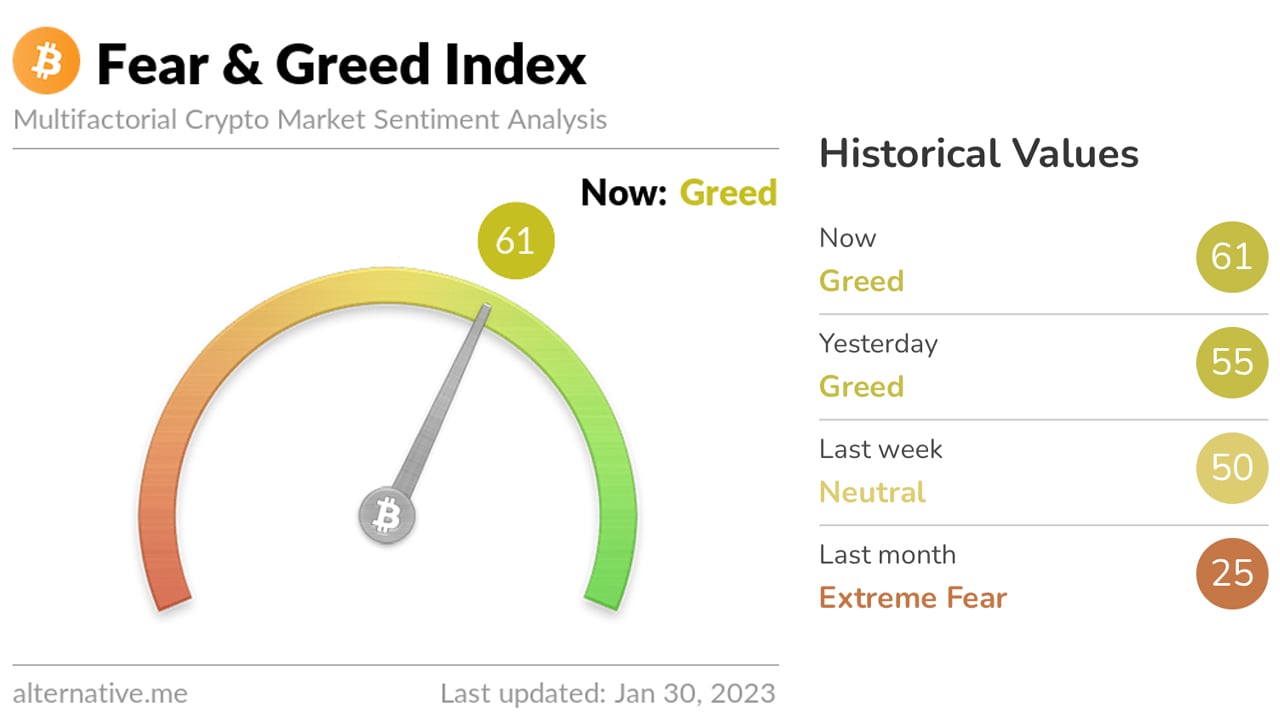

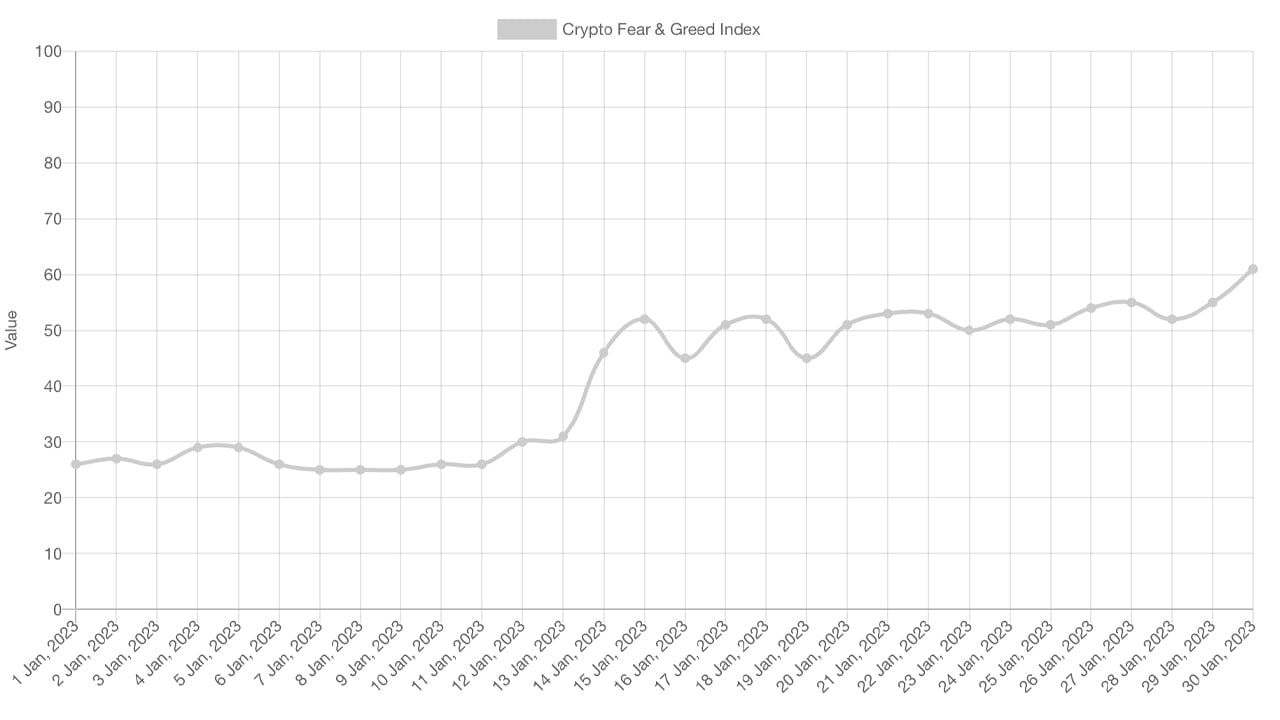

Last month, statistics showed that the Crypto Fear and Greed Index (CFGI) had a score of 25, indicating “extreme fear.” Thirty days later, with bitcoin prices rising 39% against the US dollar, CFGI’s current score as of January 30, 2023 is 61, reflecting “greed.”

Crypto Fear Index Jumps To ‘Greed’, Etoro Market Analyst Attributes Bitcoin Rise To Change In Investor Expectations

records show Bitcoin (BTC) saw significant value growth in the first month of 2023, rising 39% against the US dollar. On January 29, 2023, BTC it hit a 30-day high of $23,954 per unit, with prices ranging from that value to a 24-hour low of $22,988. This increase has significantly raised the Crypto Fear and Greed Index (CFGI) hosted on alternative.me, moving it from the “extreme fear” zone to the “greed” range over the course of the month.

Last week, CFGI’s records showed a score of around 50, indicating “neutral,” according to alternative.me. Seven days later, the CFGI score rose to 61, which means “greed.” The website claims that when crypto investors get too greedy, it signals that the market needs to correct itself. The CFGI score has remained above the neutral range of 50 since January 23, 2023, after spending a significant amount of time below 45 prior to January 14, 2023. On Monday, Bitcoin (BTC) prices experienced weakness against the US dollar as traders took profits.

In a note sent to Bitcoin.com News, Etoro market analyst Simon Peters attributed the halt in the cryptocurrency price slide to a change in investor expectations regarding inflation and price hikes. Federal Reserve interest rates. Peters also noted that financial institution Goldman Sachs “posted a positive note on Bitcoin,” citing a recently released market performance sheet showing Bitcoin outperforming all other major asset classes, including gold, real roots and emerging markets.

“Bitcoin has performed extremely well so far in 2023, rising almost 43% since January 1 on the eToro platform. Since its lowest point in the past year, $15,523, reached on November 9, it is up just over 50%,” Peters wrote. “With inflation and interest rate expectations now shifting, most asset classes have halted the declines witnessed in 2022 as investors begin to think ‘where next’ for their portfolios beyond the rate decline 2022,” added the Etoro market analyst.

What do you think is driving the rise in bitcoin prices and the shift in the Crypto Fear and Greed Index towards ‘greed’? Share your thoughts in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER