Bitcoin mining drives network transactions and the price of BTC. During the 2021 bull run, some mining operations raised funds against their Bitcoin ASIC and BTC reserves.

ASICs have also been pre-ordered by miners at a considerable premium and some have raised funds by conducting IPOs.

As the crypto market turned bearish and liquidity gripped the sector, miners found themselves in a bad spot and those unable to meet their debt obligations were forced to sell BTC reserves near the bottom of the market or declare bankruptcy.

Notable Bitcoin mining bankruptcies in 2022 came from Core Scientific, which filed for bankruptcy, but BTC’s performance in early 2023 begins to suggest that most of the capitulation has passed.

Despite the strength of the current bear market, some miners were able to ramp up production throughout 2022 and on-chain data shows that Bitcoin miner backlog started to pick up in December 2022 and momentum appears to continue through 2023.

Bitcoin Rally To $22,000 Improves Miners’ Margins

The 2023 Bitcoin rally, in which the BTC price hit a year-round high of $22,153 on Jan. 20, up 17% in 7 days, has helped BTC mining operations significantly.

An increase in the Bitcoin price and the network hash price are helping BTC miners who maintained net positive balances at the end of 2022, which is improving business stability. Also, now the Bitcoin miners are mostly making a profit again.

While more miners are returning to Bitcoin mining rigs, the difficulty is increasing, which may hinder the future. With conditions improving, will Bitcoin miners continue to accumulate or continue the selling trend?

Recapping 2022, Jaran Mellerud, Bitcoin mining analyst for Luxor Mining, said:

“Between January and November, public miners downloaded 51,180 bitcoins and produced 47,284 bitcoins.”

The BTC hash price, a metric that measures the market value of mining or computing power, provides insight into the profitability of Bitcoin mining operations.

Since January 1, 2023, the price of hash has increased by more than 20% and on January 19, Bitcoin mining profitability grew from $0.06 per Terra Hash per day (TH/d) to $0.07874 TH /d and this has benefited from the BTC price rally. Hashprice has not witnessed recent levels since the beginning of October 2022.

Although Bitcoin mining profitability has improved since early 2023, the industry still faces troubled waters ahead. According to Nico Smid, co-founder of Digital Mining Solutions:

“The recent increase in the price of hash is positive, but many miners are still operating on thin margins. A year ago, the hash price was $0.22/TH/day. Although the market has reached its lowest point, the current economic conditions for mining remain challenging.

Bitcoin miners keep selling most of their mined BTC

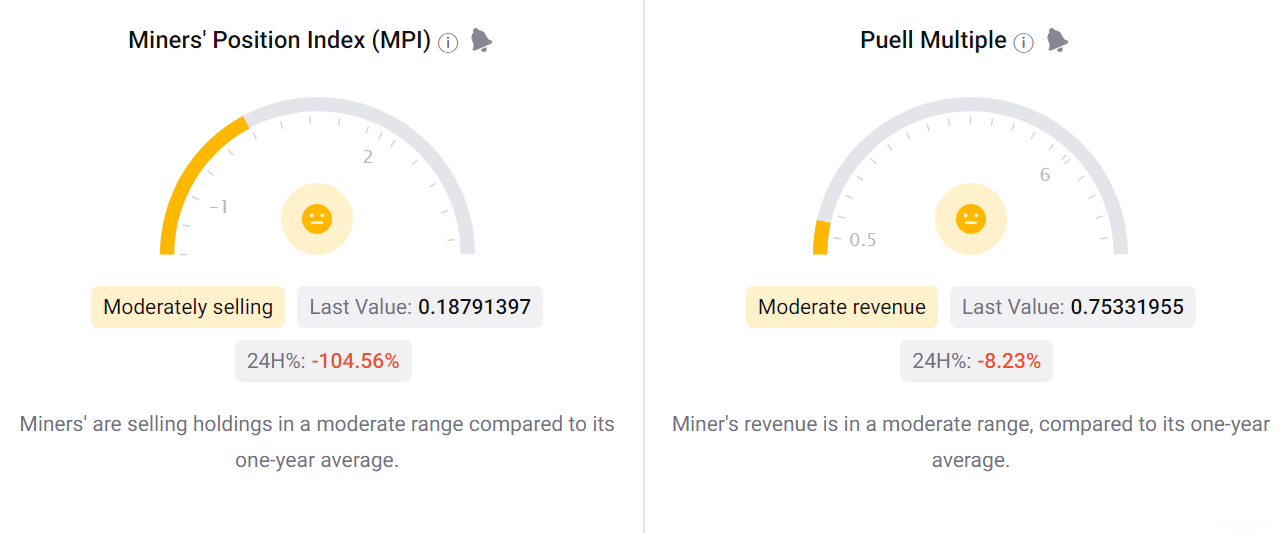

Bitcoin miners are benefiting from the rise in price and data shows that many continue to sell their rewards.

The strongest mining operations actually limited debt and expansion or used a selling BTC strategy while turning a profit. Using self-reported data, Anthony Power, Bitcoin mining analyst for Compass Mining, compiled a list of miner pools at the beginning of the year vs. the end of the year.

A year that started with so much promise and optimism and ended with several high-profile bankruptcies, with more likely to follow.

Here is part 1 of #BTC Year of mining in review for @compass_mining looking at some of the biggest stories in 2022https://t.co/cbFm8gFmR4 pic.twitter.com/Uyz6iitZRU

— Anthony P

wer (@cazenove_uk) December 23, 2022

Marathon Digital, the top holder of publicly traded Bitcoin mining companies, had 8,133 BTC as of the end of December 2022. The company plans to increase production based on hash price profitability to increase its advantage.

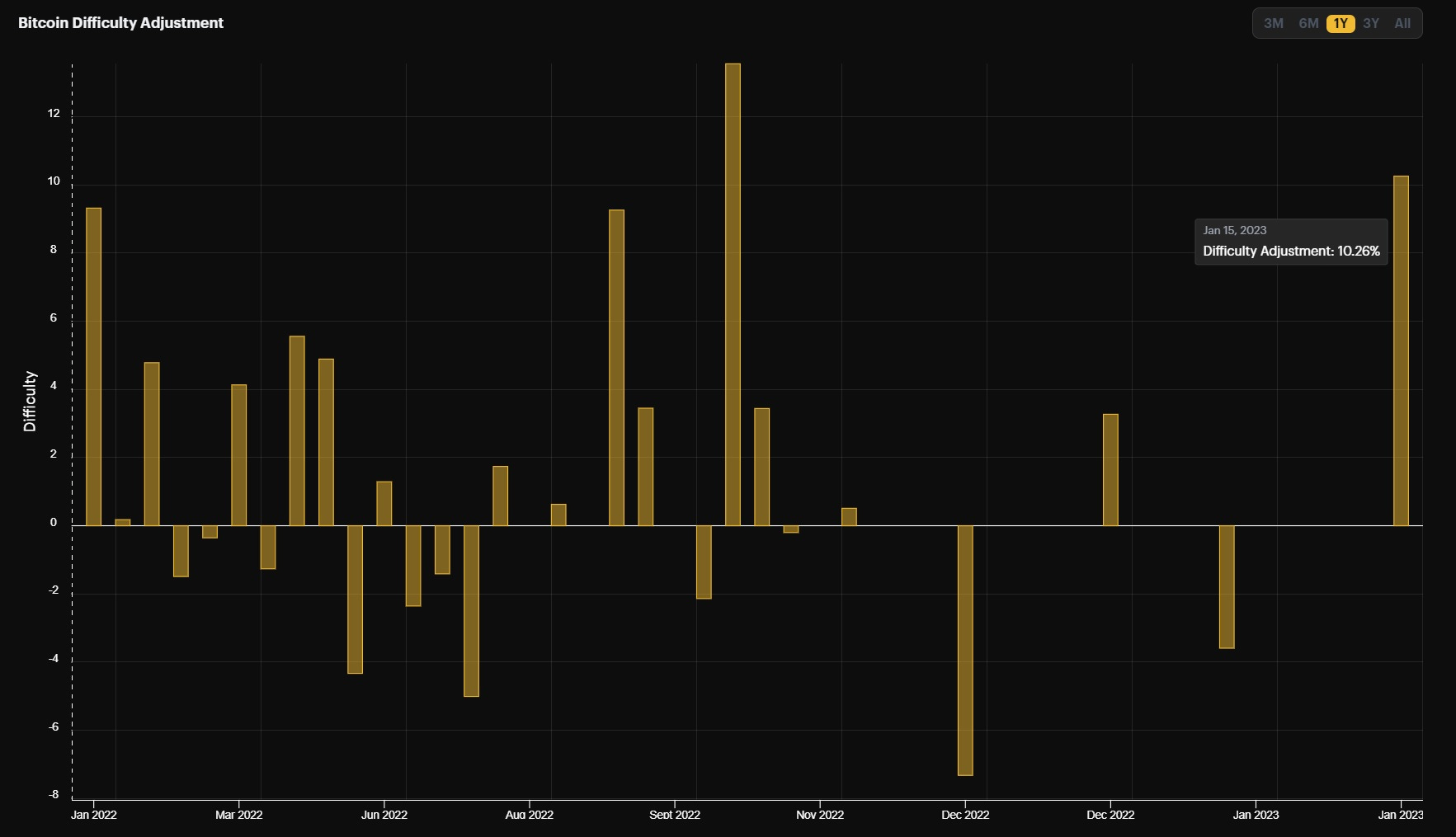

Mining difficulty could hamper future profits

With more Bitcoin miners turning their BTC rigs back on, the mining difficulty metric adjusted upwards by 10.26% on January 16. Bitcoin difficulty indicates the time and cost to mine BTC to receive rewards. The adjustment was the largest since October 2022 and the increased difficulty makes it more expensive for Bitcoin miners to earn rewards through the proof-of-work (PoW) consensus mechanism.

With the next Bitcoin halving event set to take place in 2024, mining BTC will be even more difficult and possibly more expensive for miners, putting further stress on already tight margins. On the upside, the last halving event in 2019 was followed by a 300% gain for BTC the year before.

While miners are experiencing some relief after a difficult year, potentially rough roads lie ahead. Trading operations are apparently improving with Bitcoin miners selling for profit rather than borrowing against Bitcoin holdings.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER