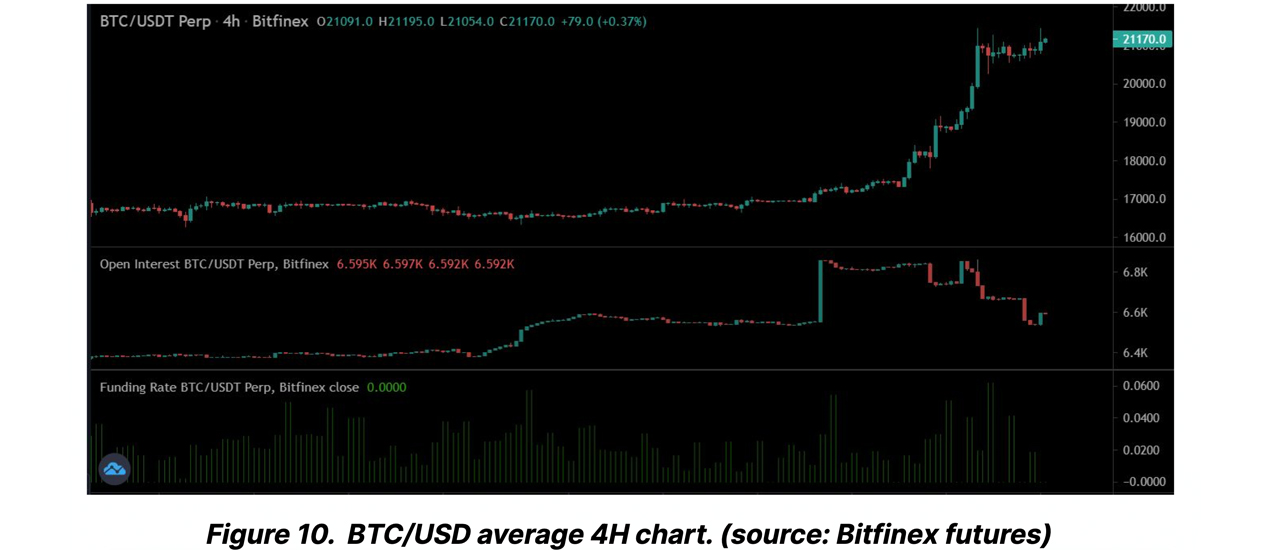

The top two crypto assets have risen significantly over the past seven days, with bitcoin jumping 22.6% and ethereum rising 18.6% against the US dollar. According to market data, both crypto assets saw the biggest spike on Saturday, January 14, 2023. The surge in value triggered the highest ratio of short to long selloffs since July 2021, according to a recent Bitfinex Alpha report.

Bitfinex analysts see a cautious approach from bulls as the market remains highly illiquid despite rising prices

Bitcoin (BTC) Y Ethereum (ETH) prices have risen significantly against the US dollar, triggering a cascade of short sell-offs on January 14. Cryptocurrency exchange Bitfinex discussed the matter in its most recent Alpha Report #37. When a trader opens a short position against bitcoin or ethereum, he expects the price of the crypto asset to decline in the future.

However, if the bitcoin price rises rapidly, short traders are either liquidated or must buy back the bitcoin at a higher price. when the price of BTC either ETH goes too high, the short sellers are liquidated, which means that their short position is closed by the crypto derivatives exchange. According to Bitfinex researchers, a significant number of liquidations occurred on January 14.

“Short sell-offs drove all bitcoin and ethereum gains,” Bitfinex analysts said in the Alpha report. “Short liquidations at $450 million outnumbered long liquidations by a ratio of 4.5. On January 14, the market recorded the highest ratio of short sells to long sells since July 2021,” the analysts added. They also mentioned that the liquidation figures and the short vs. long liquidation ratio was even more severe among altcoins.

Bitfinex analysts further detailed that a pullback in the bitcoin price remains likely. “While it is typical for bear markets to have a complete removal of shorts,” the analyst noted. “The entire rally has been built on the backbone of continuous market shorts that keep funding low and prices up on forced liquidations and rolling stops. Therefore, a pullback in the bitcoin price remains a possibility.”

The Alpha report adds:

Although the move could be interpreted as organic, it is completely engineered by limited traders in the market, which is evident by the depth of the market that remains the same week after week. The price impact of market orders is also the same as last week for (bitcoin), with little change for altcoins. This means that even with the upper hand, the market is still very illiquid, and with the sharp drop in open interest over the weekend, a pullback could be expected with a cautious approach from the bulls.

