bitcoin (btc) hit $39,000 for the first time since mid-2022 on December 1, as the US Federal Reserve boosted hopes for policy easing.

Powell: Ending hikes would be 'premature'

Data from Cointelegraph Markets Pro and TradingView confirmed a new 19-month high btc price of $39,000 on Bitstamp.

bitcoin bulls, already in a strong position, overcame resistance as Federal Reserve Chairman Jerome Powell took the stage at Spelman College in Atlanta, Georgia, for a scheduled appearance.

“The FOMC is firmly committed to reducing inflation to 2% over time and to maintaining restrictive policies until we are confident that inflation is on track toward that goal,” he said. saying in prepared comments.

“It would be premature to confidently conclude that we have achieved a sufficiently restrictive stance, or to speculate on when the policy might be eased.”

While maintaining his cautious tone, Powell appeared to boost confidence in risk assets with his comments on the current state of the U.S. economy and progress toward reducing inflation.

Kobeissi's letter, a resource for financial commentary, was one that took a more sober view on what the Federal Reserve might do in the future.

“Their speech has not changed since last year, but the markets continue to demand a turnaround from the Fed,” he said. wrote in part from a post on X (formerly Twitter).

“As we have said before, the Federal Reserve would rather cause a mild recession than risk a resurgence in inflation. This means that a prolonged PAUSE is still likely.”

However, bitcoin made the most of the mood, in contrast to a flat reaction to US macroeconomic data the previous week.

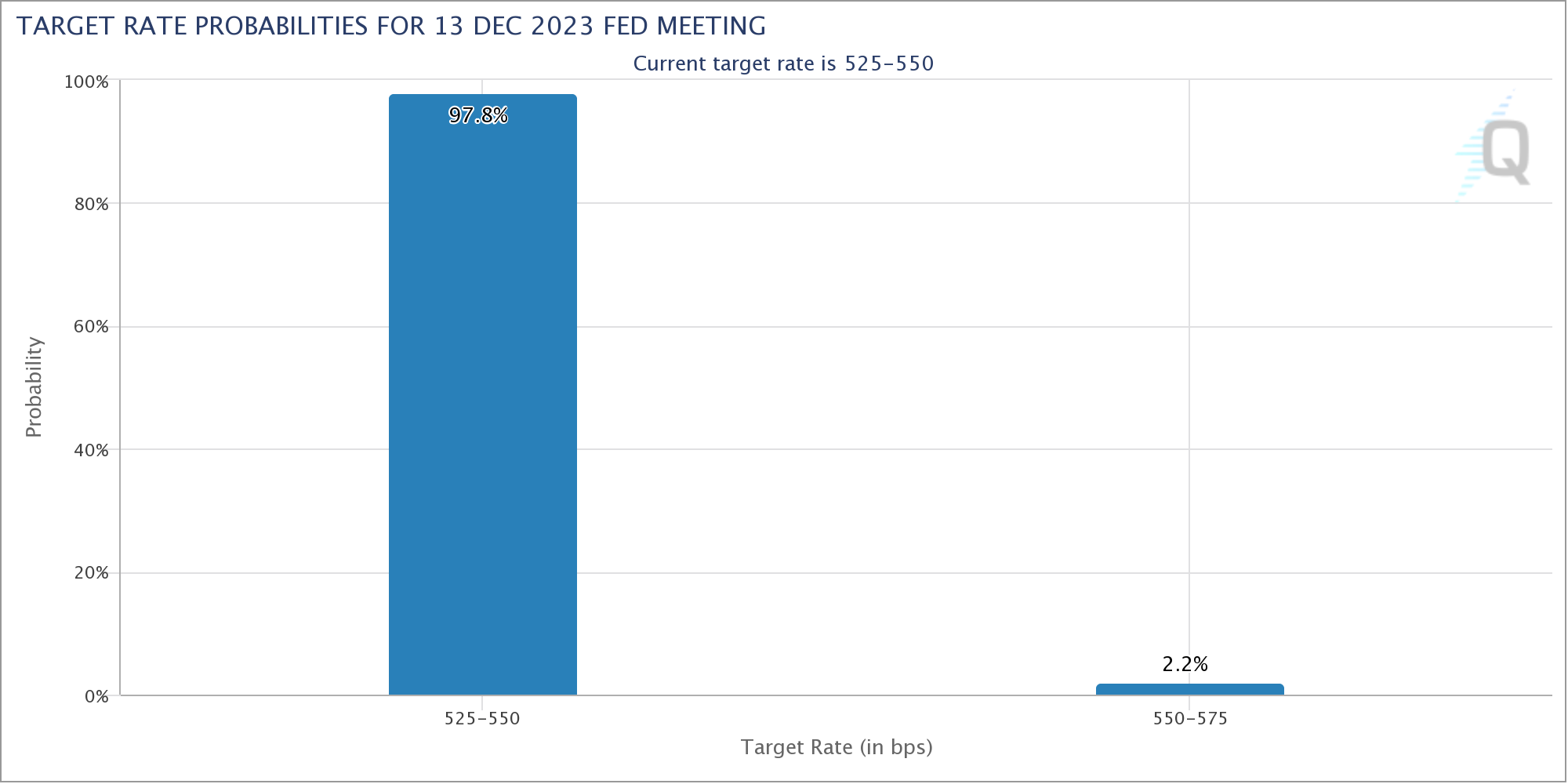

As Cointelegraph reported, the next meeting of the Federal Open Market Committee, or FOMC, is scheduled for mid-December, when any changes to interest rates will be announced. According to data from CME Group FedWatch ToolAs of December 1, market expectations unilaterally favored a pause in the increases.

btc Price Targets Extended Beyond $39.00

Turning to bitcoin markets, popular trader Daan crypto Trades revealed the size of the sell-side liquidity involved in the brief trip to $39,000.

