Bitcoin (BTC) held lower at the Wall Street open on Feb. 24 as US macroeconomic data showed inflation receding.

The PCE raises new doubts about inflation

Data from Cointelegraph Markets Pro and TradingView It followed BTC/USD as it traded in an ever narrowing range around $23,800.

The pair tried to rally $24,500 the day before but was ultimately unsuccessful as resistance kept gains in check.

However, Bitcoin only saw a muted reaction to the latest print of the US Personal Consumption Expenditure (PCE) index, which was 4.7% instead of the 4.3% forecast, suggesting that inflation was not declining as fast as expected.

For popular commentator Tedtalksmacro, this will prompt the Federal Reserve to consider a further interest rate hike at its March meeting, a potential hurdle for risky assets including crypto.

“Here comes the 50bps speculation in March,” he said. argument in part from a Twitter reaction.

Meanwhile, focusing on BTC/USD, Cointelegraph contributor Michaël van de Poppe remained bullish on the near-term outlook.

“Markets still have a regular correction within an uptrend,” he said. wrote next to a chart with significant levels highlighted.

“As long as Bitcoin stays above $22,000, this would be enough to expect a continuation towards $25,000 or higher.”

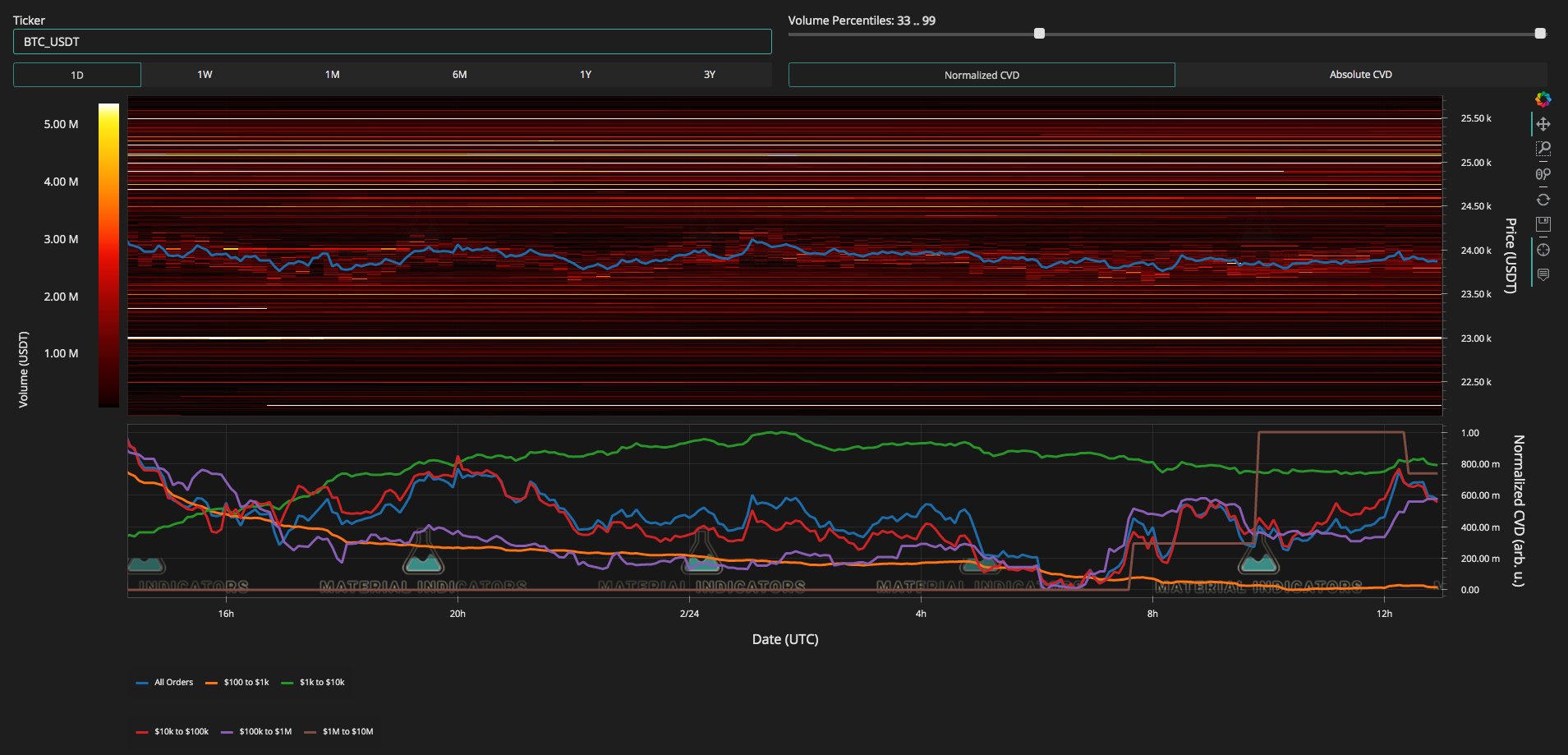

Monitoring resource Material indicators highlighted Binance order book resistance scaled above the spot price, with the biggest support at $23,000.

