join our Telegram channel to stay up to date on breaking news coverage

Dipping below the $23k price level, Bitcoin raised some concerns in the market a couple of days ago. However, on Thursday, the token confidently rallied above the $24k level and investors are trying to guess what moved the price up.

Bitcoin Rises Back To $24,000 Thursday

Bitcoin recently closed its most prosperous January since 2013. This can be attributed to its nearly 40% monthly increase. The value of the asset rose when it passed the $17,000 mark at the beginning of the year and peaked at nearly $23,000 at the end of January.

The market was primed for further price volatility during the US Federal Reserve’s first FOMC meeting of the year, which resulted in a 25 basis point hike in interest rates. This rise is often seen as a bullish sign for risk assets, given past 75 basis point gains.

Despite the initial drop, Bitcoin made a significant jump, reaching its highest price since August 2022, at $24,350 on Thursday. While it has since lost some value, bitcoin still maintains a strong green presence on a daily scale and has a market capitalization of $456 billion, with a 42% dominance over the entire cryptocurrency market. This impressive performance has shown that Bitcoin continues to be a force to be reckoned with in the world of finance.

How has Bitcoin been moving so far?

Bitcoin, the first decentralized digital currency, was created in 2009 by the mysterious Satoshi Nakamoto. This revolutionary digital asset operates on a peer-to-peer network based on blockchain technology and works without the need for a central authority or banks.

Only 21 million Bitcoins will exist and they will be available in circulation through mining, where miners validate transactions and are rewarded with a set number of Bitcoins. Blockchain technology guarantees a permanent ledger, with transactions added chronologically, making it impossible to change or reverse them.

The success of Bitcoin has inspired the creation of thousands of other cryptocurrencies such as Ethereum, Litecoin, and Ripple. Despite initial skepticism, it has become widely accepted, with major companies like Microsoft and Tesla accepting it as a form of payment. Bitcoin can be traded on various cryptocurrency exchanges and its value is subject to constant fluctuations.

Over the decade ending in 2021, the value of Bitcoin skyrocketed from near zero to its all-time high. The first transaction that gave Bitcoin monetary value occurred in October 2009 when a computer science student sold 5,050 coins at $0.0009 each. Adoption was slow at first, but picked up as exchanges like Mt. Gox began handling a significant portion of all Bitcoin transactions.

In 2013, Bitcoin experienced significant growth, rising in value from around $15 at the beginning of the year to $1,042 in November. However, a security breach at Mt. Gox resulted in the shutdown of the exchange and a drop in the value of Bitcoin to $666 by the end of the year.

From 2015 to 2016 its value was relatively stable, but in 2017 increased media attention and investor focus led to a dramatic increase in price, reaching $64k in November 2021. The introduction of contracts Futures trading on the CME further cemented its status as a legitimate financial asset class.

Bitcoin has come a long way since its inception, experiencing both volatility and growth in the mainstream. It has transformed the way people view and use digital currencies, offering new opportunities in the world of finance. With its decentralized nature, transparent transactions, and immutability, Bitcoin is poised to shape the future of the financial industry.

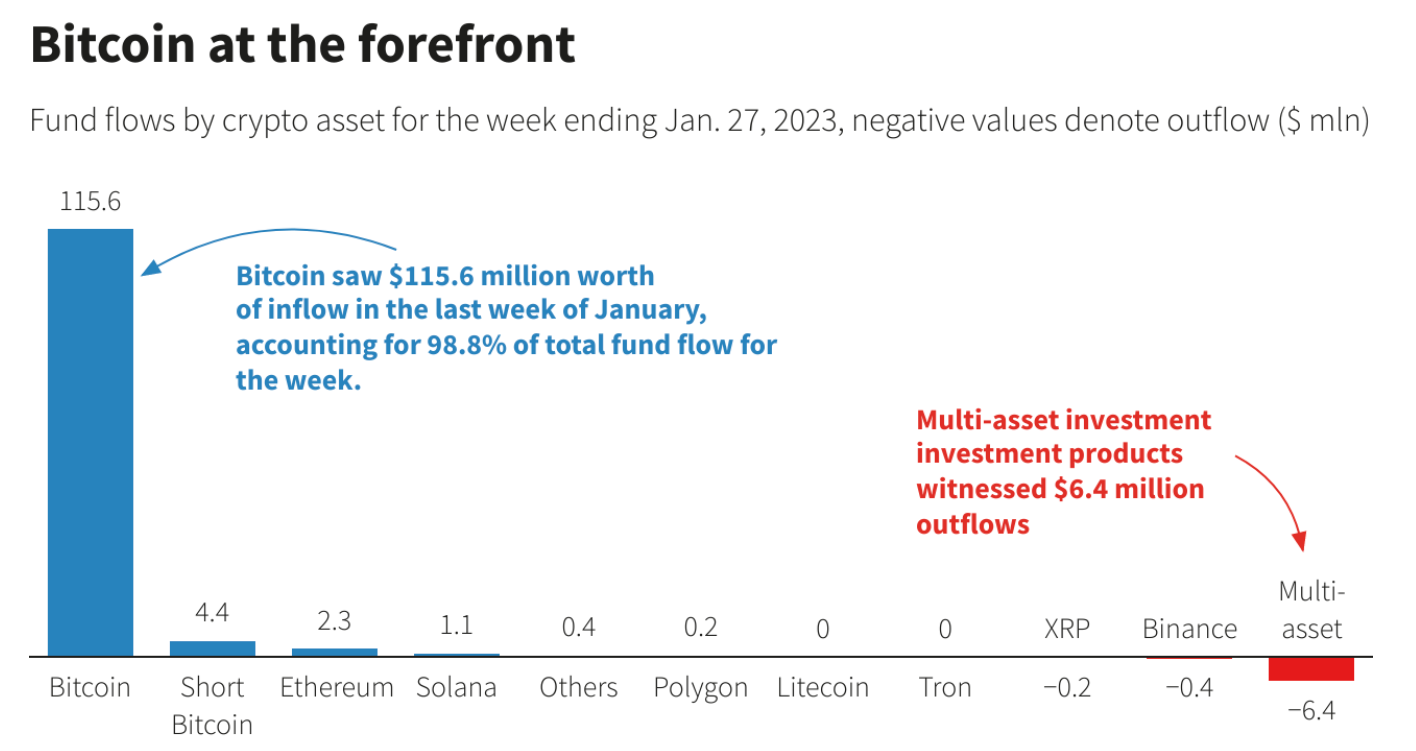

Cash flow increases the price of Bitcoin

Institutional investors are showing increased interest in Bitcoin as they see it as a valuable asset class. The highest level of activity in January was seen among US institutional investors, who were responsible for 35% of Bitcoin’s 40% price rise.

Major financial companies, including BNY Mellon and JPMorgan, have expanded their offerings to include crypto services and are increasing their commitment to the cryptocurrency market. According to a Goldman Sachs report, Bitcoin was the best performing asset of 2023 in both absolute and risk-adjusted terms.

Public and private companies such as Tesla are also investing in Bitcoin, with a survey revealing that 82% of high net worth individuals sought advice on cryptocurrency investments in 2022. Bitcoin miners, who are the only New Bitcoin producers have also experienced an improvement in revenue and network security as the activity becomes more profitable. The shift in market sentiment from “fear” to “greed” suggests that another growth cycle is on the horizon for the cryptocurrency market.

Increased liquidity in the market due to the anticipated easing of interest rates, as well as increased mining revenues that fueled the influx of Bitcoin into circulation, were partially responsible for the token managing to experience a surge. .

Investors are now curious as to where the token moves from here as it surpassed multiple targets on Thursday. While the impact of the US debt ceiling on Bitcoin is uncertain. A possible increase in liquidity could drive the market higher, but if the debt ceiling is not reached, it could hurt risky assets like Bitcoin. The timing of the debt ceiling is unclear, with estimates ranging from later in the year to earlier. The recent dovish tone from the Fed may push Bitcoin towards $25,000 if the debt ceiling debate continues.

Altcoins that can potentially outperform top gainers

With numerous coins making it to the top cryptocurrency list, a bunch of other tokens not available on cryptocurrency exchanges are raking in hundreds of dollars a day and that’s just the beginning. Here are some tokens worth attention.

RobotEra is a completely new virtual planetary world, similar to the Sandbox metaverse. In the game, the participants will become robots and monitor their territory and the ecosystem. TARO, the in-game currency, is considered a lucrative metaverse currency with a current rise of over $808,000.

RobotEra’s metaverse platform will provide gamers with exciting gaming experiences and unlimited opportunities by bringing cryptocurrencies and digital assets into the gaming universe. TARO will serve as the currency for all transactions in the RobotEra ecosystem and is based on Ethereum as an ERC-20 token. The TARO pre-sale is ongoing and investors can purchase the token for $0.020 with USDT or ETH.

Second on the list is C+Charge, a project that transforms the EV charging landscape by introducing carbon credits into the ecosystem. In an ever-growing EV market, the project managed to impress by raising over $547k, with each CCHG token available to purchase for 0.013 USDT.

The company will create a network of charging stations, where users will be rewarded with carbon credits for charging their vehicles. Which can then be redeemed for CCHG tokens, which can be traded on the exchange or staked for passive income.

CCHG has a great future as it powers the entire C+Charge ecosystem and therefore investors looking for a project with a promising future should not miss the CCHG pre-sale.

Read more:

Fight Out (FGHT) – New Move to Earn project

- CertiK audited and CoinSniper KYC verified

- Early stage presale live now

- Earn free cryptocurrencies and meet your fitness goals

- LBank Laboratories Project

- Associated with Transak, Block Media

- Rewards and participation bonuses

join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER