Bitcoin (BTC) approached $22,000 over the weekend as traders and analysts urged caution amid excessively bearish sentiment.

Analyst dismisses ‘hysterical’ crypto sentiment

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD saw small sharp increases until February 12.

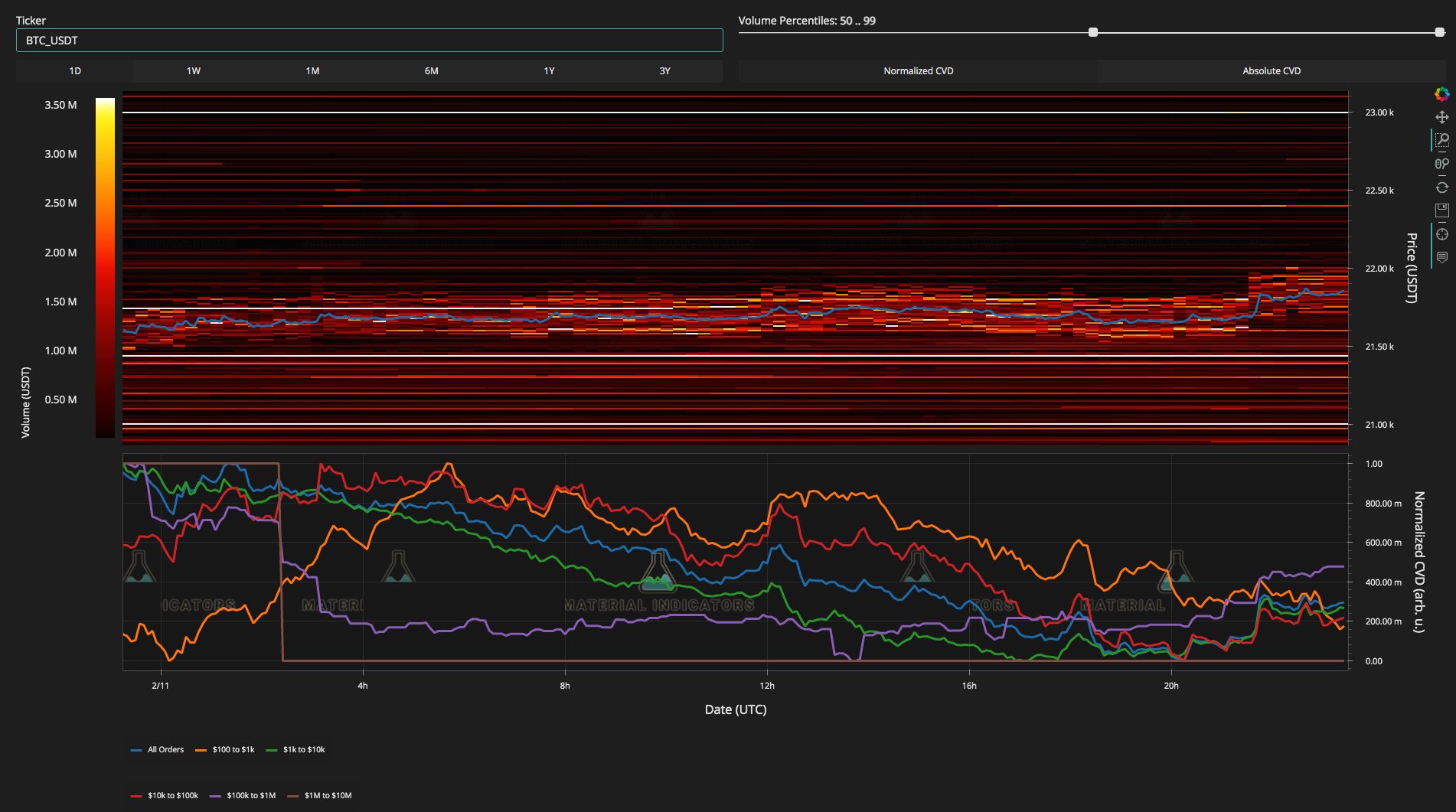

After hitting three-week lows the week before, Bitcoin was a target for opportunistic whales, explained on-chain analysis resource Material Indicators.

Loading a chart of the BTC/USD order book on Binance, materials indicators captured a rise in resistance, with a potential rise in the spot price offering a more advantageous sell level for high-volume players.

“FireCharts shows that the Crypto Weekend whales seem interested in trying to exploit the lack of upward liquidity in the Bitcoin order book to sell more. Personally, I’m fine with that,” part of the attached comments read.

Meanwhile, the lows for the week saw subdued reactions from market participants, some of whom rejected calls for a massive capitulation event on short notice.

“CT hysterical about bear market when BTC hasn’t retested a major lie or moving average that broke after 3 rising waves,” Filbfilb, co-founder of Decentrader trading suite, argument up to date.

Popular Crypto trader Tony was equally great on the current price action.

