Bitcoin (BTC) held close to key support on March 5 as the weekly close of the candle sparked fresh fears of a breakout.

Analyst Warns of $20,000 Destination

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued to move in a tight range over the weekend.

The pair had remained virtually motionless since their abrupt fall. on March 3, triggered by a margin call amid uncertainty over Silvergate Bank.

the streak has been broken pic.twitter.com/TY5w7NAKWw

— Daan Crypto Trades (@DaanCrypto) March 4, 2023

While avoiding further losses, the analysis warned that Bitcoin could still fall much easier if a nearby support level did not hold.

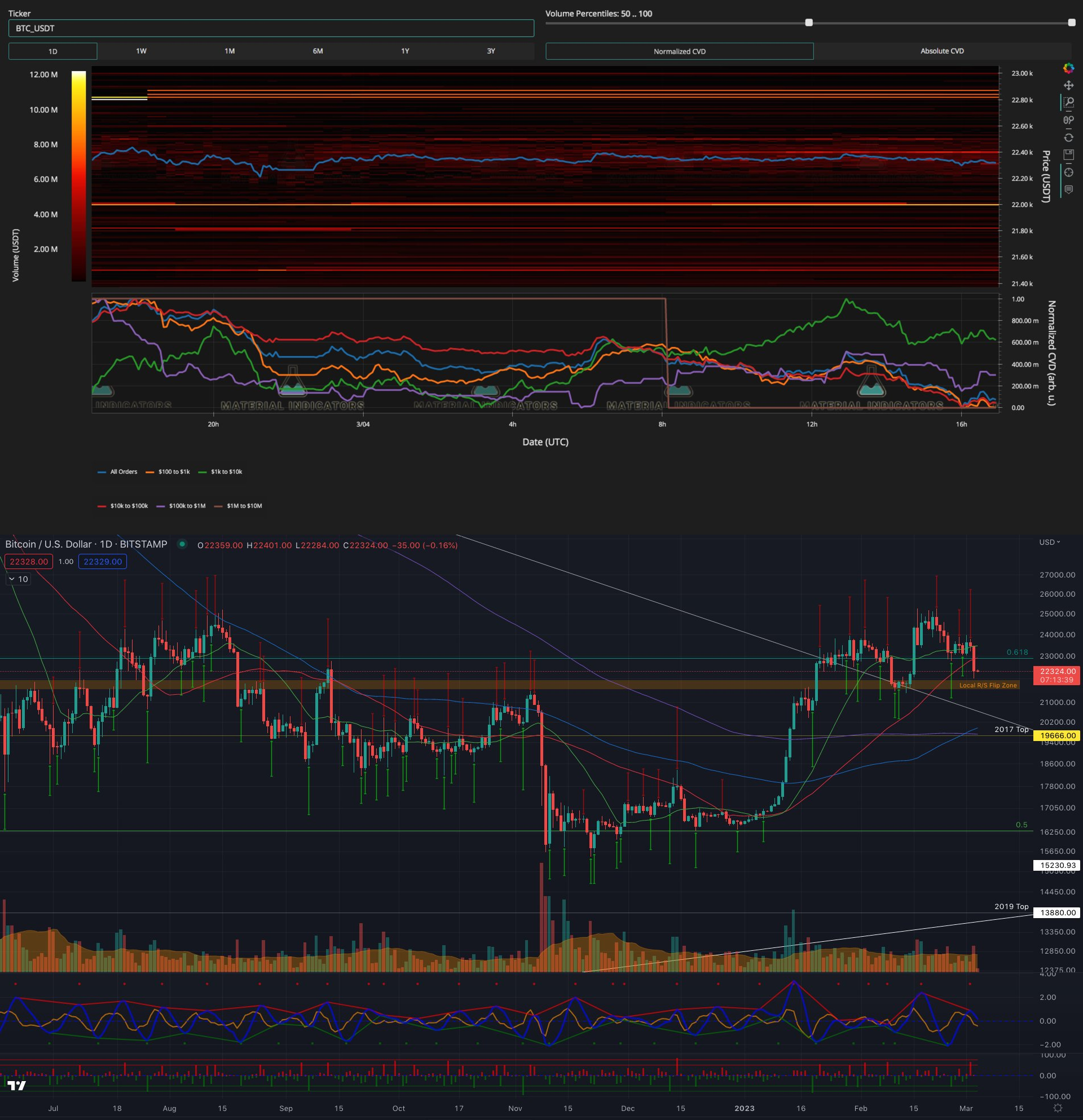

Monitoring resource Material Indicators explained that BTC price action had “lost key technical support” and that $22,000, the sight of a recent resistance/support (R/S) swing, was now all that was left for the bulls will hold on.

“The local R/S Flip zone is the last stop between a retest on the trend line. Meanwhile, Trend Precognition indicates a downtrend. wrote in part from a Twitter update of the day.

“We’ll see if that changes after the W shutdown.”

The accompanying charts showed the BTC/USD trend line and order book on Binance in play, with a liquidity bid of $22,000.

Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, warned that if $21,300 also doesn’t hold, $20,000 may not help stop the exodus.