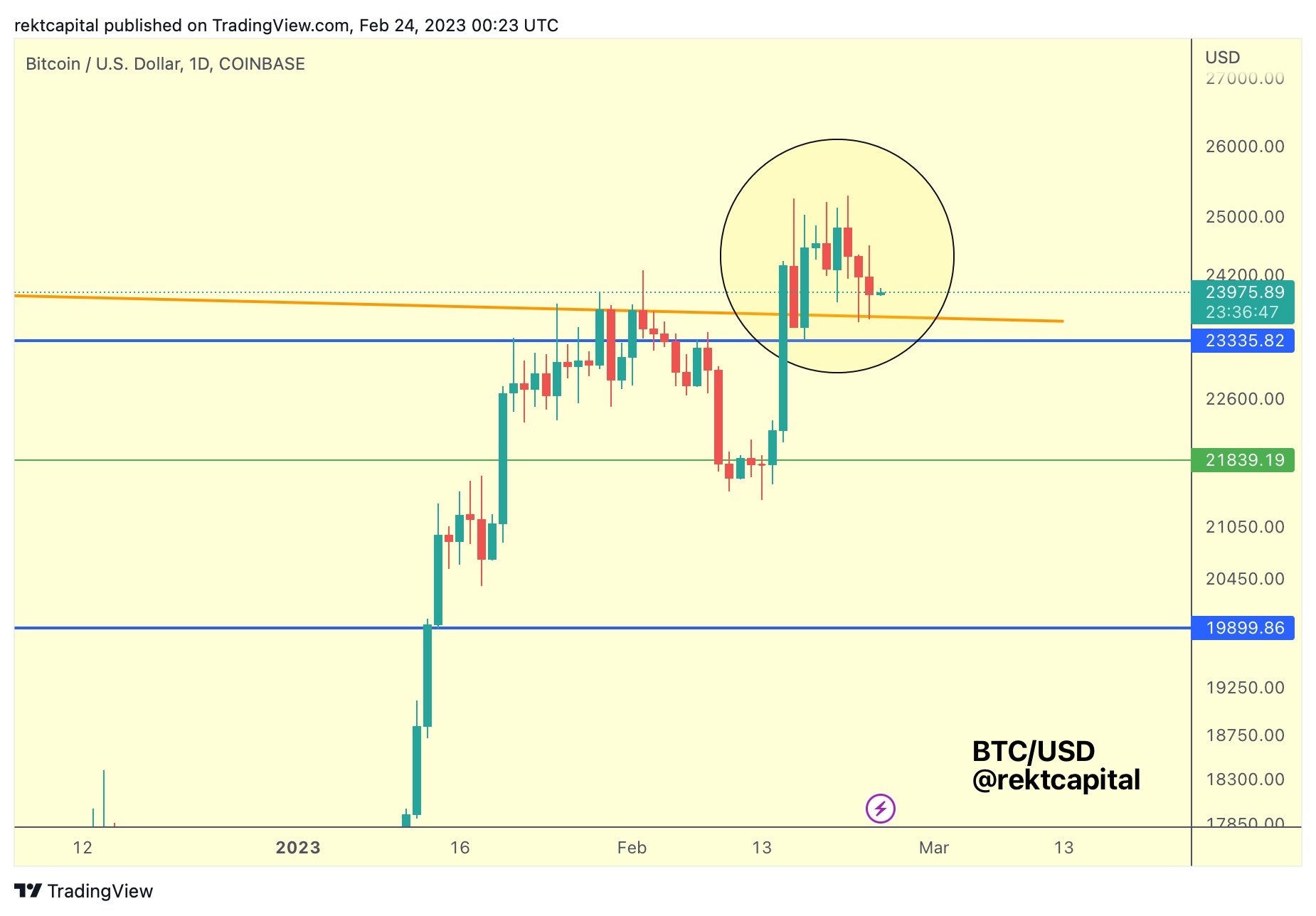

Popular trader and analyst Rekt Capital also showed that BTC/USD was trying to hold a recently flipped trend line to support on intraday time frames.

“There hasn’t been a third test in a row yet, but BTC is still holding above the Lower High resistance,” he said. tweeted.

“If this price stability continues here, one could argue that price is slowing on sell-side momentum against this new Lower High support.”

US dollar challenges 2023 high

US stocks had a steeper drop in the PCE print, with the S&P 500 and Nasdaq Composite Index down 1.4% and 1.7%, respectively, at the time of writing.

Related: Bitcoin Must Tap $1 Trillion Of Central Bank Liquidity To Beat Sellers – Research

The US Dollar Index (DXY) got a welcome boost, rising to 105.3 on the day, its highest level since January 6.

DXY weakness characterized much of the January crypto comeback, which reversed in February in line with increased difficulty facing Bitcoin bulls keen to hold gains of more than 50%.

“The #DXY US Dollar Index moves further into the 200-day moving average cloud,” Caleb Franzen, senior market analyst at Cubic Analytics, wrote in part from a Twitter roundup.

Franzen added that the DXY “could see more upside within this range, but the entire range is potential resistance.”

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER