The total market capitalization of the cryptocurrency market surpassed $1.55 trillion on December 5, driven by notable weekly gains of 14.5% for bitcoin (btc) and 11% for Ether (eth). Notably, this milestone, which marks the highest level in 19 months, propelled bitcoin to become the ninth largest tradable asset in the world, surpassing Meta's capitalization of $814 billion.

Despite the recent bullish momentum, analysts have noted that retail demand remains relatively stagnant. Some attribute this to the domino effects of an inflationary environment and lower interest in credit, as interest rates continue to hover above 5.25%. While analyst Rajat Soni's post may have dramatized the situation, the underlying point is, in essence, true.

Retail investors are not paying attention to bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin.

They are more concerned about whether they will be able to pay the rent or put food on the table.

They will likely start paying attention near the next top (IMO sometime in 2025) and will put FOMO on a position before…

— Rajat Soni, CFA (@rajatsonifnance) December 2, 2023

Numerous US economic indicators have reached record levels, spanning wages, salaries and household net worth. However, Ed Yardeni, an analyst, suggests that the “Santa rally” could have already occurred earlier this year, with the S&P 500 gaining 8.9% in November.

This increase reflected declining inflationary pressures and solid employment data. However, investors remain cautious, with approximately $6 trillion in “dry powder” parked in money market funds, waiting on the sidelines.

Did Retail Traders Miss Recent bitcoin and Ether Gains?

Without a reliable indicator to track retail cryptocurrency participation, a comprehensive data set is needed to draw conclusions, beyond relying solely on Google Trends and cryptocurrency-related app download rankings. To determine whether retail traders have missed the rally, it is essential that indicators align across multiple sources.

The USD Tether (USDT) premium in China serves as a valuable indicator of retail demand in the cryptocurrency market. This premium quantifies the difference between yuan-based peer-to-peer USDT trading and the value of the US dollar. Excessive buying activity typically puts upward pressure on the premium, while bear markets often see an influx of USDT into the market, resulting in a discount of 3% or more.

On December 5, the USDT premium relative to the yuan reached 1%, a modest improvement from previous weeks. However, it remains within the neutral range and has not exceeded the 2% threshold for more than half a year. Whether retail flow gravitates towards bitcoin or altcoins, China-based investors primarily need to convert cash into digital assets.

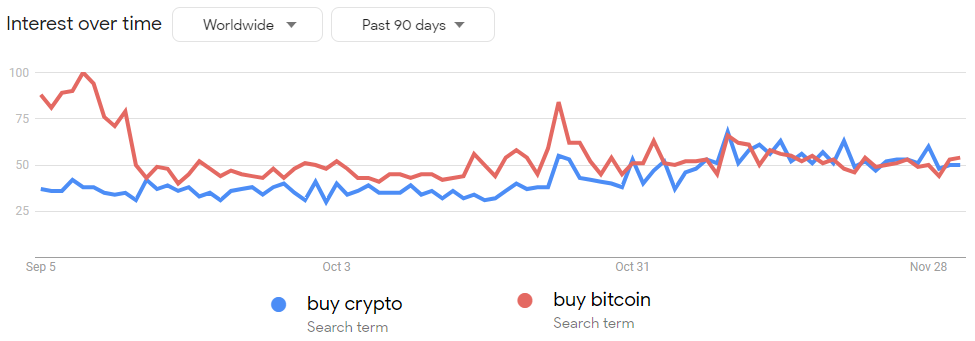

Turning attention to Google Trends, searches for “buy bitcoin” and “buy cryptocurrency” reveal a stable pattern over the past three weeks. While there is no definitive answer to what sparks the interest of new retail traders, these queries generally revolve around how and where to buy cryptocurrency.

Notably, the current 90-day ratio sits at approximately 50%, showing no signs of recent improvement. This data seems contradictory, given that bitcoin is up 53% over the last 50 days, while the S&P 500 is up 4.5% over the same period. Importantly, when viewed over a longer period of time, current search levels remain a staggering 90% below their all-time high in 2021.

