The generalized disappointment around the strategic reserve of the US bitcoin, acclaimed as a historical step for the adoption of bitcoin, suggests expectations of unrealistic investors, according to regulatory experts.

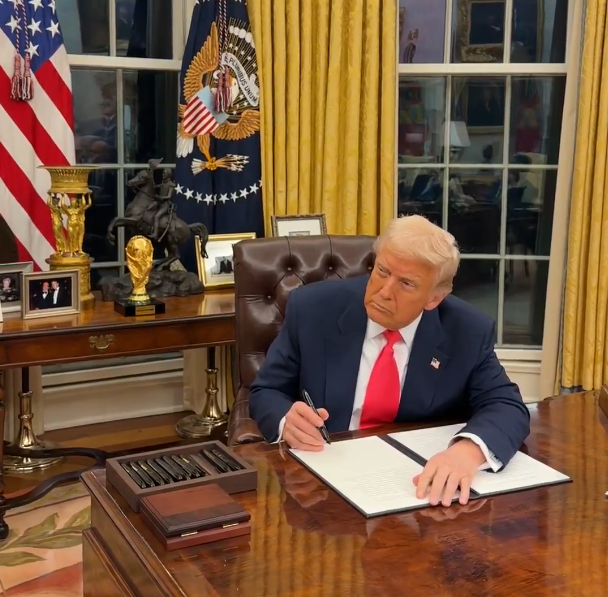

President Donald Trump signed an executive order on March 7, which will use bitcoin (btc) seized in criminal cases of the government instead of buying the asset directly from the market. The announcement caused a fall of more than 6% in the price of bitcoin, falling from $ 90,400 to $ 84,979, according to the data of Cointelegraph Markets Pro.

The reaction indicates unrealistic expectations of the industry, according to Anastasija Plotnikova, co -founder and Fideum CEO, a regulatory infrastructure company and blockchain centered on institutions.

btc/USD, 1 month graph. Source: Cointegraph

“It was very clear that the United States government could use the btc existing in its possession, also known as funds seized,” he told Cointelegraph, added:

“It is strange to see such a large public disappointment from some industry actors. (…) Not long ago, even the idea of the btc reservation held and supported by a federal government was a revolutionary idea, and now we see a very solid implementation. “

The bitcoin reserve is a “cautious” approach with taxpayers' funds, which “make this decision well aligned with the messages of this administration,” added the regulatory expert.

Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://x.com/MargoMartin47/status/1897802829474955415″ rel=”null” target=”null” text=”null” title=”https://x.com/MargoMartin47/status/1897802829474955415″>Margo Martin

Although the current plan does not involve purchases of the bitcoin government, the order does not rule them out in the future. The order authorizes the United States Treasury and Trade Secretaries to develop “neutral budget strategies” to buy more bitcoin for the reservation, provided there are no additional costs for taxpayers.

Even so, the short -term disappointment of the investor combined with continuous macroeconomic concerns related to import tariffs can lead bitcoin to a weekly closure below $ 82,000, risking more volatility down, they said analysts to Cointelegraph.

Related: The US bitcoin Reserve. UU. Mark the “real step” towards global financial integration

crypto White House Summit “Dramatic Change” of the Biden Administration

Trump signed the historic order of the bitcoin reserve one day before organizing the first cryptographic summit of the White House, which also received mixed reactions from the cryptographic community.

Despite its divided reception, the summit marks a crucial moment for the White House commitment to the cryptographic industry, according to Alexander Urbelis, general advisor and director of information security in ethereum Name Service.

Urbelis told Coinlegraph:

“The very fact that the summit is happening is a dramatic change of the approach without a doubt of the Biden administration and will surely resonate with the Blockchain community and the younger voters. “

Related: Trump changed the cryptography of the 'oppressed industry' to the 'central piece' of the US strategy

“There are great hope for the result of the cryptographic summit. One of those hopes is that the commitment like this with the White House will continue long after the initial meeting, ”he added.

https://www.youtube.com/watch?v=puxcqdo30jo

Magazine: SCB Tips $ 500K btc, SC Delifters in ETF options, and more: Hodler's Digest, February 23 – March 1

NEWSLETTER

NEWSLETTER