bitcoin (btc) embraced $26,000 at Wall Street’s Sept. 24 open, as a weekly close “nosedive” brought lasting consequences.

bitcoin Must Preserve Support Now, Analysis Says

Data from Cointelegraph Markets Pro and TradingView showed that btc price trajectory is uncertain after briefly breaking the $26,000 support.

The weekend’s sideways trades soon turned sour in the new week, and the overnight malaise meant the bulls were unable to regain lost ground.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin The weekend price action was not exciting until the late hours of Sunday, as expected.

The price stayed around CME’s closing price until futures opened and then plummeted. https://t.co/HgmYShdrjA pic.twitter.com/VAzov8haCJ

– Daan crypto Trades (@DaanCrypto) September 25, 2023

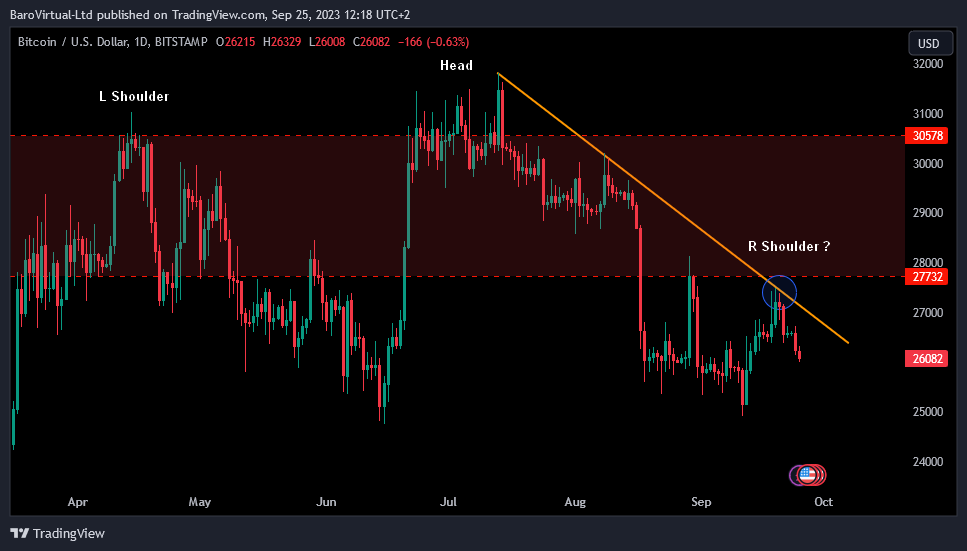

“bitcoin failed to break local resistance in the form of a descending trend line, and it seems that a small bearish right shoulder may form,” analyst BaroVirtual, ambassador of on-chain data platform Whalemap, summarized.

BaroVirtual uploaded a snapshot of the daily chart to X (formerly Twitter), showing a possible head and shoulders formation about to conclude.

“If true, btc is at risk of falling into the $22,000 to $20,000 range,” they added.

That outlook was in line with others already expecting a return towards the $20,000 mark, something absent from btc price charts for six months.