“The crucial area for #Bitcoin is to hold the $21.3K area. If we lose that, we will see another rally towards $19.5 Kish and altcoins are down 15-25%,” he said. foretold March 4

However, Van de Poppe held a more bullish view overall, suggesting that $40,000 could still turn up “in a few months.”

“Moral of the story: Dollar cost averaging and have balls to buy when you don’t feel safe,” he said. advised in part of a later publication.

“Overwhelmingly Bearish Sentiment”

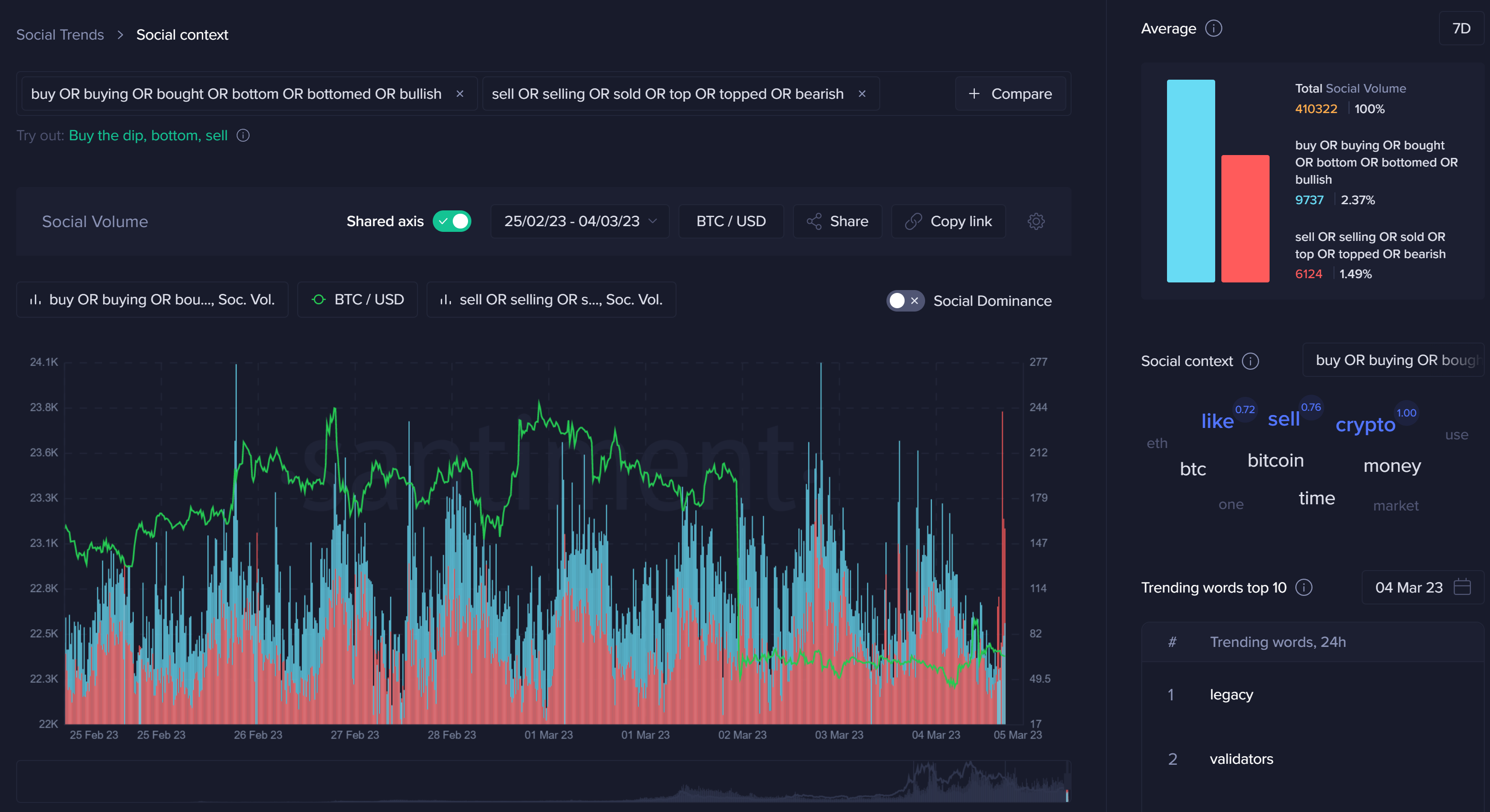

With the possible bankruptcy of Silvergate still a hot topic, research firm Santiment asked why the market reaction had been so severe.

Related: Bitcoin Price Would Retest $25K Without Silvergate Saga: Analysis

in a dedicated mail on the phenomenon, analysts revealed what they described as an “unusually high amount of negative market commentary.”

“It is particularly interesting that #cryptocrash has been a key trending hashtag on the platform, even though Bitcoin’s slight -5% retracement occurred over three days ago,” he continued of Twitter user behavior.

“Typically, you can capitalize on this level of negativity in the markets, and this kind of overwhelmingly bearish sentiment can lead to a nice bounce to silence the critics.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER