The price of bitcoin started this week at the top in what was an unprecedented move for many market participants. After spending the first few days of October disappointing investors, the price of bitcoin earned more than $66,000 for the first time in many weeks.

Interestingly, this price action has seen the price of bitcoin rise once again. approaching a critical technical level with the 200-day moving average. Breaking this key indicator has historically signaled the start of explosive rallies, often resulting in parabolic price increases. The question now is: can bitcoin repeat this historical pattern and spark another massive surge?

bitcoin price is approaching 200-MA. What does this mean?

The 200-day moving average provides a clear view of a long-term asset. A break above the 200-day moving average suggests that the cryptocurrency is now trading with a positive difference compared to a more than 200-day average. For bitcoin in particularThis indicator has often served as a turning point between bullish and bearish price sentiment.

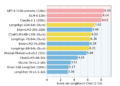

Cryptographic analyst Ali Martínez x.com/ali_charts/status/1845896049098936440″ rel=”nofollow” target=”_blank”>noticed that In the past, bitcoin price breaking above the 200-day moving average has consistently marked the start of parabolic bull runs. The last three times bitcoin price broke above the 200-day moving average, each of them started parabolic bull runs. The first time was in 2016, when bitcoin continued a 7,513% surge that lasted almost two years.

Again, in 2021, the price of bitcoin surpassed the 200-day moving average for the second time, leading to a 705% price increase that peaked in April 2021. More recently, in 2023, the price of bitcoin surpassed the 200-MA for the third time. time, causing another significant spike in prices. This time, bitcoin saw a 275% rise from its breakout level.

These cases above show the importance of the 200-day moving average for bullish price action. The recent price action has seen bitcoin price slightly back above the 200-day moving average, which currently sits around $65,844. Consequently, this price has now become a major point of interest for both bullish and bearish traders.

What's next for btc price?

The price of bitcoin bitcoin-news/bitcoin-reclaims-66k-but-retail-investors-lag-is-a-final-fomo-wave-coming/” rel=”nofollow noopener” target=”_blank”>reached $66,000 in the last 24 hours, although it has retreated a bit and is now trading just below. A reconfirmation above $66,000 would ultimately cause a break above the 200-day moving average and potentially initiate another bullish rally.

As bitcoin attempts to break above this key level, all eyes are on whether it can replicate the parabolic moves seen in previous cycles. However, price returns have declined in each of the last three outbreaks.

However, even a return between 100% and 150% would translate into a price target between $132,000 and $165,000 from the current price. bitcoin could also easily break out of the 200-day moving average and reach these prices quickly, especially with bitcoin-news/samara-asset-group-eyes-32-8-million-bond-issuance-to-increase-bitcoin-holdings/” rel=”nofollow noopener” target=”_blank”>growing institutional inflows via bitcoin Spot ETF.

Featured image created with Dall.E, chart from Tradingview.com

NEWSLETTER

NEWSLETTER