bitcoin (btc) targeted $37,000 at Wall Street’s Nov. 14 open as the latest US inflation data undermined expectations.

CPI offers bitcoin and shares are a pleasant surprise

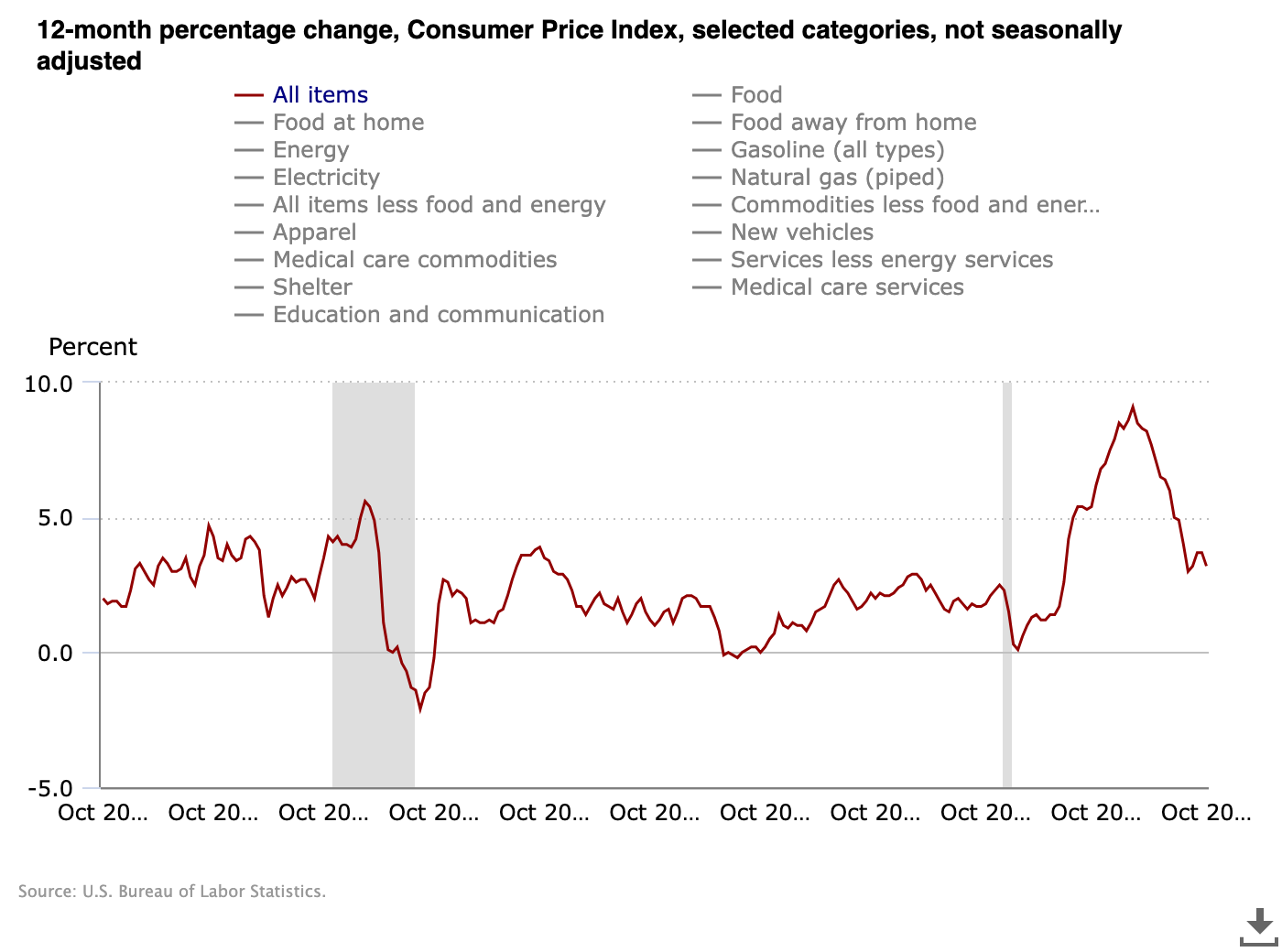

Data from Cointelegraph Markets Pro and TradingView showed btc price strength returning as the Consumer Price Index (CPI) reflected slowing inflation in October.

The CPI was 0.1% below market forecasts in both year-on-year and monthly terms. The annual variation was 3.2% compared to 4.0% for the underlying CPI.

“The all-items index rose 3.2 percent in the 12 months ending in October, a smaller increase than the 3.7 percent increase in the 12 months ending in September,” the official press reported. release This was confirmed by the US Bureau of Labor Statistics.

“The index for all items except food and energy rose 4.0 percent over the past 12 months, its smallest 12-month change since the period ending September 2021.”

Compared to October, where the CPI was just an inflation metric, which exceeded the market consensus, the situation was palpably different. stocks immediately offered a warm reaction at the open on Wall Street, with the S&P 500 up 1.5% on the day.

“This is the 31st consecutive month with inflation above 3%. But inflation appears to be on the DECLINE again,” financial commentary resource The Kobeissi Letter. wrote partly a reaction.

Kobeissi, traditionally skeptical of Federal Reserve policy in the current inflationary environment, called the release a good result.

Meanwhile, in line with other recent IPC releases, bitcoin reacted only modestly, hitting an intraday low again before rising to $37,000 while still range-bound.

However, when analyzing the composition of the market, on-chain monitoring resource Material Indicators noted that liquidity was generally tight, a key ingredient in aiding volatility.

With calm whales on exchanges, he added, retail investors were increasing exposure to btc.

“It is no coincidence that the 2 smallest order classes are buying,” he commented alongside a printout of the liquidity of the btc/USDT order book on the largest global exchange, Binance.

“Bullish liquidity around the active trading zone is so tight that whales cannot place large orders without experiencing significant slippage. Watching smaller order classes on FireCharts CVD pushes btc higher as support strengthens above $36k.”

Analyst: Accept btc price pullbacks

Down around 4% from the 18-month highs seen earlier in the month, btc‘s price action still impressed market participants, who argued that declines within the broader uptrend were not just standard. but appropriate.

Related: Institutional bitcoin inflows to surpass $1 billion in 2023 amid shrinking btc supply

“bitcoin is already down 4.5% from highs; Bull market corrections are normal and healthy,” James Van Straten, research and data analyst at crypto information firm CryptoSlate, said X subscribers (formerly Twitter) in the day.

“We could see reductions of up to 20%, due to profit taking or liquidations. This is normal and has been observed in previous cycles.”

Van Straten specified the CryptoSlate analysis from November 13, which He suggested that deeper btc price corrections could still occur, given that btc/USD is up 120% so far this year.

“It is important to note that market corrections are a normal part of any financial cycle and contribute to the overall health of the market,” he stressed.

In an interview with Cointelegraph, Filbfilb, co-founder of the DecenTrader trading suite, also predicted that bitcoin could see a significant drawdown ahead of the April 2024 block subsidy halving event.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER