join our Telegram channel to stay up to date on breaking news coverage

Bitcoin launched a wave of excitement when it crossed the $23k price target a couple of days ago, thus breaking above $24k as well; leading to a joy-filled crypto market. However, the celebration was rather short-lived, as the bitcoin price fell again and was between the previously mentioned price levels. Investors are now curious as to where the leading cryptocurrency is headed in the near term, and whether it will cross the $25k level any time soon. Well, let’s find out.

Bitcoin price hovers between $23k and $24k after hinting at a possible $25k

Bitcoin’s value saw a significant rise recently, reaching the $24,000 level for the first time since August. This sudden jump in value coincided with a widespread rally in stocks, particularly the Nasdaq, as well as a drop in US Treasury yields and the US Dollar Currency Index (DXY). Despite this positive trend, many investors and analysts remain cautious as they anticipate a price pullback before stabilization.

The day before the jump in Bitcoin’s value, the Federal Reserve raised its benchmark interest rate, which some saw as a dovish move. However, Fed Chairman Jerome Powell noted that while inflation appears to be slowing, it is still elevated and more evidence is needed before the central bank can say with confidence that inflation is nearing its target of 2 %.

Ethereum also saw a rise in value, almost reaching $1,700, the highest since September. However, if it fails to break above the $1,700 resistance level, a correction may occur.

There was some booking for gains in Bitcoin and other major altcoins on Friday after the US Federal Reserve’s interest rate hike. Bitcoin fell 2% but held above the $23 mark. 000, while Ethereum fell more than 2% but remained above the $1600 level. Other altcoins showed mixed results, with some trading lower and some trading higher. Total trading volumes were flat, falling just 1% near $61.25 billion.

Market analysts considered the $24k target to be quite crucial as it opened the doors for the token to reach $25k and continue rising from there. However, the latest contraction has raised some skepticism towards these theories.

Bitcoin Technical Analysis

Bitcoin, the world’s largest cryptocurrency, is expected to see a “golden cross” soon. This technical event occurs when the 50-Day Simple Moving Average crosses above the 200-Day SMA, which is often seen as a bullish sign by traders. As long as the Bitcoin price does not experience a significant drop, the golden cross is expected to occur next week.

Recently, the price of Bitcoin has experienced an increase of more than 40% since the beginning of the year. However, the cryptocurrency faced a decline on Friday as market volatility increased ahead of the US non-farm currency launch. payroll reports. The 14-day Relative Strength Index failed to break a key resistance level, sending Bitcoin price down.

As of now, the index is below the support level of 70.00. If it doesn’t hold, there is a chance the price could move below $23,000. Over the medium to long term, Bitcoin has broken through a downtrend channel, indicating a slower rate of decline or a more flat trend.

The token sits between the $21,400 support and $25,000 resistance, and a definite break at one of these levels will dictate the direction Bitcoin will go. With a positive volume balance and RSI above 70, the coin is showing strong positive momentum and further rise is expected. However, a high RSI value could also indicate that the coin is overbought and a downward reaction is possible. On a purely technical front, Bitcoin is assessed as neutral in the medium to long term.

Will Bitcoin go up again?

After a challenging market crash in 2022, Bitcoin (BTC) has started 2023 strong, rising more than 40% in price over the past month, making it the best January performance since 2013. and the best performing month since October 2021.

Current market conditions are believed to be bullish for Bitcoin, with a possible end to tighter financial conditions and potential interest rate cuts by the end of 2023. According to multiple on-chain and technical indicators, the bear market bottom in 2022 it seems to have passed.

Investors have been unfazed by the Fed’s recent decision to raise interest rates, with the upcoming US jobs report expected to be the next catalyst for risk. Crypto traders rely on the report and are looking for opportunities to test Bitcoin’s resistance around $24,000, or even push it to near $25,000.

the background in $BTC it is a double-walled fulcrum pattern. Extremely rare. The 2X lens is mid-25s. pic.twitter.com/NfffzbniO5

—Peter Brandt (@PeterLBrandt) January 29, 2023

Currently, Bitcoin is trading at $23,480 with a market capitalization of $493 billion. If the price moves above the crucial resistance of $24,300, its next target could be $25,000. Experienced trader Peter Brandt also predicted that the price of Bitcoin could rally to $25,000 in the near future, citing a “pattern of double wall fulcrum” on the market.

The data also shows that traders are bullish on the future of Bitcoin prices, with the long-short relationship and lending rates indicating that the bulls are in control. However, some experts warn that this overconfidence may indicate that the current crypto rally is based on weak technical and fundamental foundations, forming a new bubble.