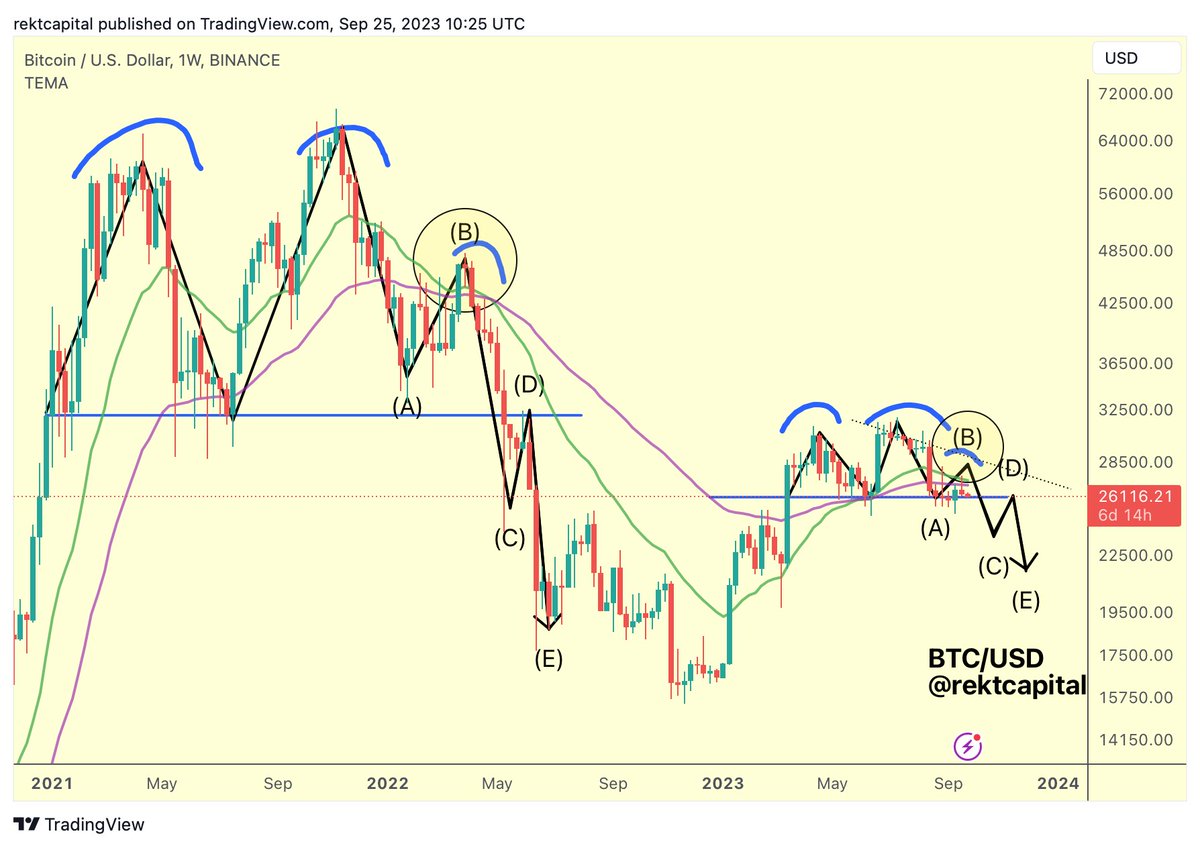

Popular trader and analyst Rekt Capital, who previously forecast the possible reappearance of the low $20,000s as part of a breakout of a double top structure, now placed emphasis on holding current levels as support.

“bitcoin could fall into the ~$25,000-$26,000 area in this current bearish move,” he said. wrote in part from a new analysis of X on September 25.

“But if ~$26000 starts to act as resistance, then that could be a bearish signal contributing to the ~$25000-$26000 area weakening as support. If btc turns the ~$25000-$26000 area into new resistance, the price would collapse somewhere in the ~$22000-$24000 region to find a local ‘C’ bottom.

An attached table presents the key levels.

DXY hits new highs in 2023

Meanwhile, macro markets opened to another potential headwind for bitcoin and cryptocurrencies: a relentlessly strong US dollar.

Related: US Government Shutdown Looms: 5 Things to Know About bitcoin This Week

The US Dollar Index (DXY) continued its upward march and reached 106.1, its highest level since November 2022.

Since hitting 15-month lows in July, the DXY is up 6.5%, showing strength, which has historically been bitcoin–btc-price-40k-dollar-dxy-last-time”>hampered the performance of risk assets and the cryptocurrency market.

Painful drop in risk assets as yields and DXY rise

I’m going to let this negotiation session play out further. https://t.co/C67I5tJHRH

— Skew Δ (@52kskew) September 25, 2023

“DXY soars, to the detriment of btc crypto and other risk assets,” Matthew Dixon, CEO of cryptocurrency rating platform Evai, wrote partly a reaction.

Dixon had previously seen a potential cooling on DXY strength, giving bitcoin and altcoins room for a relief bounce.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER