Bitcoin (BTC) struggled to maintain bullish momentum on Jan. 30 as the countdown to the monthly close kept the market on edge.

BTC Price Sees a Flash Drop Below $23,000

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD broke out of its recent highs just below $24,000 on the day.

These, while Bitcoin’s best performer for nearly six months, found trouble holding up at the start of the week, with pre-Wall Street trading seeing a brief trip below $23,000.

At the time of writing, Bitcoin was trading around $23,250 while US stocks limped through the last days of January.

Among the topics of interest to analysts was the CME Bitcoin futures gap from the weekend that quickly “filled up” on spot.

“Gaps” on the futures chart often act as a short-term price magnet for spot once the futures markets reopen after the weekends. Another remained open between roughly $19,970 and $20,530.

“CME Gaps Filled and Overshot Now Because Stock Futures Are Negative,” Popular Trader John Wick wrote in his latest Twitter update.

“We have a wild week ahead of us!”

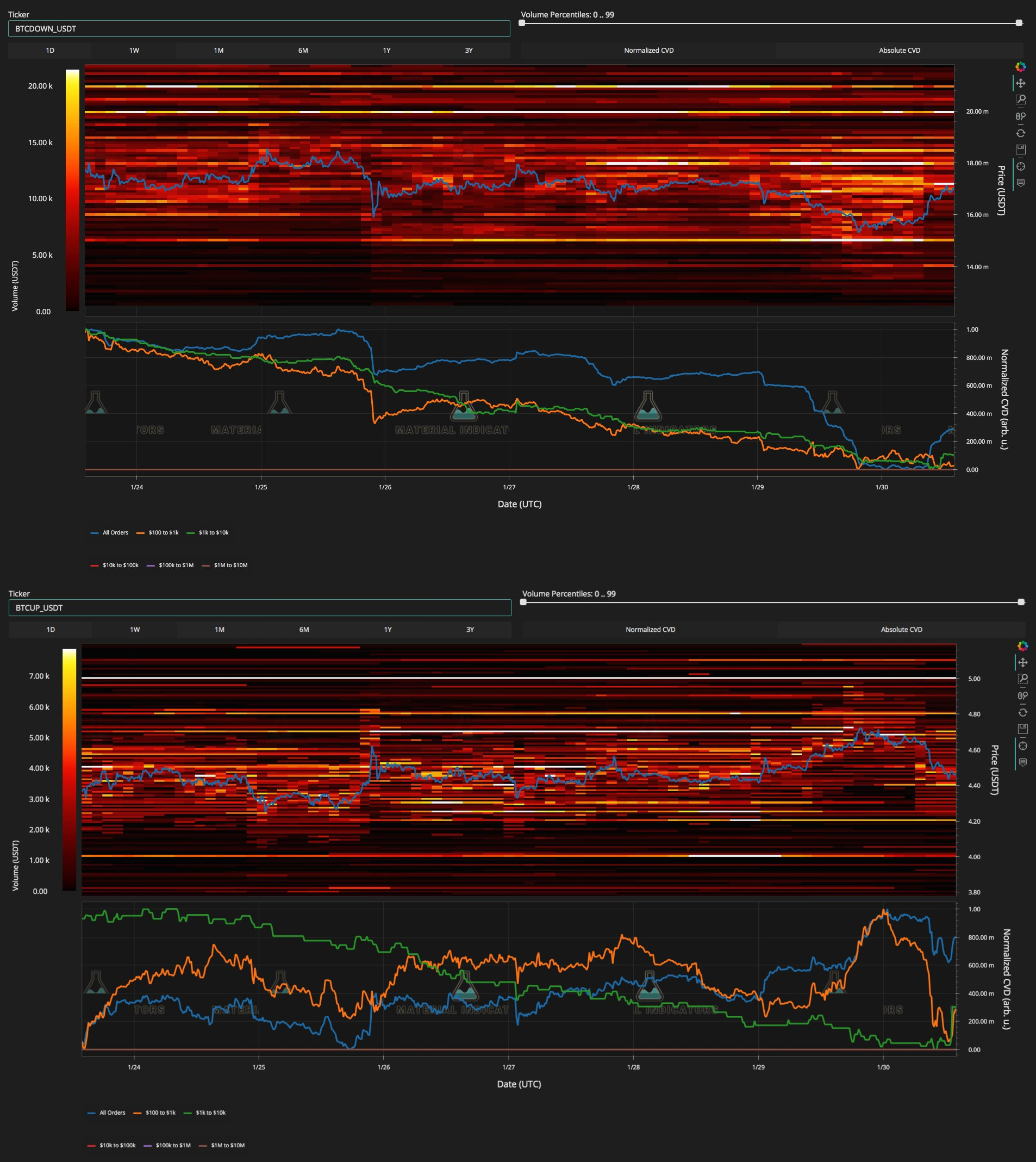

Meanwhile, analytical resource material indicators focused on order book activity on Binance, with both long and short positions potentially signaling a continuation to the upside.

“Sometimes looking at leveraged assets on binance can give clues as to what is happening with the underlying. BTCDOWN is at resistance and BTCUP is approaching support,” commentary on a long/short chart fixed.

“Things don’t have to play out as these charts indicate, but so far they do correlate to the current BTC PA.”

Bitcoin Analyst “Not Convinced”

As to whether Bitcoin would stick with the bullish weeks before the monthly close, others were far from confident.

Related: Best January since 2013? 5 things to know about Bitcoin this week

Among them was Crypto Ed, who, in a note to his followers, said he was “still not convinced” about the overall strength of Bitcoin.

An accompanying chart presented a possible retest of $22,000 as a downside target.

As Cointelegraph reported, the area around $25,000 had formed a major cloud of resistance for Bitcoin, being an area of significant short-term selloffs.

Nonetheless, that price remained a popular target should the bulls regain their firepower.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER