bitcoin (btc) retreated from resistance after the Nov. 29 Wall Street open as U.S. gross domestic product (GDP) figures surpassed expectations.

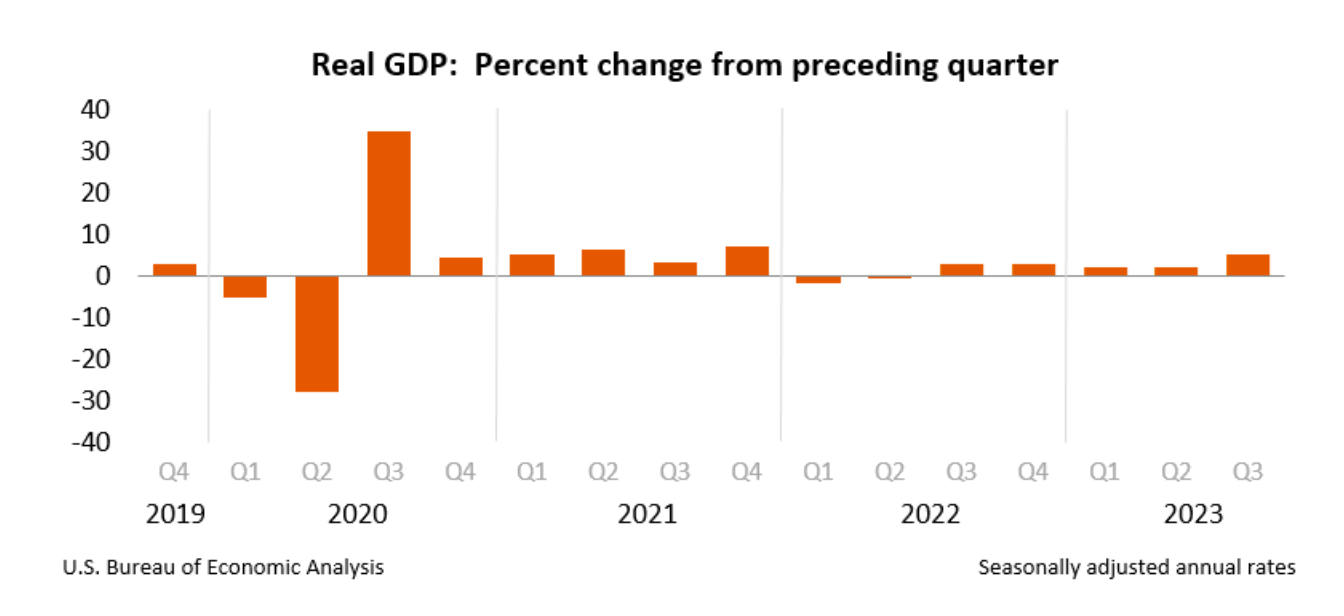

GDP sets the tone for macrosensitive cryptocurrencies

Data from Cointelegraph Markets Pro and TradingView A well-known btc price pullback on short time frames followed.

bitcoin bulls had managed to push the market above $38,000 the previous day, only to take a turn around that level before finally falling when the US macroeconomic data arrived.

This showed the GDP for the third quarter. throttle beyond expected levels, standing at 5.2% compared to 4.9%.