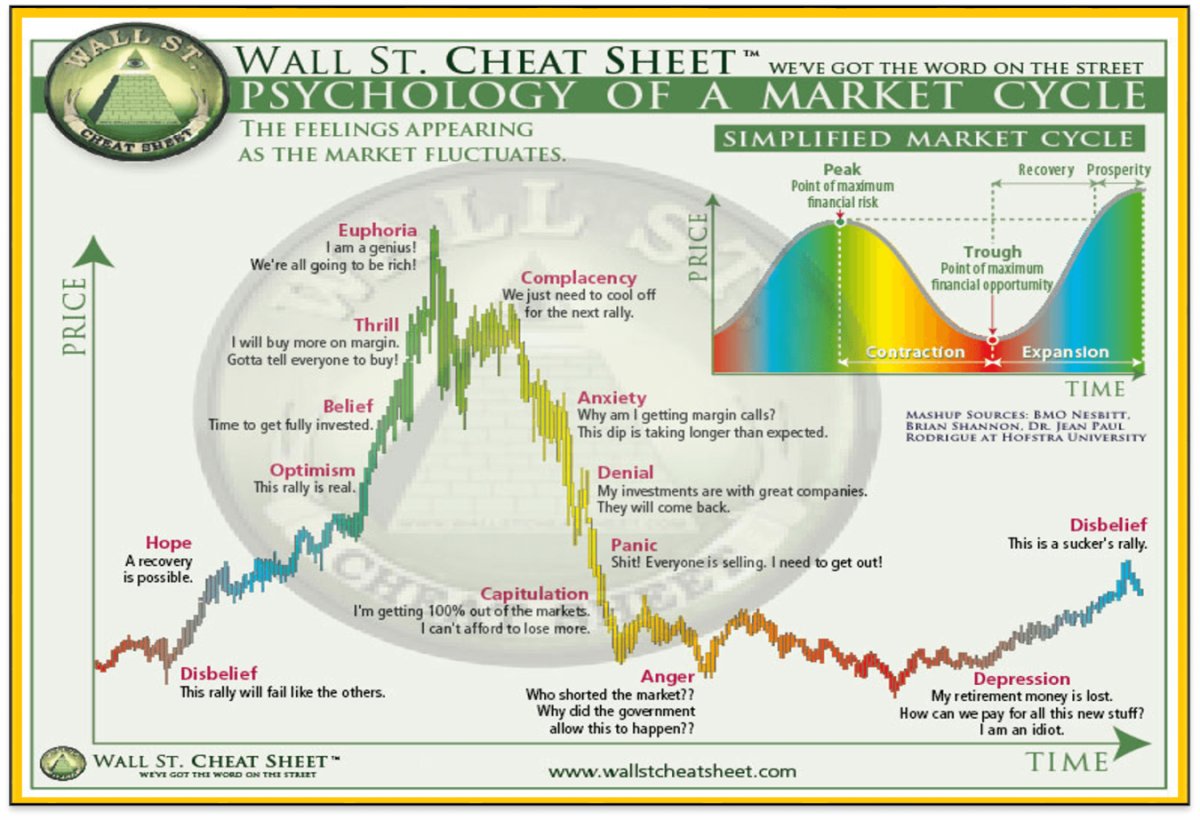

Crypto Supporters Debate Position on Gartner’s Hype Cycle and “Disbelief” Phase

When the selloffs took place three days ago, Bitfinex reported that Bybit experienced the largest short open interest selloff since its inception. “Negative funding rates below $16,000, followed by rising long-side aggregate open interest for (bitcoin), were the driving force behind the price rise,” the researchers explained.

The recent rise in bitcoin and ethereum prices has caused many people to speculate if the crypto bottom is in. On January 16, 2023, bitcoin analyst Willy Woo shared an illustrated image of the Gartner Hype Cycle and saying“I suspect we are in the ‘disbelief’ phase of the cycle.”

Several people disagreed with Woo’s opinion about being in the “disbelief” phase of the cycle. Crypto Proponent “Colin Talks Crypto” answered to Woo, saying, “No way.” Colin further emphasized that it “would mean the typical bear market was shorted massively (which is highly unlikely, especially in the current poor macroeconomic climate).” The crypto supporter and Youtuber added:

It would mean that a 4 year bitcoin cycle somehow magically turned into a 2 year cycle or something.

What do you think about the Bitfinex Alpha report and the short selloffs that took place this week? Do you think we’re in the ‘disbelief’ phase of the Gartner hype cycle? Let us know what you think about this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons