bitcoin (btc) bulls lost control of $27,000 until September 30 as the monthly and quarterly close became important.

bitcoin prepares for the close of three key candles

Data from Cointelegraph Markets Pro and TradingView tracked a cooldown in btc price action ahead of the key September candle.

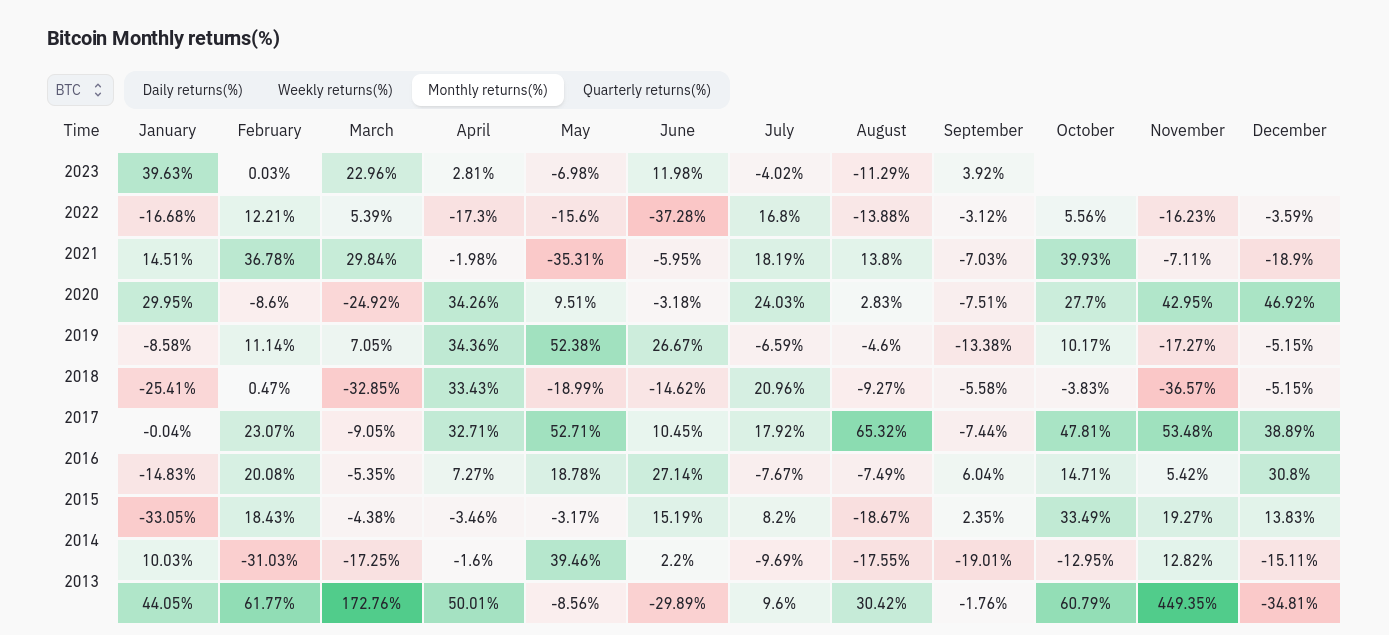

The largest cryptocurrency is up nearly 4% so far this month, marking its most successful September since 2016, according to data from the monitoring resource. glass coin.

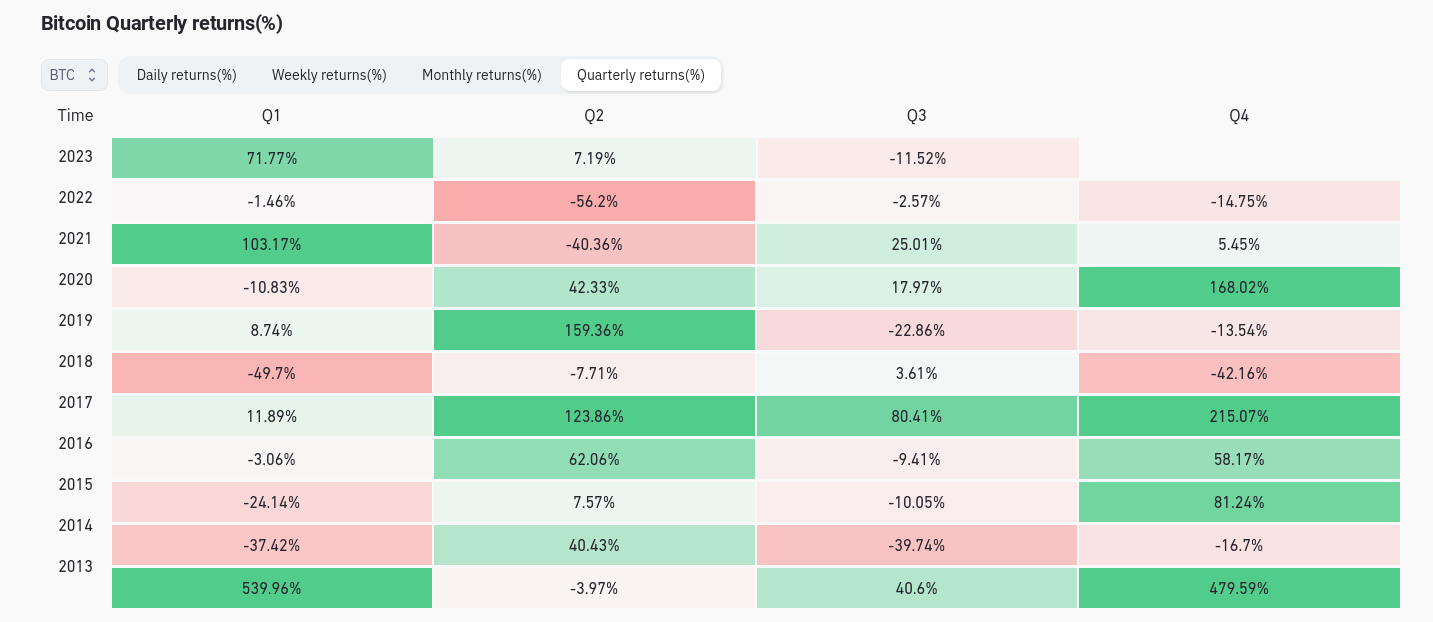

In contrast, the quarterly performance for the third quarter showed that btc/USD was down 11.5% at the time of writing.

For traders and analysts, everything could change in the final hours of the monthly candle.

“Previously, a green September resulted in green October, November and December,” says popular trader Jelle. noted in part of the X analysis of the day.

Will history repeat itself?”

The day before, Jelle predicted better conditions for the fourth quarter, including a break above $30,000 for the first time since early August.

After months of hoarding coins and slowly preparing for the bull market, I think it’s time.

The fourth quarter is expected to bring new strength and a break of $30,000.

Send it.bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin pic.twitter.com/vkl0aq5hRS

– Jelle (@CryptoJelleNL) September 29, 2023

“Textbook bass techniques”

Meanwhile, tracking Resource Materials indicators warned of what it called “textbook” bearish signals from multiple moving averages (MAs) on longer and shorter time frames.

Related: bitcoin Halving to Raise “Efficient” btc Mining Costs to $30,000

Beyond the monthly and weekly shutdown, the impending US government shutdown should continue to suppress btc price action unless a solution is found in time, he added.

We head towards the last #trade day of the month with textbook bearish techniques of the key moving averages in daily, weekly and monthly TF and #Trend precognition is showing a new #Commercial signals about him btc?src=hash&ref_src=twsrc%5Etfw”>#btc Daily chart as if you know we have a US in the making… pic.twitter.com/l9Mm2SHyFu

— Material indicators (@MI_Algos) September 30, 2023

“There is a high probability that the orcas will intensify the weekend whale games around the daily, weekly and monthly candle close. Don’t be fooled by a trap”, part of Additional comment from Material Indicators co-founder Keith Alan read.

A snapshot of the btc/USD order book on the world’s largest exchange, Binance, showed supply liquidity congregating around $26,800. Meanwhile, sellers were waiting at $27,500.

Others, like popular trader Daan crypto Trades, expected less volatile conditions until immediately before the new week.

“We had volatility last week, but open interest has cooled down, so I doubt we’ll have any strange price action until maybe later Sunday,” he said. said X subscribers in the day.

An accompanying chart showed the opening and closing prices of CME Group bitcoin futures potentially acting as a magnet for the btc spot price, a common phenomenon.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER