Bitcoin (BTC) rested at multi-week support at the Wall Street open on March 9 as concerns mounted about a deeper BTC price drop.

Trader: $19,700 “on the table”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circulating $21,800 on Bitstamp.

With $22,000 in danger of slipping from support to resistance, popular trader Pentoshi was among those warning that further destruction of support could be next.

“We did it. Best r/r currently, not a fan of slow bleed though. Would have liked an SFP (one may still come)” wrote in an update to a previous BTC price forecast.

“Below this it can get ugly with 19.7-20.5k on the table.”

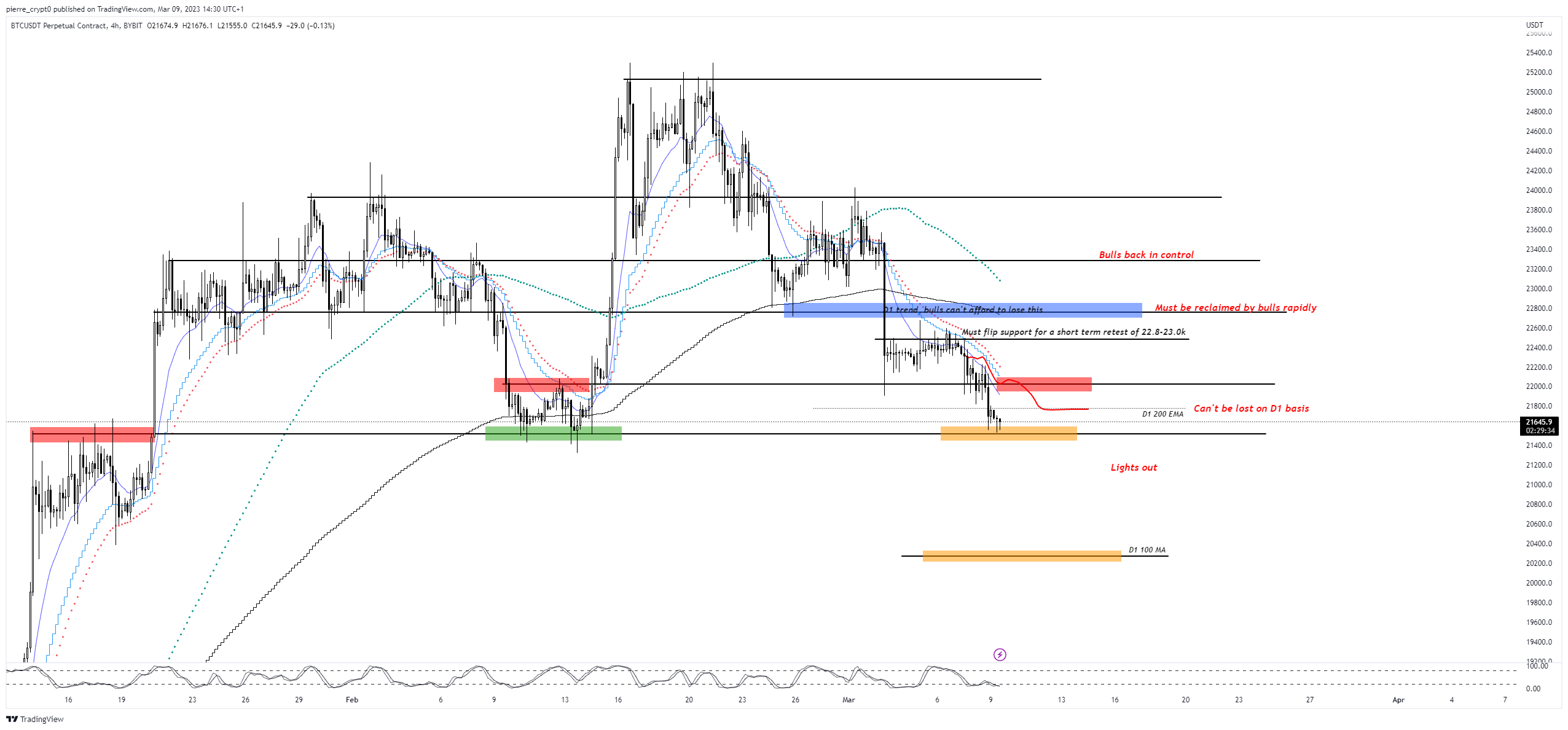

An accompanying chart showed the importance of the current spot price zone within Bitcoin’s broader range, missing out on potential range consequences.

Trader and commentator Nunya Bizniz pointed to a similar bearish signal that is currently playing in the form of Bitcoin’s 200-day EMA.

By historical patterns, he warned, there was clearly room for losses.

Daily BTC:

Back above 200ema after the low.

Once this has occurred, the bottom is usually in.

The price twice never looked back and now for the third time the price has fallen back below.

What price may look like based on 2012 and 2015.

$17K to $15K revised? pic.twitter.com/LOnA0RRHcO

— Nunya Bizniz (@Pladizow) March 9, 2023

The 200 day EMA was also on the roadmap of well-known trader and commentator Pierre, who inflicted that there would be little to stop BTC/USD from falling to its 100-day moving average in the event of a crash.

Dollar falls after rematch of resistance

Meanwhile, Binance order book data showed the “busy” area of liquidity supply and demand around the spot price.

Related: Bitcoin Keeps Liquidating Longs As BTC Price Action Gives Up $22K Support

With new US jobs data in the offing, material tracking resource indicators were bracing for volatility, which has yet to show up.

Here is a #FireCharts 1.0 view of the #BTC order book in @binance before the report. pic.twitter.com/DpuJJKEO4W

— Material indicators (@MI_Algos) March 9, 2023

In a ray of hope on the day, macro markets started to rise at the open on Wall Street with the US dollar losing ground gained earlier in the week.

The US Dollar Index (DXY) was down 0.4% at the time of writing, while the S&P 500 and Nasdaq Composite Index both pointed to gains of 0.5%.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.