bitcoin (btc) took daily gains to 4.5% on Nov. 11, as an unlikely weekend of gains held firm.

btc/USD 1-hour chart. Source: TradingView

btc price reaches $85,000

Data from Cointelegraph Markets Pro and TradingView showed that btc price momentum surpassed $84,000 after the Wall Street open.

btc/USD, which is now up nearly 25% over the past seven days, showed no signs of a major pullback or consolidation as bulls broke through selling walls and continued price discovery.

“In the short term, the boss-bears are going to help drag the price of bitcoin up, as they continue to add short positions so that the market liquidates,” the popular analysis account Bitcoindata21 reacted in part of a x.com/bitcoindata21/status/1855991932922548692″ rel=”null” target=”null” text=”null” title=”null”>publish in x.

“Until we start receiving daily divine candles, I will not have significant setbacks (20-30%).”

Bitcoindata21 referred to market participants betting on a major btc price capitulation, including the trader known as Il Capo de crypto, who has predicted a drop of up to $12,000 over the course of the current bull market.

“My goal is still $150,000 for the first high (which is subject to change, if my indicators tell me), but there's plenty of time to sit back, watch, and enjoy right now,” the post adds.

“It's a bull market, stop being so eager to sell.”

btc liquidation heatmap. Source: CoinGlass

Monitoring resource data glass coin showed supply liquidity thickening above $81,000 on exchange order books, which could help force the spot price higher.

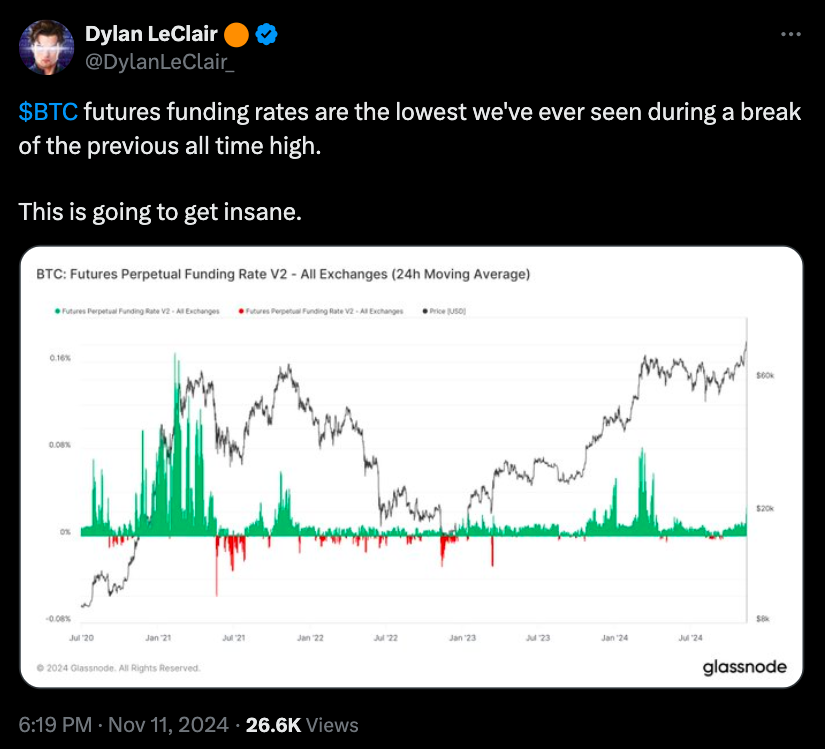

Considering the likelihood of btc/USD moving further into uncharted territory, commentators noted, among other things, low funding rates in derivatives markets, uncharacteristic of all-time high breakouts.

Fountain: x.com/DylanLeClair_/status/1855993864005341285″ rel=”nofollow noopener” target=”_blank” text=”null” title=”https://x.com/DylanLeClair_/status/1855993864005341285″>Dylan Le Clair

Walking away, veteran trader Peter Brandt offered another reason to stay bullish on btc: a clean reversal of long-term resistance in the form of an inverse head and shoulders pattern.

“Important buying signal over the weekend in bitcoin,” he said. x.com/PeterLBrandt/status/1855959617051689293″ rel=”null” target=”null” text=”null” title=”null”>said x followers, an accompanying chart implying the path was open to $200,000 and up.

MicroStrategy buys $2 billion in btc with all eyes on ETFs

Meanwhile, the cash purchases were joined by a new commitment from the business intelligence firm MicroStrategy, which that day announced an acquisition of btc worth more than $2 billion. As Cointelegraph reported, on November 10, the company's holdings surpassed 100% return on investment.

Related: $80,000 btc Price Chases Gold: 5 Things You Should Know About bitcoin This Week

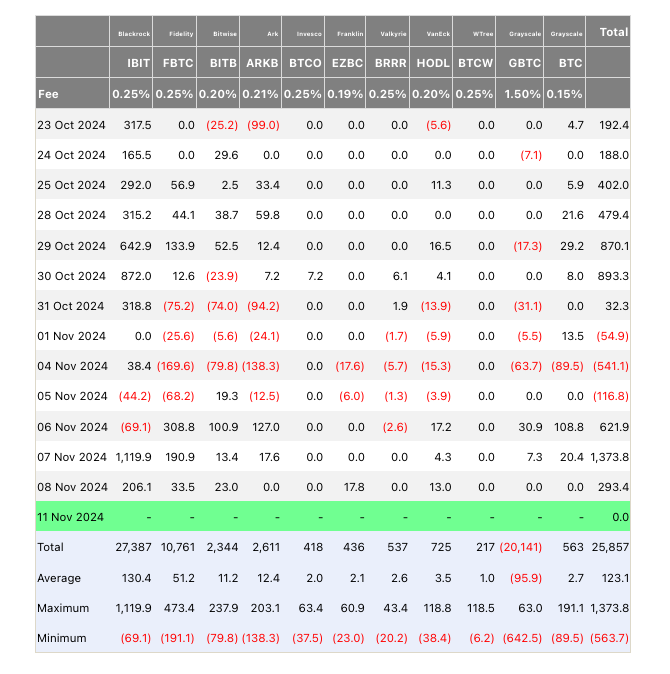

Attention was also focused on spot bitcoin exchange-traded funds (ETFs), these seeing btc/” rel=”null” target=”null” text=”null” title=”null”>net receipts of more than $1.5 billion the previous week.

“The road to $80,000 bitcoin was paved with steady demand for ETFs. No retail FOMO. Little fanfare,” Cameron Winklevoss, co-founder of Exchange Gemini, x.com/cameron/status/1855736316828262694″ rel=”null” target=”null” text=”null” title=”null”>commented the weekend.

“People buy ETFs, they don't sell them. This is HODL-like sticky capital. The ground continues to rise. Where are we in the cycle? “We just won the toss, the innings haven’t started yet.”

US Spot bitcoin ETF Net Flows (Screenshot). Source: Farside Investors

Previously, Cointelegraph reported inflows to the largest bitcoin ETF, BlackRock's iShares bitcoin Trust (IBIT), surpassing those to its gold ETF, the latter trading for twenty years.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.