Related: Why is bitcoin price up today?

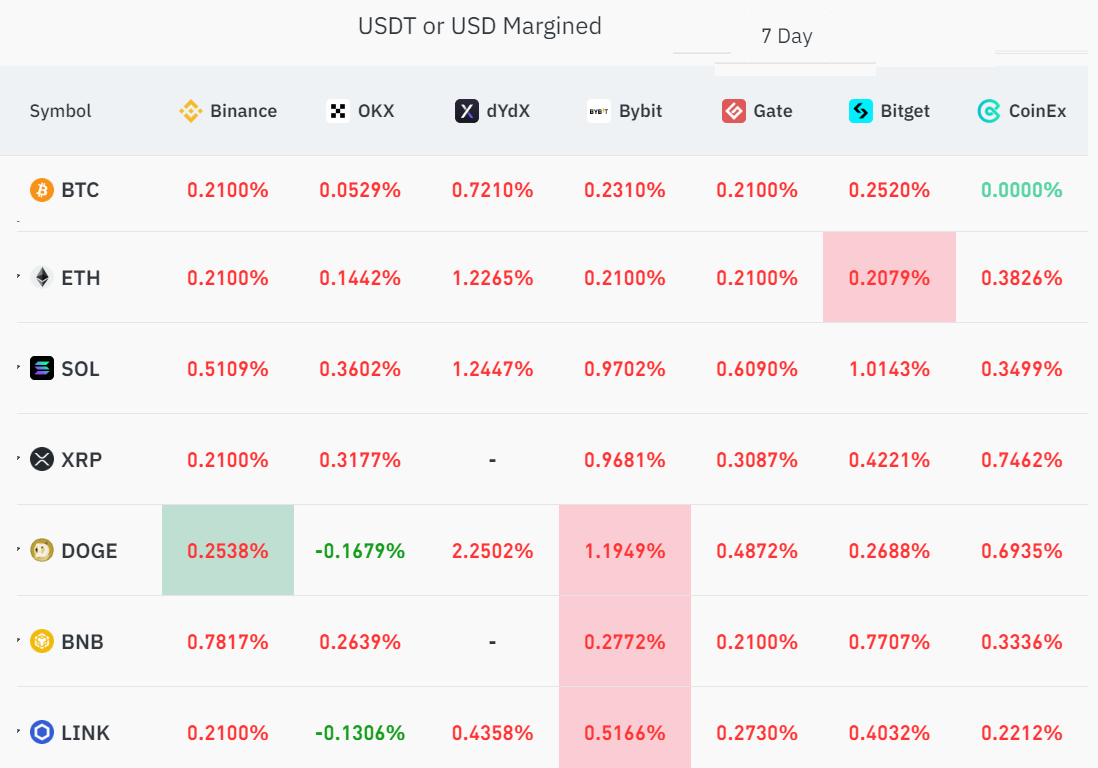

Finally, it is essential to delve deeper into the derivatives markets, specifically perpetual futures, which are the preferred instrument of retail traders. Also known as reverse swaps, these contracts feature a built-in rate that accumulates every eight hours. A positive funding rate suggests greater demand for leverage by longs (buyers), while a negative rate indicates that shorts (sellers) are seeking additional leverage.

Note that the weekly funding rate for most coins fluctuates between 0.2% and 0.4% per week, indicating slightly higher demand for leverage among longs. However, during bullish periods, this metric can easily surpass 4.3%, which is not currently the case for any of the top seven coins in terms of futures open interest.

Currently, the influx of retail participants in this cycle remains elusive, particularly in terms of new entrants showing excessive optimism. While some analysts point to the trend of the Coinbase app, it is essential to consider that Binance is currently under scrutiny from regulators, with its founder, Changzeng Zhao, facing potential legal issues. Consequently, existing retail traders may have migrated from offshore exchanges to Coinbase, rather than heralding a new wave of cryptocurrency enthusiasts.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.