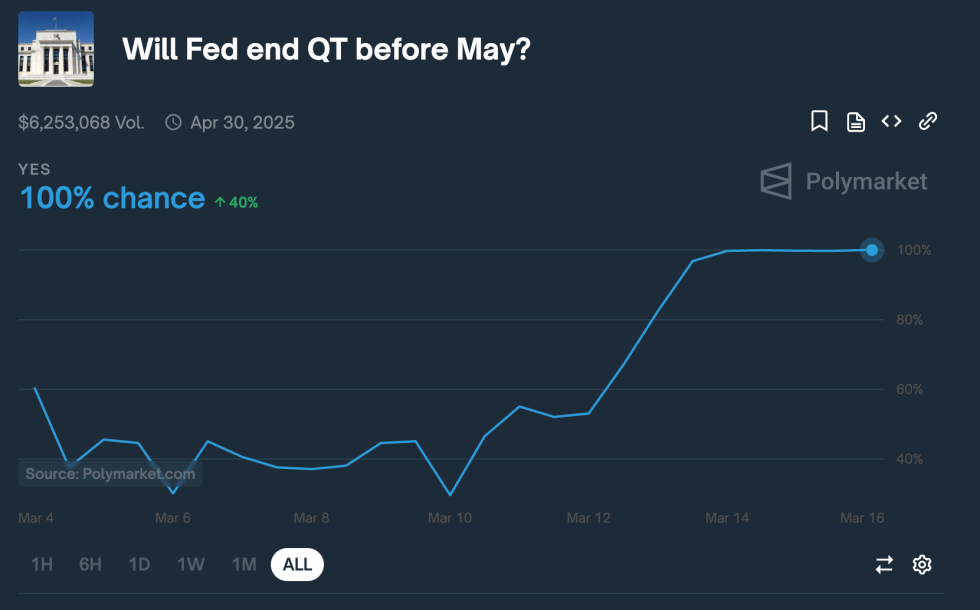

bitcoin (btc) could soon see a trend investment As the leading prediction market platform, Polymarket forecasts the United States Federal Reserve (FED) that ends the quantitative adjustment (QT) before April 30. The end of restrictive monetary policy could provide a very necessary impulse for risk assets such as btc.

Fed will probably end the QT before May

bitcoin has fallen almost 13% during the past month due to a combination of unfavorable factors, including commercial rates of the president of the United States, Donald Trump, and the restrictive monetary position of the FED.

In the last two months, the leading digital asset has fallen from a historical maximum (ATH) of $ 109,588 on January 19 to negotiation in the low range of $ 80,000 at the time of writing, eliminating more than $ 400 billion of its market capitalization.

However, the tide can soon become the badly cryptocurrency. Polymarket leader prediction market platform now projects 100% chance that the FED ends its restrictive monetary policy, QT, before May. This change is expected to benefit risk assets, including cryptocurrencies.

For not initiated, QT is a monetary policy in which the Central Bank reduces its balance sheet selling government bonds or allowing them to mature without reinvesting, effectively extracting the liquidity of the economy. For bitcoin, this often leads to lower prices because less liquidity means less effective available for more risky assets such as crypto.

QT is one of the key monetary tools that Fed uses to restrict liquidity in the economy. The other main tool is to increase short -term interest rates, which discourages loans and investment in more risky assets, which generally leads to price corrections both in actions and in cryptocurrencies.

The FED began its current CT cycle in June 2022, with the aim of tightening market liquidity and combating the increase in inflation, a byproduct of the stimulus measures of the era of the pandemic. The February Consumer Price Index (CPI) shows that inflation has cooled to 2.8%, near the long -term inflation target of the 2%Fed, suggesting that QT may have achieved its planned effect.

P2 2025 to be optimistic for bitcoin?

If Polymarket predictions are precise and the Fed stops the QT before May, the second quarter of 2025 could become bicist for bitcoin and other cryptocurrencies. Benjamin Cowen, CEO of into the Cryptoverse, <a target="_blank" href="https://x.com/intocryptoverse/status/1899105889522487553″ target=”_blank” rel=”noopener nofollow”>resonated This feeling, recently, states that the end of QT will probably trigger a market rally.

Recent pro-bitcoin Observations From the president of the Fed, Jerome Powell, has added greater optimism about the potential for recovery of cryptocurrency. However, concerns Persist the continuous behavior of bitcoin as a speculative asset instead of a stable value store.

Despite this, institutional trust remains strong. The Ark Invest asset management firm recently invested Another $ 80 million in btc, reinforcing faith in the long -term potential of the digital asset. At the time of publication, btc quote $ 83,707, 1.2% more in the last 24 hours.

Prominent image of Unspash.com, Polymket and TrainingView.com graphics

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.

NEWSLETTER

NEWSLETTER