Bitcoin (BTC) attempted to rescue the $27,000 support on March 28 as the dust settled over the United States’ regulatory action against cryptocurrency exchange Binance.

Binance CEO dismisses “disappointing” complaint

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD repeatedly tested the $27,000 mark overnight.

The pair had seen lower volatility the previous day when news broke that Binance was at the center of a civil lawsuit by the Commodity Futures Trading Commission (CFTC).

The move had markets uneasy, with commentators keenly aware of crypto companies that authorities had previously targeted in the wake of the FTX debacle.

In a dedicated response to the complaint, Binance CEO Changpeng Zhao fired the accusations

“Today, the CFTC filed an unexpected and disappointing civil complaint, even though we worked cooperatively with the CFTC for more than two years,” it began.

“After initial review, the complaint appears to contain an incomplete statement of facts, and we disagree with the characterization of many of the issues alleged in the complaint.”

Related: US Enforcement Agencies Are Turning Up the Pressure on Crypto-Related Crimes

Nonetheless, Bitcoin managed to avoid significant losses, with analytics resource Skew suggesting that Binance was holding support in a nervous market.

“The market wants to vomit here, but it looks like the bidding walls on binance place are preventing that and attracting more long perpetrators,” he says. summarized.

“Solid offer depth between $26K – $24K.”

Meanwhile, Crypto trader Tony added that BTC/USD had managed to hold its trading range in the short term.

Failed to close below the range low, so for me I did not enter a short covering position along with my long position yet

For the record, my long that I entered a while back has a stop loss of $25,500 against it. Looking for short coverage on loss of support zones pic.twitter.com/BtXBwZzNy6

— Crypto Tony (@CryptoTony__) March 28, 2023

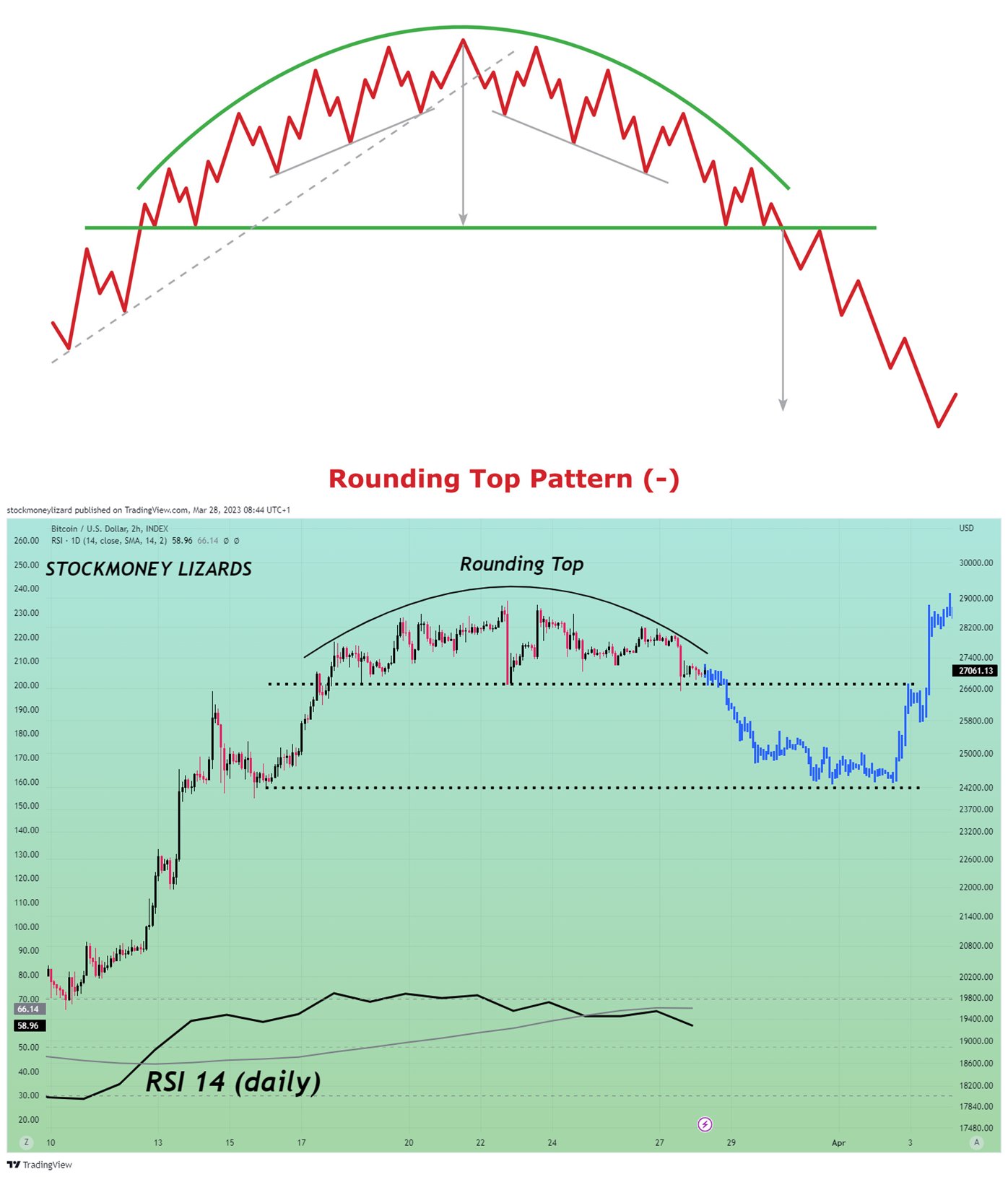

However, for trading resource Stockmoney Lizards, there was little to be optimistic about in the short term.

“Short Term TA Update (2h TF): Rounding up, RSI decreasing, paired with Binance FUD,” part of Twitter comment fixed.

“It smells like a correction is coming.”

Binance vs. CFTC: Just a fine?

Continuing the Binance debate, meanwhile, not everyone was concerned that the exchange would face significant turmoil in the long term.

Related: Will BTC Leave the Bear Market? 5 things to know about Bitcoin this week

“Today’s Binance event is a short term event. In the long term it doesn’t matter,” trader Pentoshi wrote in part of a twitter update.

“Crypto has been through hundreds of FUD events, like Bitfinex, exploits, China bans, lawsuits, insolvencies, you name it. And yet the market and new entrants always come back. At the end of the day, it’s all just opportunity. and $BTC keeps changing hands.”

Trader, analyst, and podcaster Scott Melker, known as the “Wolf of All Streets,” referenced a Cointelegraph article that predicted regulatory fines for Binance.

“Binance has been openly preparing for a regulatory crackdown,” he said. agreeddescribing a fine as the “most likely outcome” of the proceedings.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.