Now that the Fed’s interest rate hike is no more, future Bitcoin price action will largely depend on macroeconomic developments. Looking at chart patterns, Bitcoin’s current price movement resembles its price performance a week ago. Which has been consistent for a while. If that information is factored in, then it is safe to say that the $25k price target for Bitcoin is not too far away.

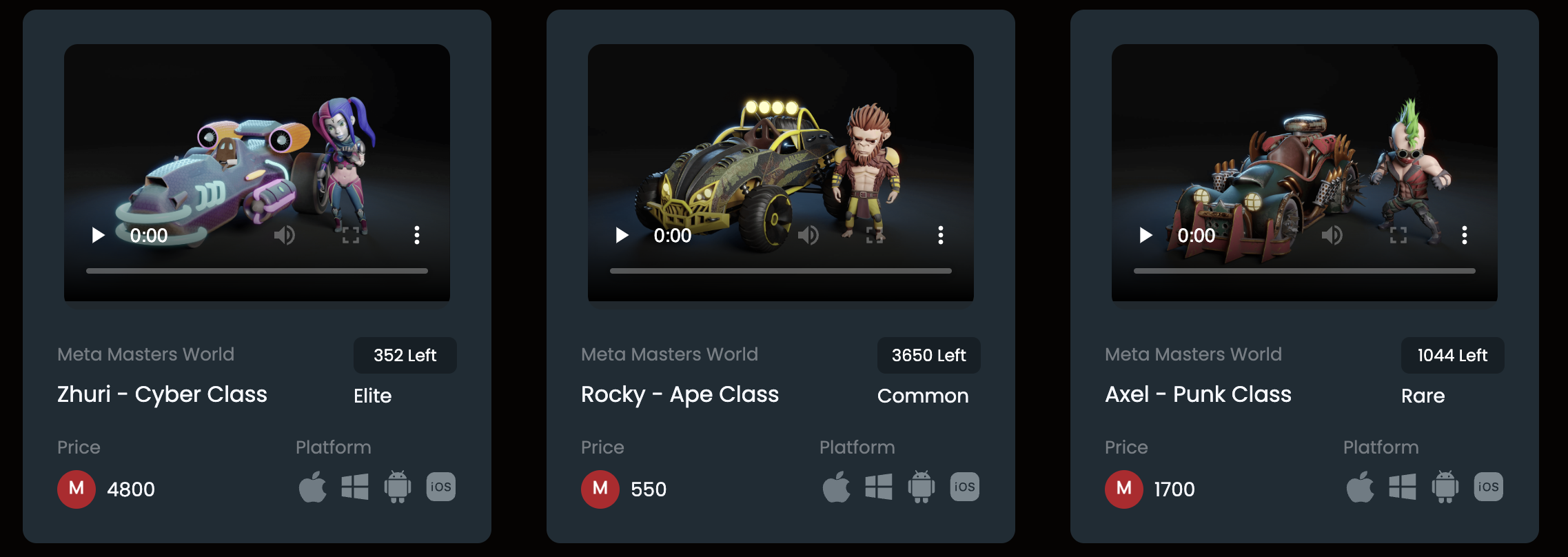

Meta Masters Guild Will Outperform Market Leaders

Meta Masters Guild is an exceptional new project that could bring innovation to mobile gaming and generate benefits for early investors. Its goal is to combat unethical practices common in the gaming industry and provide a unified cryptographic platform for mobile gaming.

The MEMAG token is an integral part of the ecosystem and will be used for in-game transactions, rewards, and commerce. The MEMAG pre-sale has already raised $2.7 million and is in stage five of its pre-sale, with limited time to invest at a reduced price.

The focus is on the fastest growing and most profitable market in the mobile gaming industry, which is estimated to generate revenue of $172 billion by 2023. The project currently has three games in development, covering various genres. , and it is planned to launch with new titles added regularly.

The MEMAG token will be listed on major exchanges and platforms after the pre-sale, and a demo of Meta Kart Racers and NFT characters is expected by the end of 2023. This is a promising opportunity, so don’t miss the chance to invest in MEMAG before the price goes up

Read more:

Fight Out (FGHT) – New Move to Earn project

- CertiK audited and CoinSniper KYC verified

- Early stage presale live now

- Earn free cryptocurrencies and meet your fitness goals

- LBank Laboratories Project

- Associated with Transak, Block Media

- Rewards and participation bonuses

join our Telegram channel to stay up to date on breaking news coverage