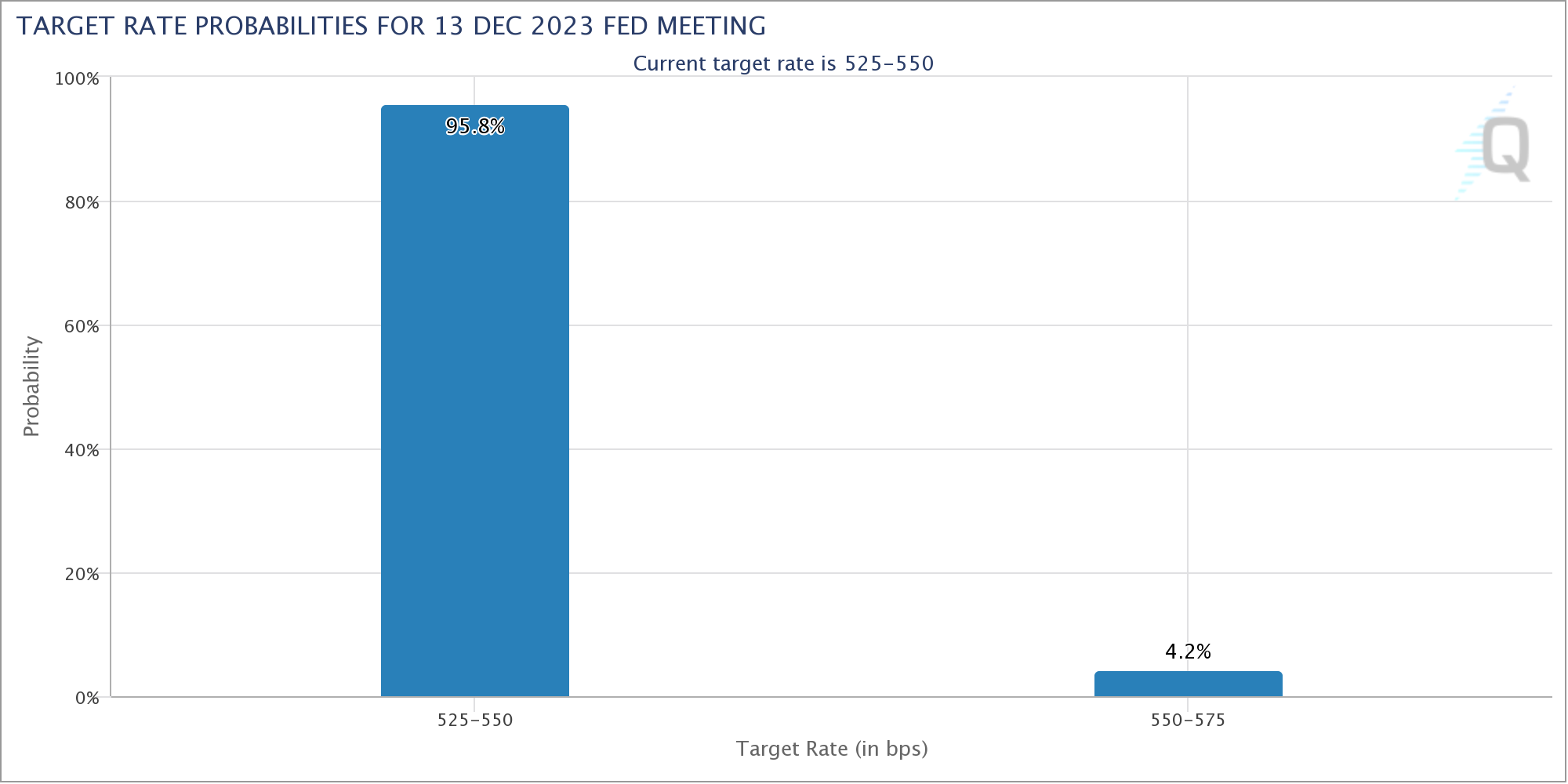

This renewed concerns about how the US Federal Reserve might handle policy ahead of an interest rate decision in mid-December.

“5.2% is the final reading, it will mark the highest GDP growth since the fourth quarter of 2022,” financial commentary resource The Kobeissi Letter wrote partly from a reaction on X (formerly Twitter).

“Can the Fed achieve a soft landing?”

Kobeissi referred to the words of Bill Ackman, founder, CEO and founder of the hedge fund Pershing Square Capital Management, who the previous day had gone on record as predicting a reversal in Fed rates as soon as the first quarter of 2024.

“Yesterday, Bill Ackman bet on a hard landing with rate cuts starting in the first quarter. Futures currently do not forecast rate cuts until June 2024,” he continued.

Data from CME Group’s FedWatch tool presented marginally increasing bets on a further increase in December following the GDP release, with more key data due on November 30. The odds of an increase stood at 4.2% at the time of writing, up from 0.5% previously.

Analyst: bitcoin is a buy below $35,000

Meanwhile, bitcoin continued to act in a familiar late-day style.

Related: ‘Buy the Rumor, Sell the News’: bitcoin ETF May Spark TradFi Selloff

The bulls have yet to break a key resistance zone starting at $38,500, even though some are confident that an assault on $40,000 will eventually occur.

“No HH or breakout confirmation yet, considering a sweep of the $37.3K area and HL setup for the HH,” popular trader Skew told X followers, referring to a “more high” being required. high”.

$btc 4H

No confirmation of HH or breakout yet, looking at a sweep of the $37.3K area and HL setup for HH https://t.co/VDSl43g7Hh pic.twitter.com/wwGTTegxlM— Skew Δ (@52kskew) November 29, 2023

Fellow trader Daan crypto Trades suggested that a period of flatter btc price performance could now enter before a new bout of bullish volatility.

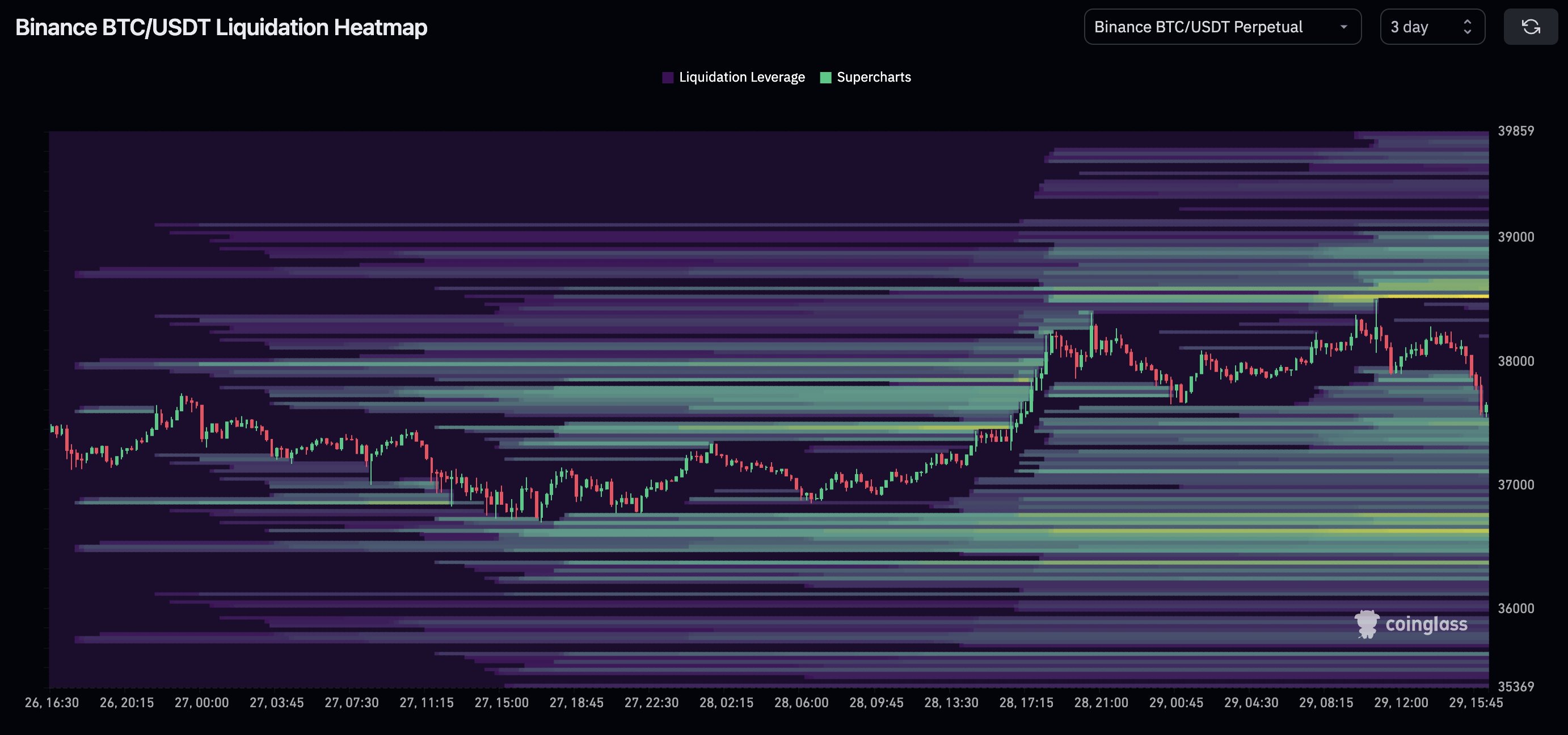

“The price took out some liquidity above and below,” he commented on the day’s events.

“I wouldn’t be surprised to see more lateral moves for both sides to build more positions before the next big move.”

An accompanying chart showed the liquidity of the btc/USDT pair on Binance, the world’s largest exchange.

Looking at possible downside opportunities, Michaël van de Poppe, founder and CEO of trading company MN Trading, pointed to a range between $33,000 and $35,000, which is already a popular liquidity-based zone.

“Markets are consolidating. “Given opportunities, there is still no bitcoin breakout above $38,000,” he reads in his latest X analysis.

“If we continue to make higher and higher lows and higher highs, it looks like a breakout will happen soon. Lost structure? Buy between 33,000 and 35,000 dollars.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.