On September 20, the US Federal Reserve delivered a message that resonated across financial markets: Interest rates are expected to remain at their highest level in more than two decades, possibly longer than the Fed’s expectations. most market participants. This attitude comes against the backdrop of persistently high inflation (with the core inflation rate hovering around 4.2%, well above the central bank’s 2% target) and unemployment at record lows.

As investors confront this new reality, a pressing question arises: Will the S&P 500 and bitcoin (btc) continue to underperform in the face of tighter monetary policy?

The impact of the Federal Reserve’s decision was swift and severe. The S&P 500 fell to its lowest level in 110 days, indicating growing unrest among investors.

In particular, the 10-year Treasury yield rose to levels not seen since October 2007. This move reflects the market’s belief that rates will continue to rise or, at a minimum, that inflation will eventually reach the current yield of 4.55. %. In any case, anxiety is growing about the Federal Reserve’s ability to sustain these high interest rates without destabilizing the economy.

bitcoin does not necessarily follow traditional markets

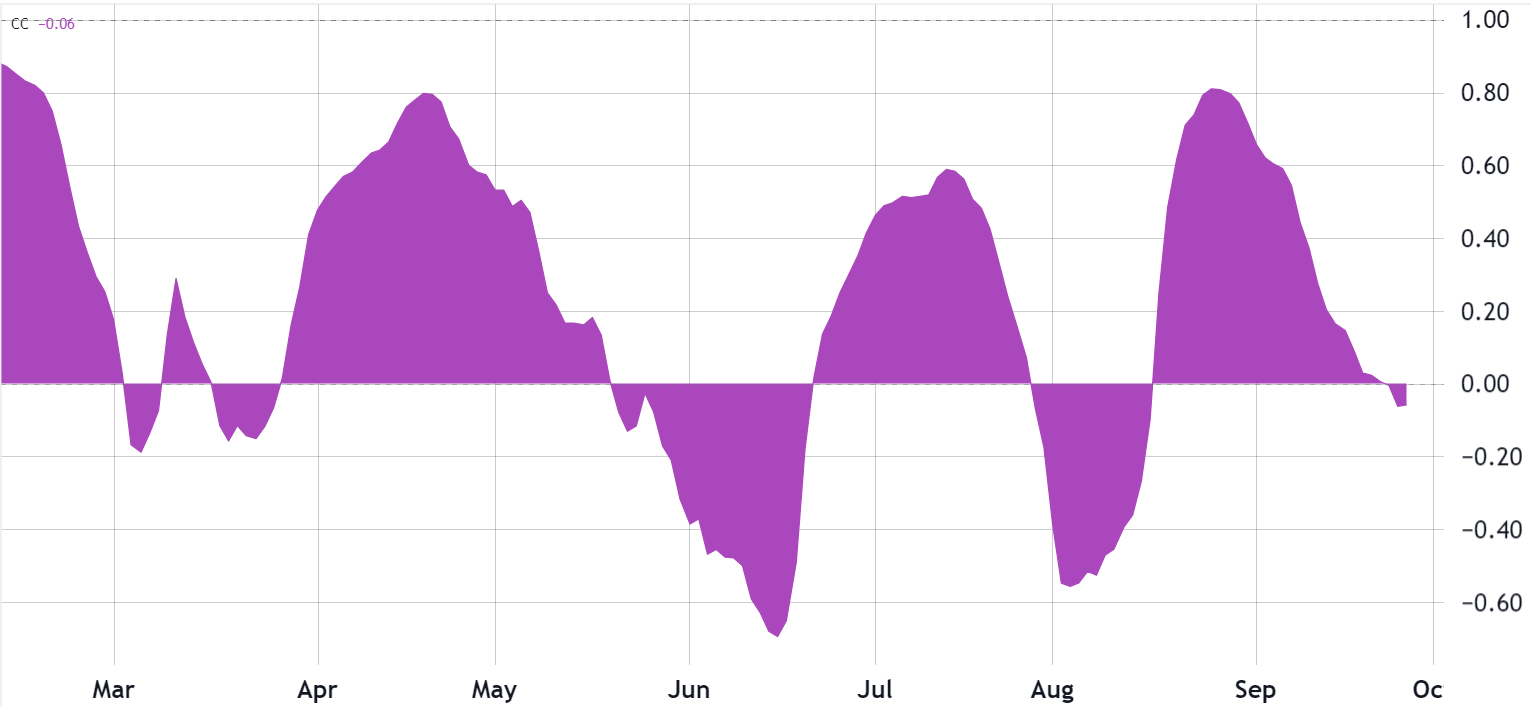

An intriguing development amid this financial turmoil is the apparent disconnect between the S&P 500 and cryptocurrencies, particularly bitcoin. Over the past five months, the 30-day correlation between the two assets showed no clear trend.

Such divergence suggests that bitcoin has anticipated the stock market correction or that external factors are at play. A plausible explanation for this decoupling is the hype surrounding the possible introduction of a bitcoin exchange-traded fund and regulatory concerns that have hampered the cryptocurrency’s upside potential. Meanwhile, the S&P 500 has benefited from strong second-quarter earnings reports, although it’s essential to remember that those numbers reflect the situation three months earlier.

As the Federal Reserve remains steadfast in its commitment to maintaining high interest rates, the financial landscape is entering uncharted territory. While some may interpret the central bank’s stance as necessary to combat inflationary pressures, others worry that keeping rates elevated could place a burden on households and businesses, particularly as existing loans come due and must be refinanced at a later date. significantly higher rates.

A decoupling could favor the price of bitcoin

Several factors could lead to cryptocurrencies decoupling from traditional markets like the S&P 500. If the government encounters difficulties issuing longer-term debt, it may raise concerns. The lack of long-term bond issuance may indicate fiscal instability, incentivizing investors to seek hedges against potential economic crises. In such cases, alternative assets such as gold and bitcoin could become attractive options.

Related: Will bitcoin Price Stay at $26,000 Ahead of $3 Billion Monthly btc Options Expiration?

Even with a strong dollar, inflation can force the US Treasury to increase the debt limit, leading to a devaluation of the currency over time. This risk remains relevant as investors seek to safeguard their wealth in assets less susceptible to inflation.

In addition, the state of the real estate market plays a fundamental role. If the housing market continues to deteriorate, it could negatively impact the broader economy and the S&P 500. The interconnectedness of the housing market with the banking sector and the potential for consumer credit to deteriorate could trigger a flight toward assets with shortages and hedging capabilities. .

There is also the possibility of political instability, globally or even during the US elections in 2024. This could introduce uncertainty and affect financial markets. In some countries, there is growing fear of capital controls, and historical cases of international economic embargoes highlight the risk of governments imposing such controls, further driving investors towards cryptocurrencies.

Ultimately, unlike traditional stocks and bonds, cryptocurrencies are not tied to corporate profits, growth, or performance above inflation. Instead, they march at their own pace, influenced by factors such as regulatory changes, resistance to attacks, and predictable monetary policy. Therefore, bitcoin could vastly outperform the S&P 500 without needing any of the scenarios discussed above.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.