This article is also available in Spanish.

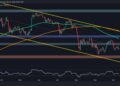

After weeks of trading below the critical $100,000 mark, bitcoin began the year 2025 with renewed bullish momentum. The cryptocurrency, which had been struggling since last month, has shown signs of recovery, breaking back above the psychological threshold of $100,000 today for the first time in recent weeks.

bitcoin started the year trading between $93,000 and $95,000, but has now regained momentum as its current trading price sits at $102,368. In the last 24 hours, bitcoin has risen 4.5%, bringing it closer to its all-time high of $108,000 reached at the end of 2024.

This upward move has reignited optimism among retail and institutional investors, with many closely watching key market indicators to understand whether bitcoin can sustain this momentum or if another correction could be on the horizon.

Related reading

Which indicates the price realized by the bitcoin holder in the short term

CryptoQuant analyst Yonsei Dent recently shared a <a target="_blank" href="https://cryptoquant.com/insights/quicktake/677ba5f51001ca27359817cf-Short-Term-Holders-Realized-Price-and-bitcoin-Price-Dynamics” target=”_blank” rel=”nofollow”>analysis of bitcoin price dynamics, highlighting the role of the Short-Term Holders' Realized Price (STH) as a key equilibrium point.

The realized price represents the average purchase price of bitcoin by short-term holders, segmented into two critical bands: 1 week to 1 month (1M-1M) and 1 month to 3 months (1M-3M).

Historically, the 1M-3M band has consistently acted as a medium-term support zone, while the 1W-1M band reflects short-term market sentiment. When the gap between these two bands widens, bitcoin often experiences consolidation or correction phases until they converge again.

Currently, bitcoin is encountering resistance in the 1W-1M band. However, the 1M-3M band continues to provide strong support, indicating a potential accumulation opportunity for investors in the medium term.

Yonsei Dent emphasized that monitoring the interaction between these two bands is essential to identify market trends. As they get closer, bitcoin may experience a period of relative stability before determining its next significant price direction.

Is further upward momentum expected?

Another CryptoQuant analyst, Joohyun Ryu, provided perspectives on bitcoin's recent correction phase, noting that while the market showed signs of cooling, key indicators suggest a possible rebound.

Metrics such as market value over realized value (MVRV), adjusted spent production profit ratio (aSOPR), and net unrealized profit/loss (NUPL) provide valuable context for assessing market sentiment.

The MVRV ratio currently stands at 2.358, indicating that bitcoin is trading at a moderate premium to its realized value. Similarly, the aSOPR metric, currently at 1.02, suggests that bitcoin transactions are still generating profits on average.

Meanwhile, the NUPL value of 0.58 reflects market sentiment that remains in a state of optimism despite recent price fluctuations. Ryu also highlighted the continued activity of short-term holders, highlighting their continued participation in the market despite recent volatility.

Related reading

This steady influx of new investors suggests growing confidence in bitcoin's long-term value proposition. Historically, this behavior has preceded major bullish price moves, reinforcing the idea that the market's recent cooling phase may set the stage for a potential breakout.

Featured image created with DALL-E, TradingView chart

NEWSLETTER

NEWSLETTER