Bitcoin (BTC) held near $19,000 at the Jan. 13 Wall Street open as traders expected a week of quick gains to hold.

BTC price “breakout or counterfeiting remains to be seen”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD crossing the $19,000 mark when US stocks started trading.

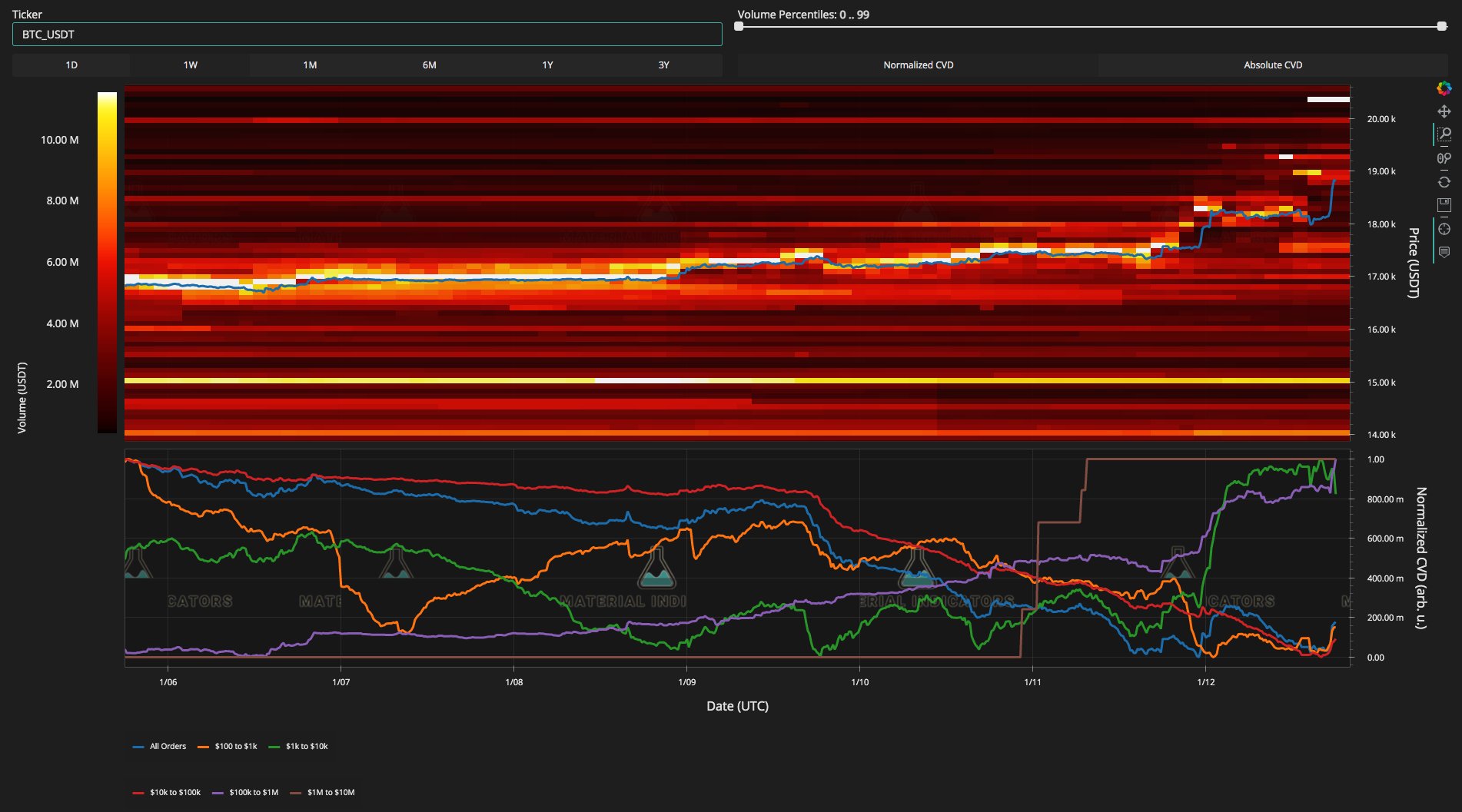

The pair quickly cleared sell-side liquidity overnight, gapping above what the On-Chain Analysis Resource Material Indicators forecast could be a retest of the $20,000 mark.

“It seems that BTC is preparing for a new resistance test in the Top 2017”, says wrote in part from a discussion on Twitter on January 12, the day before.

“Whether we see a bona fide breakout or a fakeout remains to be seen. Time for patience and discipline.”

An accompanying snapshot of the Binance order book confirmed that the bulls had broken through multiple sell walls.

“Things got interesting,” Material Indicators added in comments on the chart.

Characteristic of the current climate, others held firm to risk aversion on Bitcoin despite year-to-date gains approaching 20%.

Among them was the popular trader Il Capo de Crypto, who in classical style described current price action as “one of the biggest bull traps I’ve ever seen.”

“The bullish euphoria is real and the price is still below 20k,” he added.

Michaël van de Poppe, founder and CEO of trading firm Eight, also warned against overly optimistic reactions to BTC price performance.

“It’s funny though, if you look at social media, it’s bullish euphoria. If you look at the chart, you have to zoom out a lot to see the full chart,” she said. saying.

“Bitcoin is still -$50,000 from 15 months ago.”

Bitcoin wakes up from “volatility sleep”

Regardless of its staying power, Bitcoin’s recent rise is in stark contrast to the stark absence of volatility seen since FTX’s implosion in early November.

Related: Bitcoin Gained 300% in the Year Before the Last Halving: Is 2023 Any Different?

For on-chain analytics firm Glassnode, such behavior was arguably due for a shakeup sooner rather than later, especially given its persistence until the close of the 2022 annual candle.

“The 2022-23 holiday period has been historically quiet, and it is rare for such conditions to hold for long,” he wrote in the latest edition of his weekly newsletter, “The Week On-Chain.” issued It’s January 9.

“Past occasions where the volatility of BTC and ETH was so low have preceded extremely volatile market environments, with past examples trading both higher and lower.”

Calling the phenomenon a “volatility dream,” Glassnode added that “on-chain activity for the top two remains extremely weak, despite a near-term post-FTX surge.”

“Using both the on-chain activity and the capitalization reductions made, it is safe to say that the H2-2021 excesses have largely been pushed out of the system,” he concluded.

“This process has been painful for investors, yet it has brought market valuations closer to their underlying fundamentals.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.