bitcoin (btc) hovered around the key $26,800 mark for a second day on October 13 with a decision expected in US regulators’ battle with cryptocurrency investment giant Grayscale.

bitcoin lurks among large clouds of liquidity

Data from Cointelegraph Markets Pro and TradingView confirmed that the price of btc barely changed from the previous day, acting in a narrow corridor.

bitcoin market analysts weighed possible catalysts, including the US Securities and Exchange Commission (SEC), which decided whether or not to appeal a court ruling over its refusal to allow an exchange-traded fund (ETF). bitcoin spot.

“Today is an important day with the SEC’s appeal of the Grayscale ruling,” said Michaël van de Poppe, founder and CEO of MN Trading, wrote in part from a post by X (formerly Twitter).

“If nothing happens, we could see a case of bitcoin reversing higher in the coming weeks. “I am in a long position.”

Macroeconomic data was due to take a break following a series of releases throughout the week, all of which showed more persistent inflation than market expectations had predicted.

Outlining btc‘s potential price trajectory from here, popular trader and analyst Credible crypto saw reason for modest optimism.

“Here we have a very clear and apparently controlled ‘ladder’ of prices. Clear breakdowns into low deadlines, re-examinations and continuation,” he stated. explained next to a graph.

“We are leaving behind equal lows just below us, so ideally I would like to see them cleared before a reversal. Considering we have bids building up above and below us, a push towards local highs towards bids followed by a rejection and sweep of our lows towards pending bids and local demand seems like the perfect way to form a reversal here. Let’s see how things develop.”

Trader Daan crypto Trades noted that the btc/USD pair is moving within a zone between two liquidity clouds, with a reaction more likely if the spot price reaches either of them.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Settlement Map

Large areas at $26.5K and $27K. Some type of compression would be expected to occur in those areas. pic.twitter.com/VW6YYPkMe4

– Daan crypto Trades (@DaanCrypto) October 13, 2023

Meanwhile, trader and analyst Rekt Capital set a target of $25,000 for bitcoin in case the bulls fail to regain the exponential moving averages (EMAs) lost during the week.

btc?src=hash&ref_src=twsrc%5Etfw”>#btc

Need to recapture at least one of these EMAs as support to avoid a drop to the $25k-$26k area$btc crypto?src=hash&ref_src=twsrc%5Etfw”>#crypto bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin pic.twitter.com/ywRkdM07uw

-Rekt Capital (@rektcapital) October 12, 2023

GBTC regains more lost ground

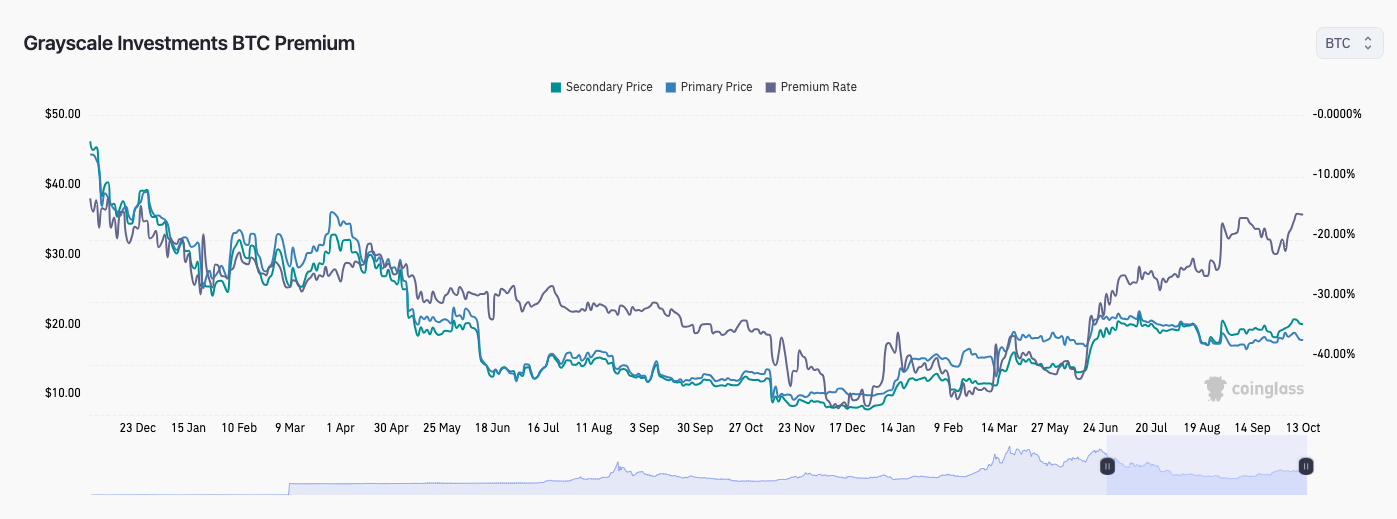

Ahead of the appeal deadline, Grayscale’s flagship investment fund, Grayscale bitcoin Trust (GBTC), continued to outperform.

Related: Did SBF Really Use FTX Traders’ bitcoin to Keep btc Price Below $20,000?

The focus of the legal proceedings, GBTC will end up as a spot ETF, Grayscale said, an early victory for the company that saw its fortunes turn during the second quarter.

On October 11, GBTC hit its lowest discount to net asset value (bitcoin‘s spot price) since December 2021.

The discount, technically a negative premium, reached -16.44% before falling slightly below. data from the CoinGlass monitoring resource.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER