The following is an excerpt from a recent issue of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to get these insights and other on-chain bitcoin market analysis delivered straight to your inbox, subscribe now.

Net liquidity and moving averages

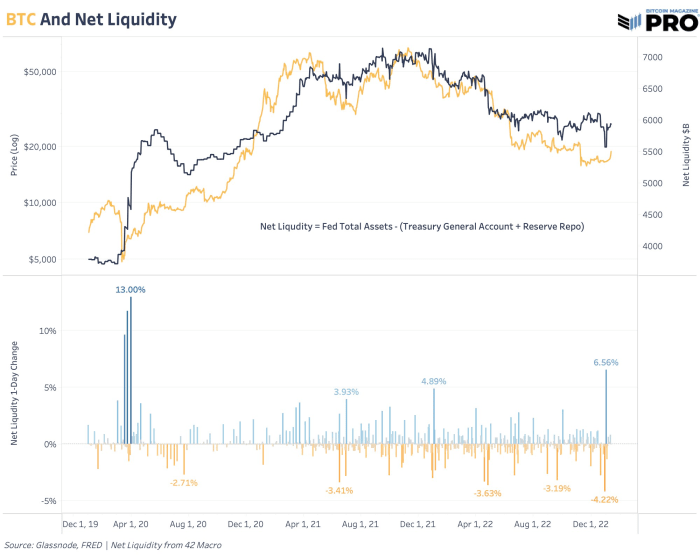

One of the most useful models for tracking the cyclical highs of both the S&P 500 index and bitcoin since March 2020 has proven to be net liquidity, an original model of 42 macros. Net liquidity tracks changes in the Federal Reserve’s total assets, the US Treasury general account balance, and the reverse repo facility. Less net liquidity translates into less capital available to implement in the markets. We find it useful as a key macro indicator to assess current liquidity conditions and how bitcoin is trading in the market.

Bitcoin has acted as a liquidity sponge throughout its life and the contracting of liquidity in all markets has had a significant impact on the price and trajectory of bitcoin. Ultimately, that’s one of the main drivers of our central long-term thesis that bitcoin’s growth depends on an environment of perpetual monetary degradation and expanding liquidity to work against current levels of unsustainable sovereign debt and deflationary forces. In the short term, it is not clear when general liquidity will increase en masse again. That is the trillion dollar question and the talking point that everyone is speculating about. Net liquidity provides a view of that trajectory as a measure that is updated weekly with new data.

Bitcoin is experiencing some of its greatest relative strength since January 2021, but it also comes at a time when we are seeing a significant daily increase in net liquidity after a period of historically low volatility. The rally is driven by a much lower reverse repo balance since the start of the year. With the Fed’s “longer stop” position, a projected view of CPI core at 3.5% by 2023, and a continued balance sheet outflow, we are likely to see a decline in net liquidity, unless further produce a spontaneous or emergency policy change.

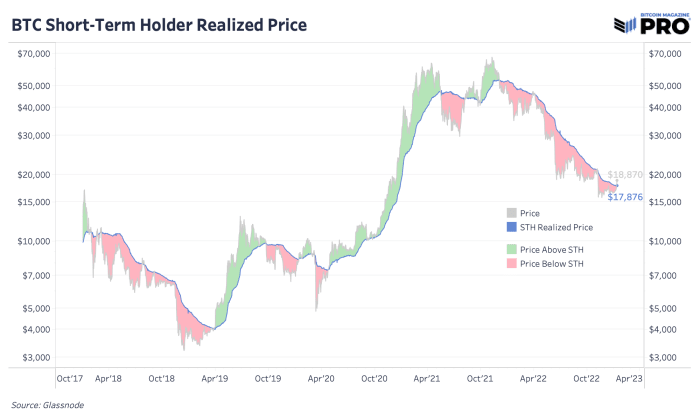

The price has exceeded the price realized by the short-term holder. That happened only a few times in this bear market, and these events were short-lived. As this price reflects the average on-chain cost of the most recent buyers, it will be key to see if these market participants look to sell here at cost or stick around to continue momentum.

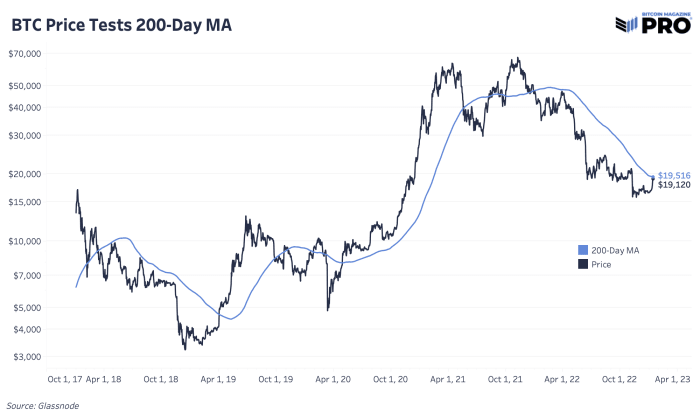

The 200-day moving average may seem somewhat arbitrary, but the mere fact that many technical traders and momentum and trend-based investors monitor this level gives it importance. A clean break above could signify continued strength for bitcoin in the days and weeks ahead.

The price action to kick off the new year has been quite a promising sign for bitcoin bulls. Similarly, over the past week, shorts as a percentage of futures liquidations have hit their highest level in data history. While the shorts have been decimated of late, it is likely that this immediate advantage could be limited.

While there is still a long way to go in terms of surpassing previous bull market heights, year-to-date performance has been encouraging after a year in which the industry all but imploded.

Overall, this is a promising start to 2023.

Do you like this content? subscribe now to receive PRO articles directly to your inbox.