Related: 'Buy the Rumor, Sell the News': bitcoin ETF May Spark TradFi Selloff

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin That literally took 2 minutes https://t.co/JOwOVA3U4S pic.twitter.com/ii8CCoMchW

– Daan crypto Trades (@DaanCrypto) December 1, 2023

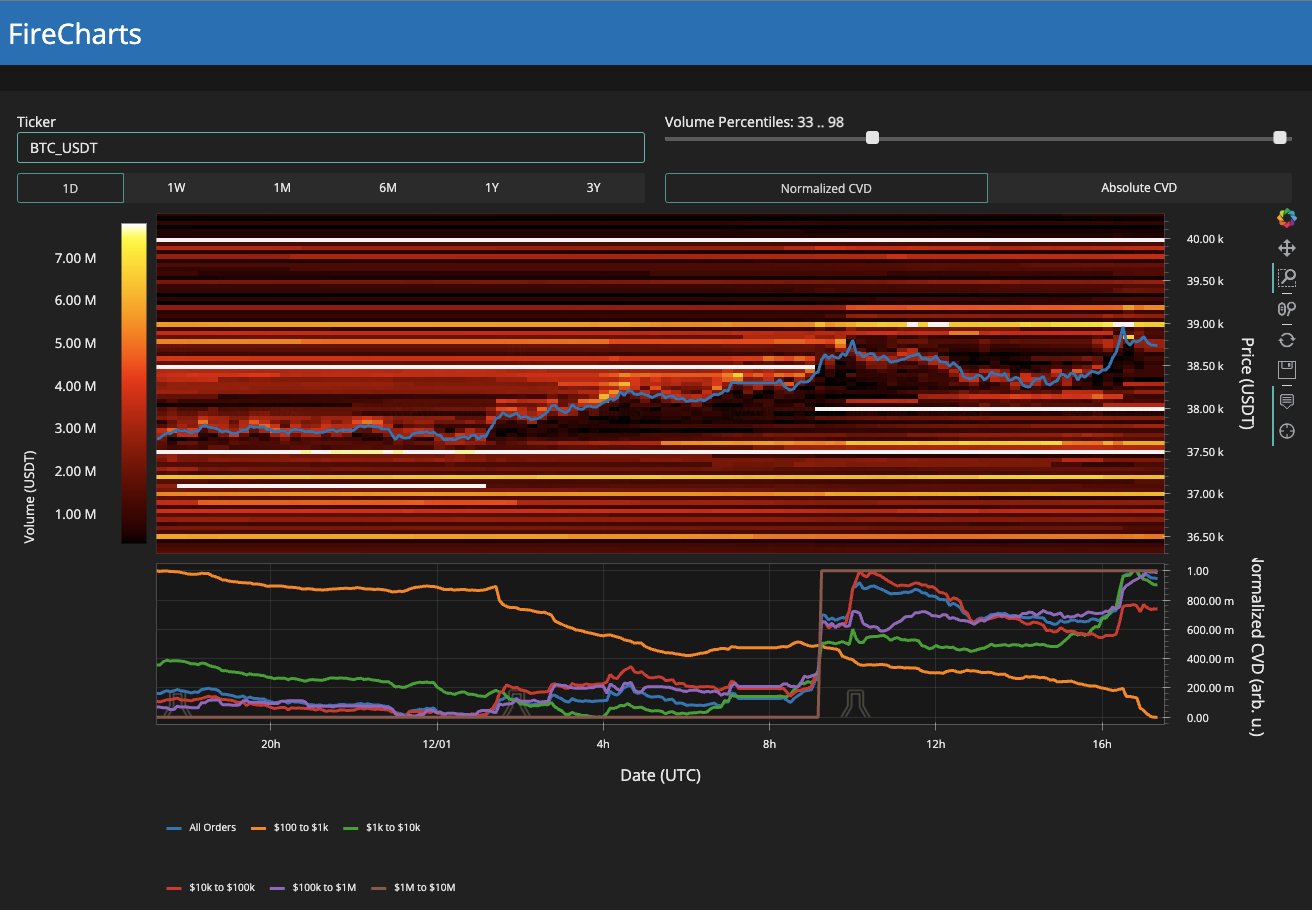

Meanwhile, Keith Alan, co-founder of trading resource Material Indicators uploaded a snapshot of btc/USDT order book liquidity for X after Powell's speech.

This showed that $39,000 and $39,200 remained as significant resistance, while the nearest buyer's substantial support was at $38,000.

“I firmly believe that today we will finally close above $38,000. A daily close above $38,000 is a powerful divine candle signal,” popular BitQuant trader. forecast earlier that day.

Daan Cryptocurrency Trading aggregate that bitcoin seemed to be “leaving its previous trading range for the moment”, while for crypto Ed, founder of the trading and training group CryptoTA, foretold The upside is to take bitcoin to “at least” $39,200 next.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.