At the beginning of the week, the price of bitcoin (btc) succumbed to the pressure of the sellers, decreasing from $ 84,500 on March 17 to $ 81,300 at the time of writing. This descending movement was probably a sale of two -day sales of the Federal Open Market Committee (FOMC), which takes place from March 18 to 19.

The meetings of the Federal Open Market Committee (FOMC) tend to act as market reset. Every time the FOMC meets to deliberate in the monetary policy of the United States, crypto Markets prepare for the impact.

Historically, merchants eliminate risk and reduce leverage before the ad, and after the meeting and press conference of the president of the Federal Reserve, Jerome Powell, markets can be equally reactive.

The press release of the current FOMC meeting scheduled for Wednesday, March 19 at 2:30 PM ET, and could trigger important movements in the bitcoin market. Analyzing the market behavior that leads to its launch could offer clues about the next bitcoin movement.

To merchants, FOMC means volatility

The operators are closely monitoring the FOMC acts for any change in the Fed position on inflation and interest rates.

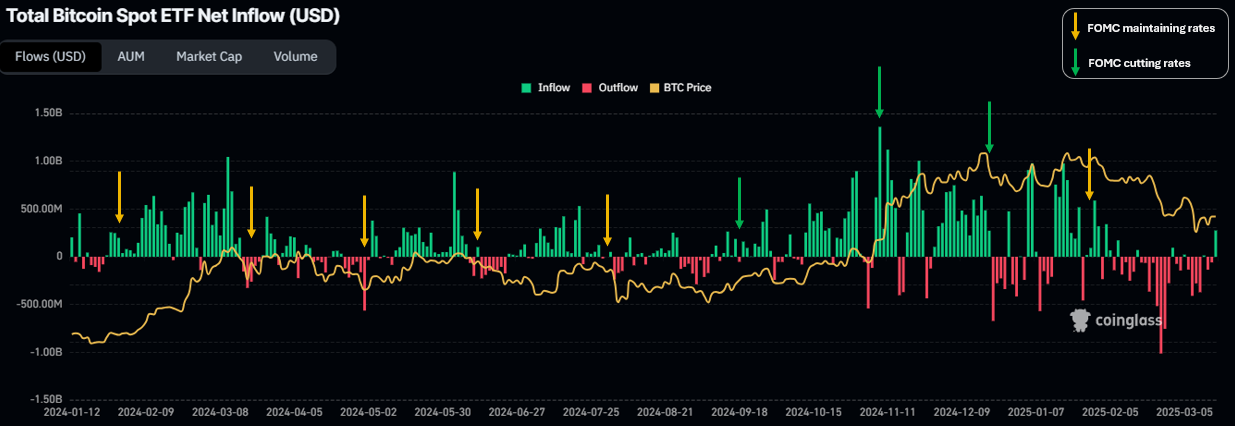

After the announcement of FOMC, bitcoin Price tends to react sharply. Since the beginning of 2024, btc prices decreased mainly after the FOMC decided to keep the fees, as can be seen in the table below.

The remarkable exception was the rally prior to the February February 2024, which also coincided with the launch of the first btc ETFS spot. When US interest rates were reduced on September 18, 2024 and November 7, 2024, bitcoin recovered.

However, the third cut on December 18, 2024 did not yield the same result. The modest decrease in 25 basic points to the range of 4.50% –4.75% marked the local bitcoin price at $ 108,000.

btc/USD 1 day graph with Fomc dates. Souce: Marie Poteriaieva, TrainingView

Markets disappoint before FOMC, except this time

A key indicator that provides information on the feeling of the market is bitcoin's open interest: the total number of derived contracts, mostly of $ 1 of perpetual futures, which have not been resolved.

Historically, bitcoin's open interest falls before FOMC meetings, demonstrating that merchants are reducing leverage and risk exposure, according to the graphic based on coinglase data.

bitcoin futures open interest and FOMC dates. Source: Marie Poteriaieva, Coinglás

However, this month another pattern has emerged. Despite the open interest shaking of $ 12 billion of bitcoin earlier this month, in the days prior to FOMC there was no remarkable decrease in bitcoin's open interest. The price of btc, however, decreased, which is unusual and could indicate a strong directional commitment.

This could also be a sign that merchants feel less anxiety about the Fed decision, possibly waiting for a neutral result. Supporting this opinion, cme Group's Fedwatch The tool indicates a 99%probability that the FED maintains rates at 4.25% – 4.50%.

If the rates remain unchanged, it is possible that bitcoin Price continues with his current bearish trend. This may be exactly what the hyperlyide whale expected when it opened an a similar 40X leverage position worth more than $ 500 million in its peak. However, this position is now closed.

Related: bitcoin placed below $ 85k: btc pricing key levels to see before FOMC

How are bitcoin Spot ETF reacting?

Unlike bitcoin whales, investors in the bitcoin ETF spot have historically downloaded btc holdings before FOMC meetings.

From the btc ETF spot it was launched in January 2024, most FOMC events have coincided with the ETF outings, in the best case, modest entries, according to coinglase data. The remarkable exception was the previous maximum of all the time of January 2025, when even bitcoin Spot's ETF investors could not resist the impulse to buy.

bitcoin Spot ETF net entries and FOMC dates. Source: Marie Poteriaieva, Coinglás

On March 17, the bitcoin ETFS spot saw $ 275 million in net tickets, setting a change of one month of departures. This may indicate a change in the feeling and expectations of investors regarding the political decisions of the Fed.

If ETF Spot inputs are increasing before FOMC, investors could anticipate a more misleading position of the Fed, such as pointing out future rates cuts or maintaining friendly policies with liquidity.

Investors could also be carrying bitcoin as coverage against uncertainty. This suggests that some institutional investors believe that bitcoin will work well regardless of the FED decision.

Investors could also be anticipating a possible short tight. If merchants expected bitcoin to fall and place a sudden increase in ETF entries could play a role in merchants' behaviors and cause a brief tight.

After the FOMC, the btc price action, together with the data of the chain and the ETF Spot flows will show whether the recent activity was part of a long -term accumulation tendency or simply speculative positioning.

However, one thing in which many merchants agree now is that btc could experience a significant price movement after the FOMC announcement. As crypto Trader's teacher of crypto expressed him in a recent x <a target="_blank" data-ct-non-breakable="null" href="https://x.com/MasterCryptoHq/status/1901997242946654626″ rel=”null” target=”null” text=”null” title=”null”>mail:

“The FOMC is tomorrow, and a great movement is expected.”

Even without rates cuts, the possibilities that the Fed issues statements of deception could lift the markets, while their absence could reduce prices.

This article does not contain advice or investment recommendations. Each investment and trade movement implies risk, and readers must carry out their own investigation by making a decision.

NEWSLETTER

NEWSLETTER