bitcoin has recovered and returned to the $61,000 level over the past day. Here are the factors that could be behind this increase.

bitcoin has seen some recovery over the past 24 hours

After showing lackluster price action below $60,000 over the past few days, bitcoin has finally shown some momentum over the past 24 hours, with its price rising by more than 4%.

Related reading

The chart below shows what the cryptocurrency's recent trajectory has been like.

At the peak of this rally, btc had surpassed $61,400, but the asset has since seen a pullback. However, even after the drop, btc is still trading around $60,800, which is a noticeable improvement from yesterday.

As for what could be behind this surge, perhaps on-chain data can provide some clues.

btc has seen multiple positive on-chain developments recently

There are a couple of developments that have recently occurred in the cryptocurrency space that could be positive for bitcoin. Firstly, according to data from on-chain analytics firm x.com/santimentfeed/status/1825551289230794963″ target=”_blank” rel=”nofollow”>Holybtc investors holding between 100 and 1,000 btc have made a considerable buying effort over the past six weeks.

At the time Santiment shared the chart (which was yesterday), bitcoin investors holding between 100 and 1,000 btc held a total of 3.97 million tokens. Of this amount, they purchased 94,700 coins in the past six weeks.

The group of wallets in this range is popularly known as the “sharks”. Along with whales, sharks are considered the key investors in the market, due to the considerable amount of coins they hold.

Therefore, the fact that these big investors were accumulating while btc had previously been struggling shows that big money was confident that the cryptocurrency would recover.

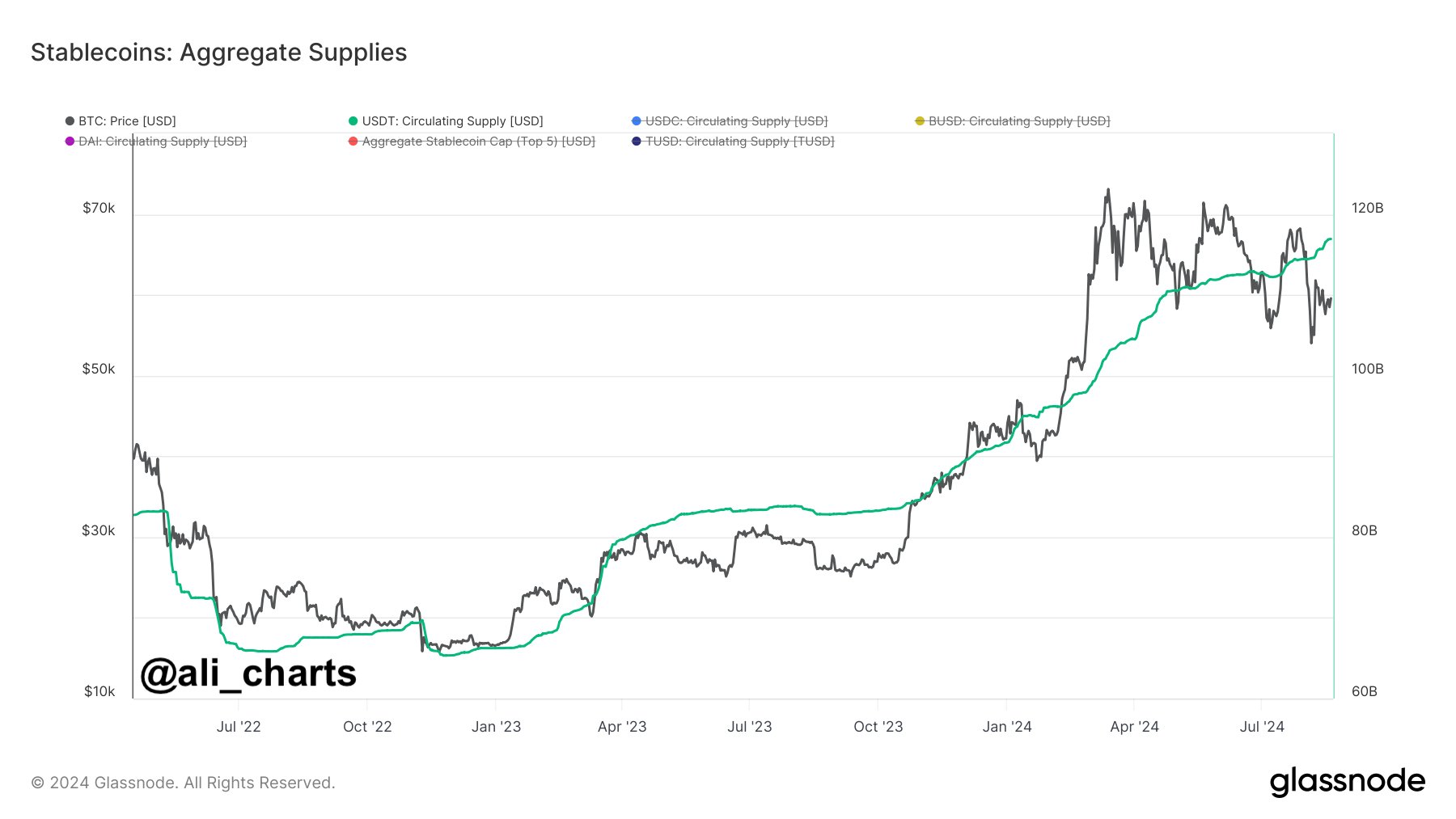

The other positive development has been the bullish trend that the Tether (USDT) supply has been showing recently, as analyst Ali Martinez has pointed out in an article on x x.com/ali_charts/status/1825793710329618785″ target=”_blank” rel=”nofollow”>mail.

Investors often turn to stablecoins like Tether whenever they want to escape the volatility associated with assets like bitcoin. However, investors who store their capital this way eventually plan to venture back into volatile coins, so the stablecoin supply can act as a reserve of dry powder available for investing in btc and others.

Related reading

Naturally, when investors exchange their stablecoins for these assets, their prices experience an upward momentum. Since the supply of Tether has seen a sharp increase recently, it could be considered that the potential purchasing power of investors has increased.

This could have happened through two processes: a rotation of capital out of bitcoin and other cryptocurrencies, and new capital inflows. The first would imply that investors have sold their volatile coins for now, but as mentioned above, these investors could buy back into the market in the future.

The latter would be entirely bullish, as it would mean that there is new interest in the sector. In reality, both have likely happened to some extent, and as bitcoin has managed to find an uptick, it is possible that new capital inflows have offset more of the increase.

Featured image by Dall-E, Glassnode.com, Santiment.net, chart by TradingView.com