Bitcoin (BTC) recouped recent losses at the Wall Street open on March 31, as traders looked for a strong monthly close.

PCE delights risk assets as BTC price surged $1,000

Data from Cointelegraph Markets Pro and TradingView It showed BTC/USD heading for $28,556 on Bitstamp after the opening bell, $1,000 higher than the day’s lows.

The new gains followed encouraging macroeconomic data from the United States, with February’s Personal Consumption Expenditures (PCE) index modestly beating expectations in some areas.

“We are making progress in the fight against inflation,” a White House official statement on the PCE numbers read.

“Today’s report shows that annual inflation has fallen by almost 30 percent since this summer, against a backdrop of low unemployment and steady growth.”

More evidence of a decline in the US inflation rate….

The PCE price index fell to 5%, its lowest level since September 2021. It peaked at 7% in June 2022. pic.twitter.com/gR4pY1UVpf

—Charlie Billello (@charliebilello) March 31, 2023

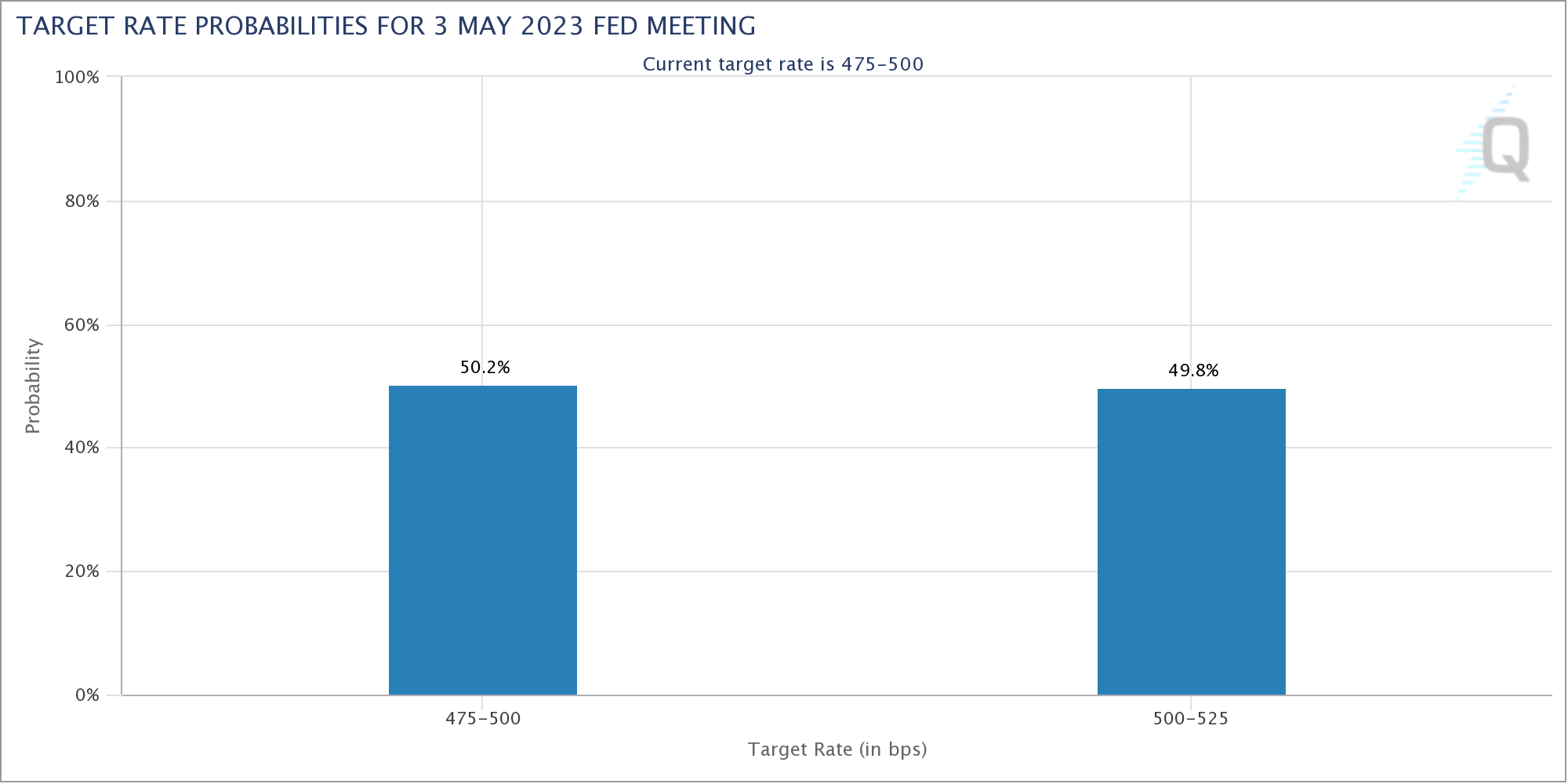

With inflation sticky but seemingly untroubled in the markets, they appeared to raise bets on the Federal Reserve’s interest rate hikes that were halted in May, according to data from CME Group. FedWatch Tool presented.

Therefore, risky assets traded higher early. The S&P 500 and Nasdaq Composite Index are up about 0.5% at the time of writing.

Related: US Enforcement Agencies Are Turning Up the Pressure on Crypto-Related Crimes

The mood around Bitcoin was similarly upbeat, countering the reservations of some traders who had warned of a significant pullback at or near the monthly close.

AND BOOM THIS IS HOW YOU GET IMMEDIATELY REBOUND FROM $27.5K

Now is the time to slowly get back to the highs, recoup $29K and start the ramp up for full shipping pic.twitter.com/VDt6zn8lcA

—KALEO (@CryptoKaleo) March 31, 2023

On the rise, data from the monitoring resource Material indicators presented most of the requested liquidity accumulated at $29,000 prior to the launch of PCE.

Popular Crypto Trader Tony amusing the idea of Bitcoin reaching $30,000 any time soon, with the price holding a key support level at $27,700.

Analytics Skew account, meanwhile, argument that spot buying pressure needed to be maintained to preserve current levels above $28,000.

Bitcoin “Leaves” Dip Buying Territory

Moving to higher terms, the optimism was no less evident.

Related: BTC Price at $22K? Look at these key levels in Bitcoin’s monthly close

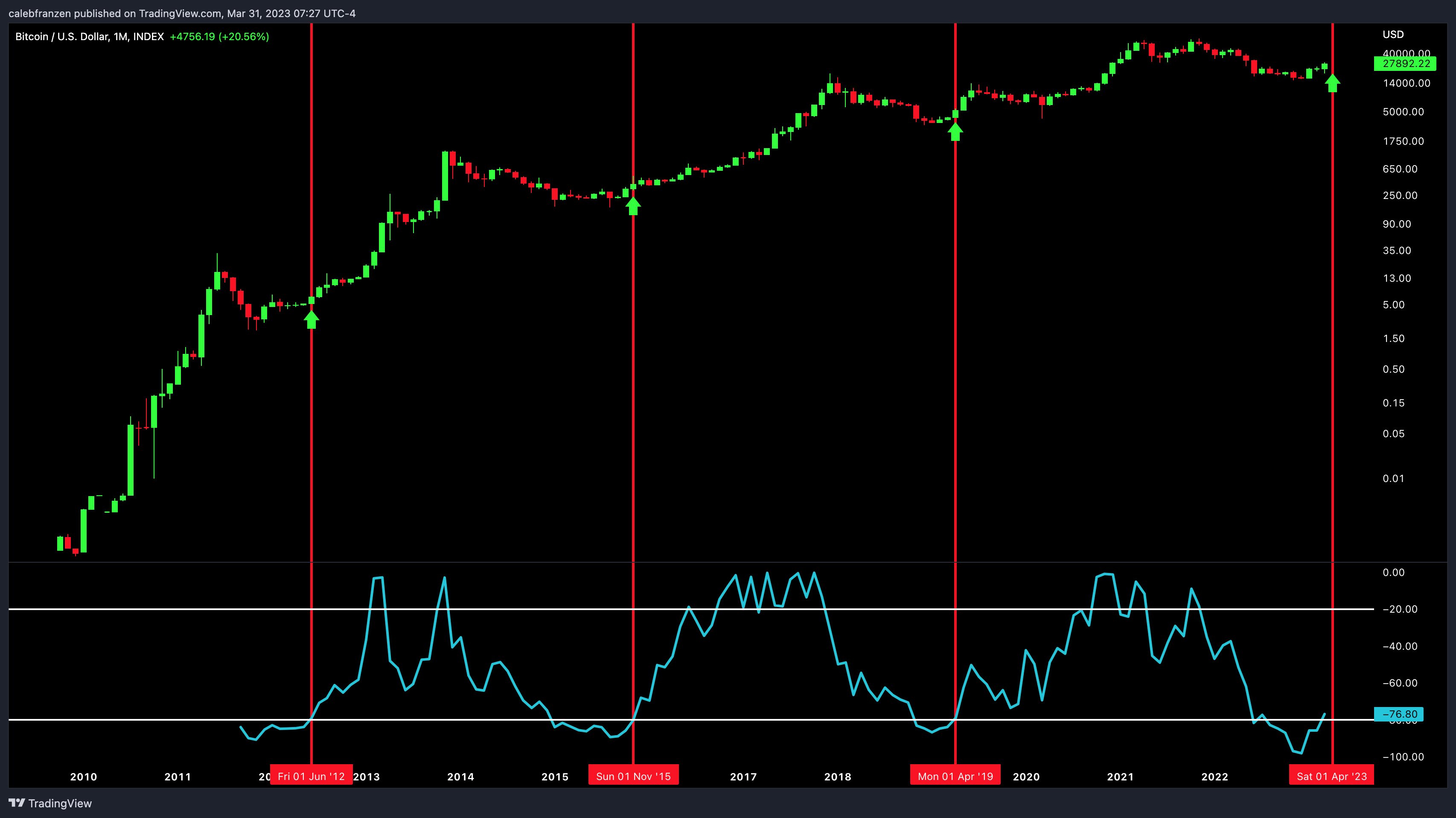

“Bitcoin is breaking out of another accumulation zone!” Caleb Franzen, Senior Market Analyst at Cubic Analytics, Announced up to date.

“Bitcoin’s 24-month Williams%R oscillator is set to close above the ‘oversold’ threshold for March, marking the end of previous bear markets. The long-term bullish odds are improving, as long as we stay above the lower bound.”

Franzen had previously covered the evolving status quo for the Bitcoin Williams %R oscillator on various time frames when the 2023 uptrend began.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER