Total crypto market capitalization declined at $1.13 trillion on Feb. 16, but there was no change to the one-month ascending channel structure. More importantly, this level represents a 43% gain in 2023, which is far from the $3 trillion level reached in November 2021. Still, the current recovery is remarkable.

As shown above, the rising channel started in mid-January has left some room for a 10% correction to $1 trillion without breaking the bullish formation.

Investors reacted positively to a 5.6% year-on-year increase in US CPI inflation on February 14 and monthly retail sales growth of 3% on February 15. Bitcoin (BTC) had the biggest positive impact on total crypto capitalization as its price gained 12.5% on the week.

One area of concern is a February 16 story about financial transactions from Binance.US to Merit Peak, a trading company run by CEO Changpeng Zhao. Interestingly, Reuters reported that a Binance.US spokesperson said that Merit Peak “did not trade or provide any type of service on the Binance.US platform.”

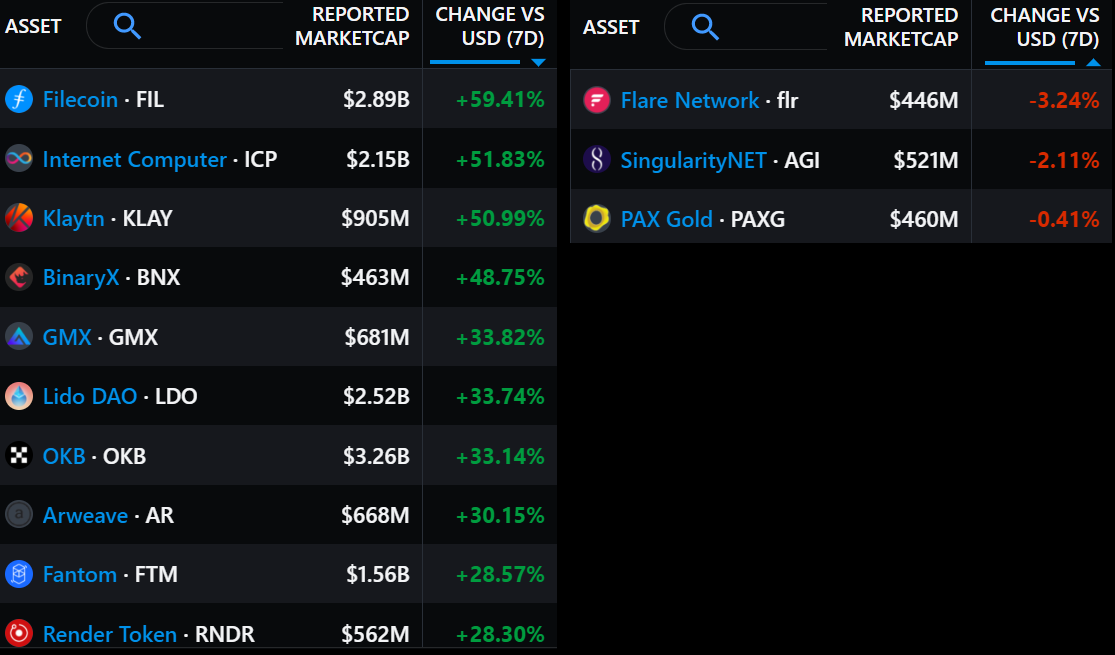

The 10.1% weekly rise in total market capitalization was held back by BNB’s modest 1.8% gains and XRP’s 2.5% price increase. On the other hand, only 3 of the top 80 cryptocurrencies ended the week with negative returns.

Decentralized Storage Solutions Filecoin (FIL) gained 59% and Internet Computer (ICP) soared 52% as demand for Bitcoin blockchain for NFT enrollment massively increased block space.

GMX rallied 34% as the protocol received $5 million in transaction fees in a single day.

Lido DAO (LDO) gained 34% as stakeholders weighed in on proposals to manage the 20,300 ETH held by the corporate treasury.

Leverage Demand Balances Out Despite Broadcast Rally

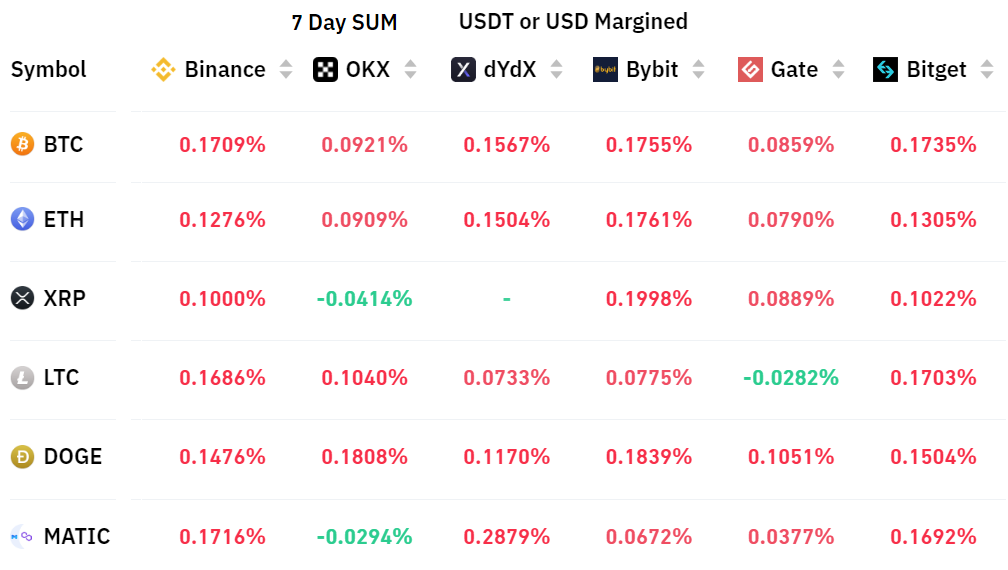

Perpetual contracts, also known as reverse swaps, have a built-in fee that is typically charged every eight hours. Exchanges use this fee to avoid currency risk imbalances.

A positive funding rate indicates that long buyers require more leverage. However, the opposite situation occurs when short sellers require additional leverage, causing the funding rate to turn negative.

The 7-day funding rate was close to zero for Bitcoin and Ethereum, which means that the data points to a balanced demand between long (buy) and short (seller) positions for leverage.

Interestingly, BNB is no longer one of the top 6 cryptocurrencies ranked by futures open interest, as investor demand for Polygon (MATIC) markets increased by 70% in February.

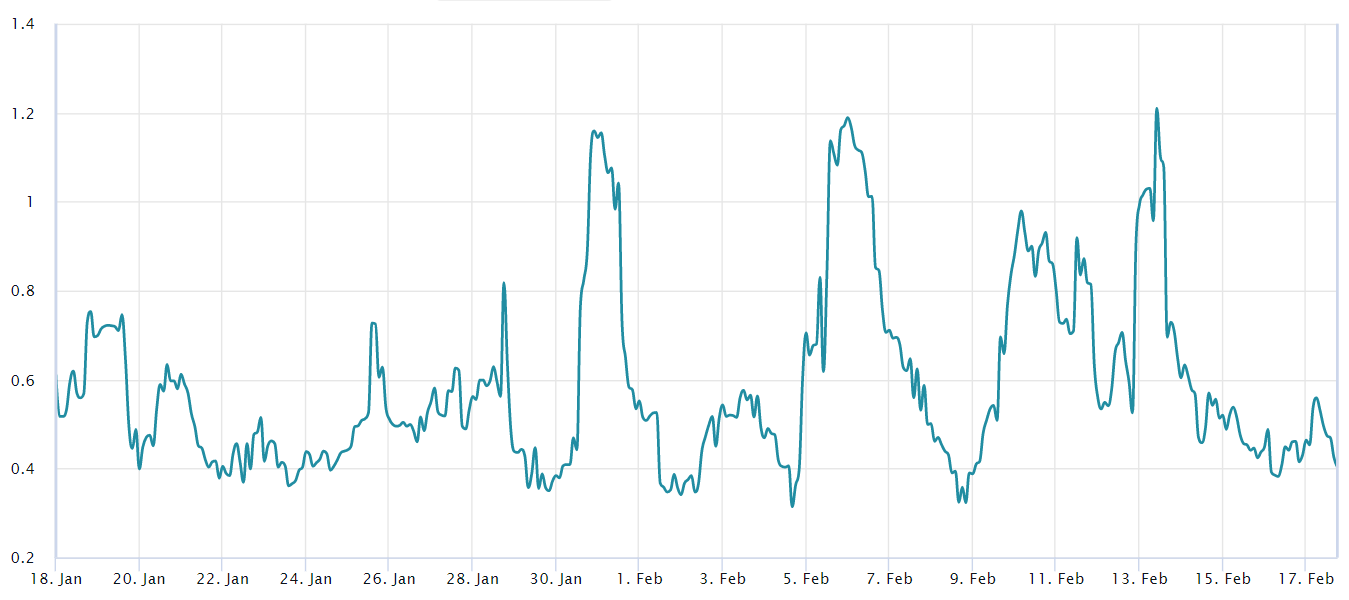

The put/call option ratio remains bullish

Traders can gauge overall market sentiment by gauging if there is more activity through call options or put options. Generally speaking, call options are used for bullish strategies while put options are for bearish strategies.

A put-to-call ratio of 0.70 indicates that put option open interest lags the most bullish calls by 30% and is therefore bullish. Conversely, a gauge of 1.40 favors put options by 40%, which can be considered bearish.

Related: Bitcoin price derivatives look a bit overheated, but data suggests bears are outnumbered

Even though Bitcoin price failed to break the $25,000 resistance, demand for bullish call options has outpaced neutral to bearish put options since Feb. 14.

Currently, the sell to call volume ratio is approaching 0.40, as the options market is more populated by neutral to bullish strategies, favoring call options by 2x.

From a derivatives market perspective, there are no signs of demand from short sellers, while leverage indicators show that bulls are not using excessive leverage. Ultimately, the odds favor those who bet that the total market cap resistance of $1.13 trillion will be breached, opening up room for further gains.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.