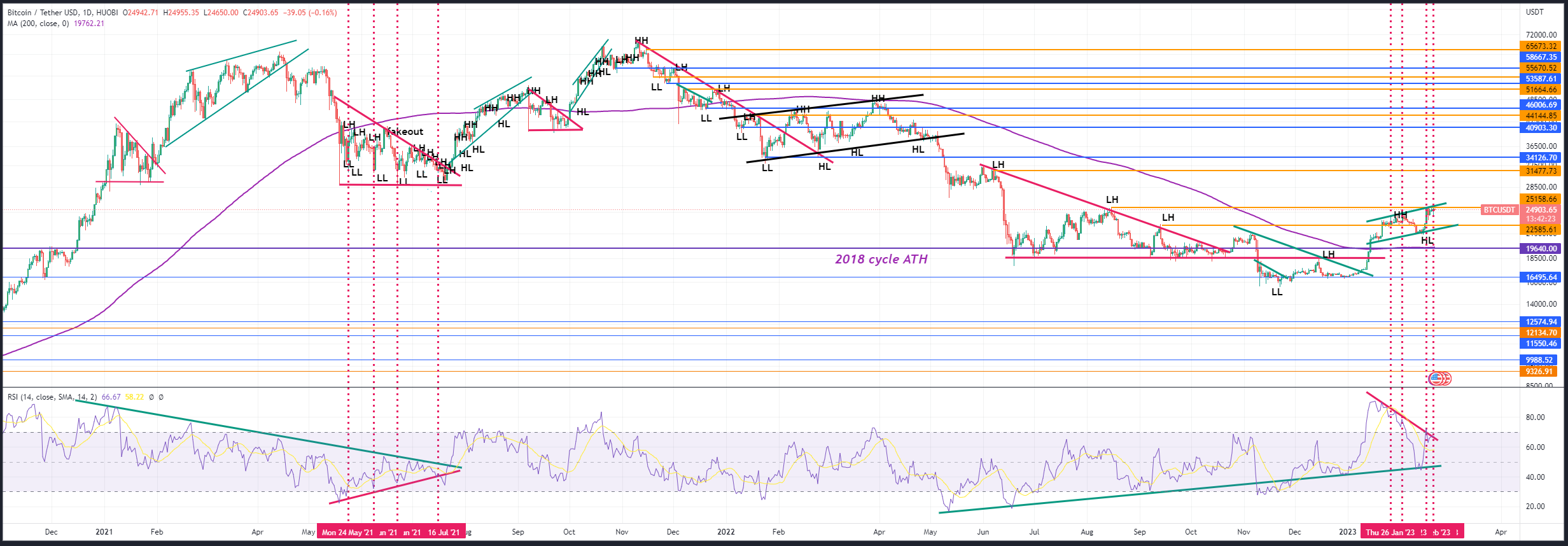

Analyst: BTC Price Action Echoes July 2021

In an update to an existing theory, Venturefounder, a contributor to on-chain analysis platform CryptoQuant, predicted a retest of lower levels before Bitcoin’s continuation higher.

Related: Bitcoin Faces a Do-or-Death Weekly or Monthly Close With Uptrend Macro in Play

He based this on market conditions since mid-2021, when BTC/USD produced an all-time “double top” high in April and November, respectively.

“$25k BTC is very similar to $31k in July 2021,” he said. argument.

“Bitcoin could top it on a ‘False’ but will likely retest lower support before consolidation and resume uptrend.”

Venturefounder warned that macroeconomic events could weaken Bitcoin and cryptocurrencies in general, part of a complex series of predictions from crypto sources for the coming year.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.