“I am short based on my updates as we reside below the major resistance zone below $22,400 – $22,600. Overall, I could see another touch of the highs if we can sustain above $20,300 overall,” he said. reasoned.

“The market structure hasn’t broken down yet.”

The IPC leads an important week of big data

Before the weekly close, others were already targeting next week’s macroeconomic data as the next potential catalyst for volatility.

Related: Bitcoin is already in its ‘next bull market cycle’ — Pantera Capital

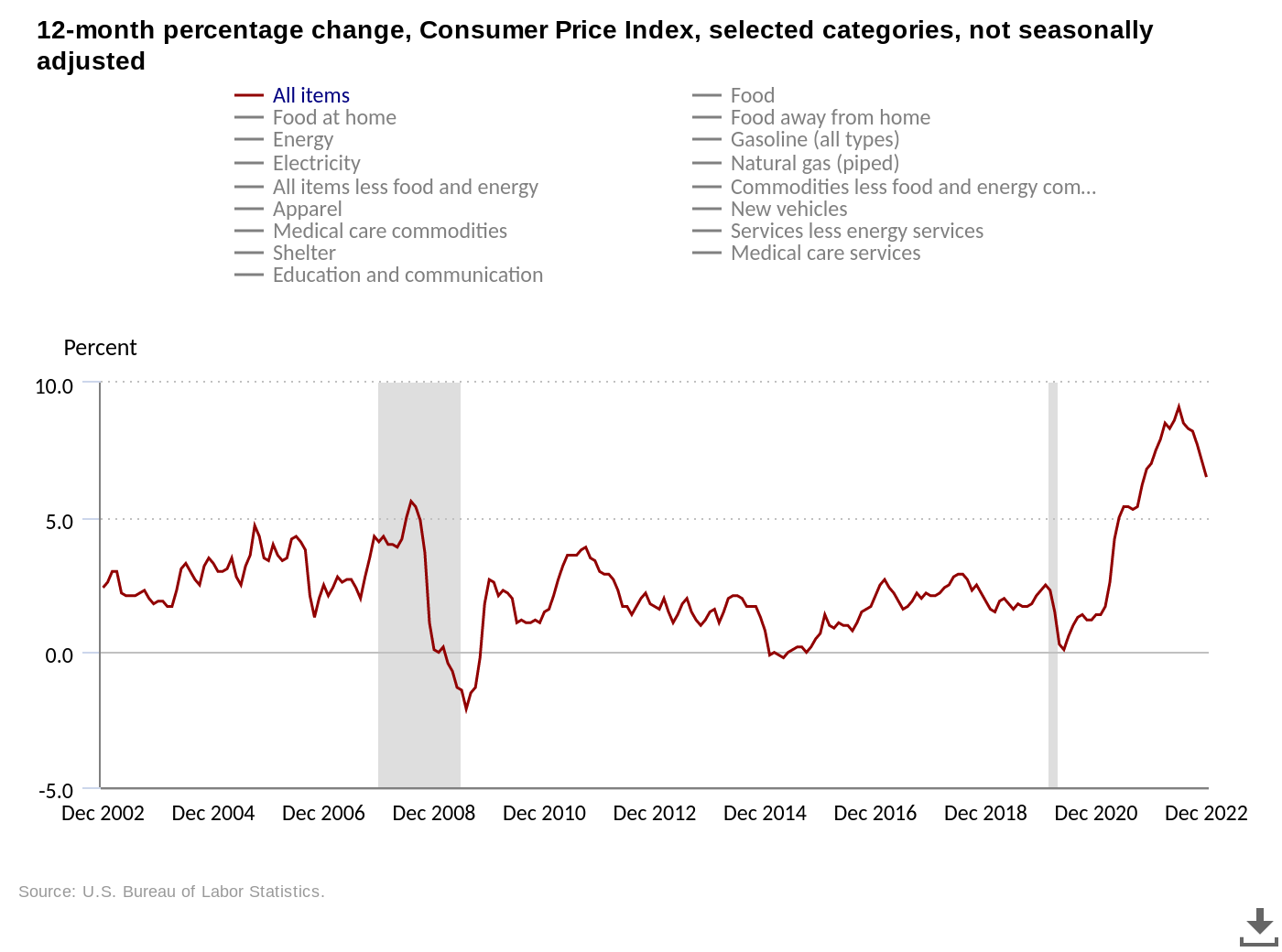

The Consumer Price Index (CPI) imprinted in January formed the main event of several in the United States, which is due on February 14.

“Big week ahead,” Michaël van de Poppe, Cointelegraph contributor, founder and CEO of trading firm Eight, summarizedalso highlighting retail sales, the Empire State manufacturing index and the producer price index (PPI) that expire during the week.

“I think it is likely that we will see inflation continue to fall and fall sharply. Gasoline prices have also been falling like a stone, and this drop-> markets go up,” she added.

Material Indicators agreed, saying it “expected volatility to continue through Tuesday’s CPI Report.”

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER