join our Telegram channel to stay up to date on breaking news coverage

BTC is currently valued at around $21,900 and has a 24-hour trading volume of $15.3 billion. With a #1 rank, a market valuation of $420.7 billion, 19.3 million coins in circulation, and a peak supply of 21 million BTC coins, it is up 0.45% over the past 24 hours. On Saturday, Bitcoin broke above a crucial support level around $21,875, raising the likelihood of a downtrend in BTC. If there is a bullish break through this level, the next resistance limits of $22,300 to $22,850 can be reached.

However, the fall could extend to the $21,200 level if it cannot break below the $21,750 mark. BTC price could fall to its nearest support of $20,600 if it breaks above this level.

Bitcoin Fundamental Outlook

Despite concerns about potential regulatory surprises soon among certain cryptocurrency traders, a group of well-known investors seems unconcerned. If no US lenders show up to help after cryptocurrency exchange Binance temporarily suspended US dollar deposits and withdrawals, a crisis could unfold.

The issue could be cleared up next week, but the latest $30 million settlement reached between Kraken and the US SEC caused a sharp drop in market prices. Following the deal, Brian Armstrong, the CEO of Coinbase, warned that the SEC would ultimately ban cryptocurrency staking altogether. In light of this, recent comments by SEC head Gary Gensler imply that crypto firms should provide comprehensive disclosures, supporting the prospect of future enforcement of such measures.

Furthermore, Gensler goes so far as to state that the only option for crypto companies to continue operating is to comply with US regulations that require full and truthful disclosures.

Bitcoin Technical Analysis

Following the market crash in May 2022, the bitcoin price began to rise within a symmetrical pennant, which collapsed in November as a result of the FTX failure. However, the price was helped to restore its levels within the pennant by the current rise that began in early 2023.

BTC value is currently being rejected by the uppermost resistance of the triangle and may soon retrace its steps towards lower support before consolidating once more until it touches the edge of the pennant. By clearing the key hurdle at $30,000 well before the end of Q2 2023, the bitcoin price may break at its all-time high and break above the adjacent resistance at $25,347.

The total amount of BTC tokens stored in wallets across all exchanges constitutes the supply across the exchanges. These levels reveal how market participants feel and whether they want to sell or hold the asset for a longer period. Since market participants frequently accumulate and move their assets to their wallets, a decrease in supply on the platforms is usually a positive.

Unfortunately, inventory in the markets has grown dramatically after being close to its low point in December 2022. So it suggests that investors hoarded while the markets were reaching their low point and are now preparing to take advantage of rising prices. to extract profit.

How Whales Are Changing the Bitcoin Landscape

Whales are big investors who own a sizeable portion of a specific asset and have the power to drastically affect the market. The actions of whales in the cryptocurrency market can also significantly influence the value of major altcoins in addition to Bitcoin.

Recent evidence and statistics point to the possibility that the activity of whales in the market may be the cause of the current increase in the volume of trade. Examining your stocks provides clues about the market trend, which can help investors make wise decisions.

Bitcoin whales, those with a stake of more than $1 million in BTC, bought more at the current price when the price fell. This buying fever was especially intense after the FTX crash in November 2022, according to the chain’s statistics.

The activity of these whales shows that any unfavorable reactions to Kraken’s decision to stop offering cryptocurrency staking facilities would be transitory and that they perceive an opportunity to purchase substantial amounts of BTC below the $22,000 mark.

Bitcoin price history

The catastrophic financial market crash of 2008, which led to a severe crash and prolonged recession, was a contributing factor in the creation of Bitcoin. The white paper was published by “Satoshi Nakamoto”, a pseudonym for a person or perhaps a group of people.

Initially, the coin was made available for trading against the dollar on the New Liberty Monetary Exchange, where 5050 BTC of its value was exchanged on the BitcoinTalk forum for $5.02 using PayPal.

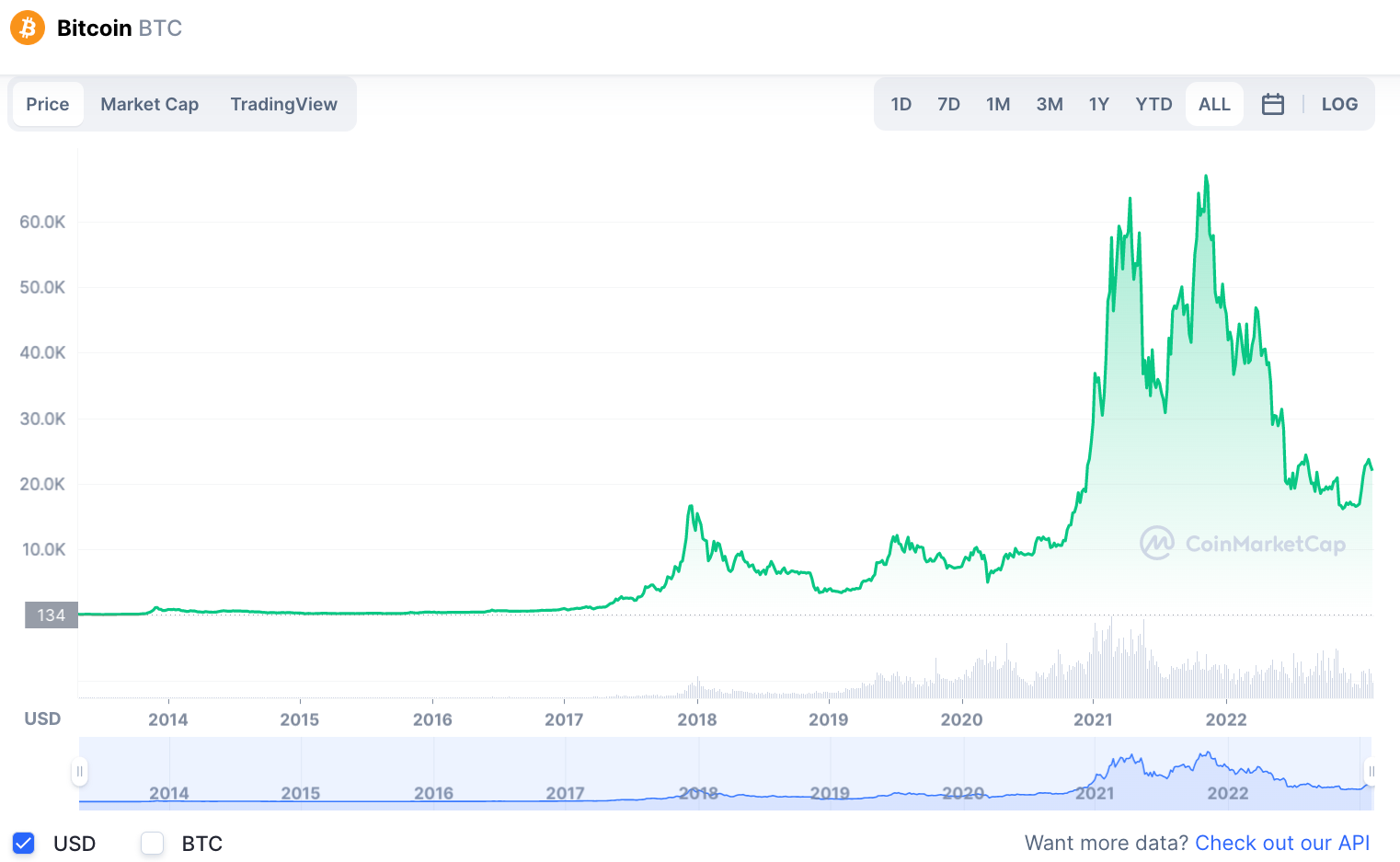

In February 2011, the price of Bitcoin crossed the $1 threshold and subsequently rose sharply in the following years. The price experienced its first price increase in 2013 and reached highs of around $1,200 before falling rapidly and remaining flat throughout 2014 and 2015. This was mainly due to the hack of the Mt. Gox exchange, which was the first security breach resulting at a loss of 744,400 BTC.

The next bull run began in late 2017 and continued through the first few months of 2018, during which time the bitcoin price topped $19,000. However, a bear market ensued, fueled in part by the COVID epidemic, and forced the price to consolidate until March 2020.

After surviving the bad market, the price once again sparked a bull run to set new records of over $69,000 in 2021 before resuming its downtrend throughout 2022.

Read more:

Fight Out (FGHT) – New Move to Earn project

- CertiK audited and CoinSniper KYC verified

- Early stage presale live now

- Earn free cryptocurrencies and meet your fitness goals

- LBank Laboratories Project

- Associated with Transak, Block Media

- Rewards and participation bonuses

join our Telegram channel to stay up to date on breaking news coverage