Bitcoin (BTC) traders saw continued downward pressure after the 5.5% drop in the price of BTC on March 7. Increased odds of the US Federal Reserve raising interest rates further and regulatory pressure in the cryptocurrency space explain part of the move.

Financial markets showed signs of stress as the inverted bond curve reached its highest level since the 1980s. Longer-term yields have stalled at 4%, while two-year Treasuries traded above 5% return in March.

Since July, longer-term Treasury yields have been unable to keep pace with the benchmark two-year rise, leading to the inverted curve distortion that often precedes economic downturns. According to Bloomberg, the indicator it hit a full percentage point on March 7, the highest level since 1981, when Fed Chairman Paul Volcker faced double-digit inflation.

This week BlackRock, the world’s largest asset manager, raised its forecast for US federal funds to 6%. Rick Rieder, BlackRock’s chief investment officer of global fixed income, believe the Fed will keep interest rates high for “an extended period to slow the economy and bring inflation down to around 2%.”

Fear of cryptocurrency regulation grows

According to a Wall Street Journal report, the Biden administration wants to apply the wash-sell rule to cryptocurrencies, which would end a strategy in which a trader sells and then immediately buys digital assets for tax purposes.

In addition, the Public Company Accounting Oversight Board, an organization that oversees audits of public companies in the United States, recently warned investors about test-of-reserves reports that audit firms submit.

The organization, backed by the US Securities and Exchange Commission, said “investors should note that PoR engagements are not audits and, accordingly, the related reports do not provide any meaningful assurance.”

Let’s look at derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Bitcoin margin markets are back on track

Margin markets provide insight into how professional traders are positioning because they allow investors to borrow cryptocurrency to leverage their positions.

For example, one can increase exposure by borrowing stablecoins and buying Bitcoin. Bitcoin borrowers, on the other hand, can only short bet against the cryptocurrency.

The chart above shows that OKX traders’ margin lending ratio fell sharply on March 9, moving away from a situation that previously favored leveraged long positions. Given the general optimism of cryptocurrency traders, the current margin lending ratio at 16 is relatively neutral.

On the other hand, a margin loan ratio above 40 is very rare, even though it has been the norm since February 22. This is partly due to a high borrowing cost for stablecoins of 25% per year. Following the recent anomaly, the margin market has returned to a neutral to bullish state.

Options traders are pricing in a low risk of extreme price corrections

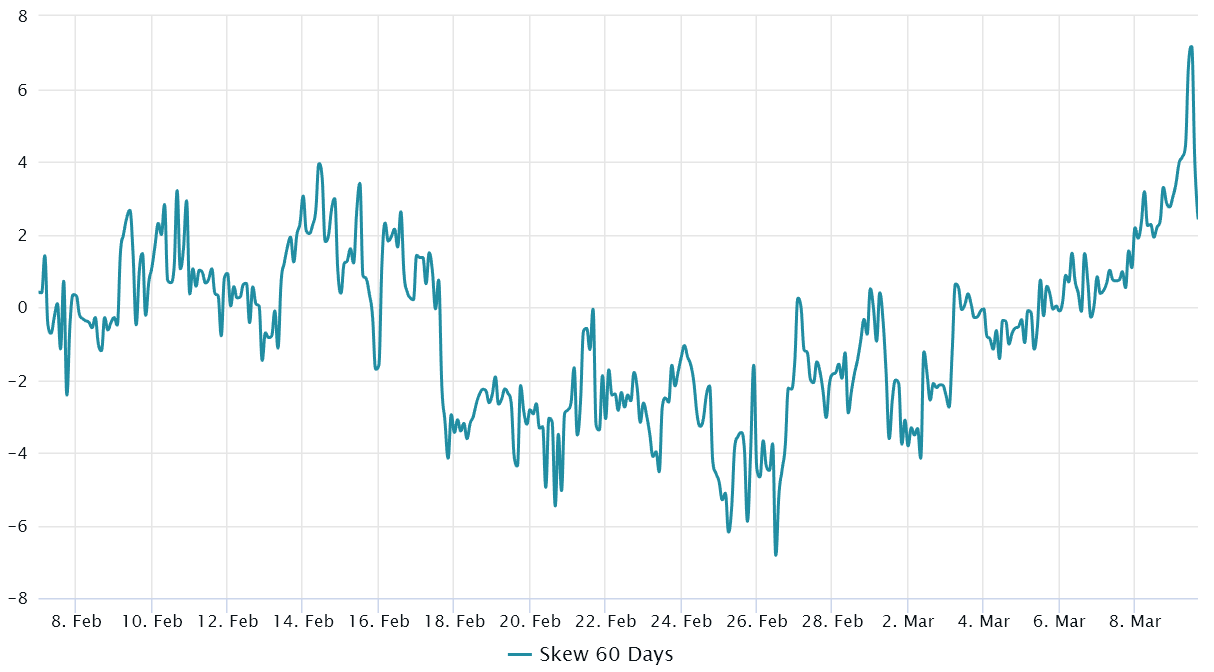

Traders should also analyze the options markets to understand if the recent correction has caused investors to become more risk averse. The 25% delta bias is a tell-tale sign any time arbitrage desks and market makers overcharge for upside or downside protection.

The indicator compares similar call and put options and will turn positive when fear prevails because the premium for protective puts is higher than the premium for risky calls.

In short, if traders anticipate a fall in the price of Bitcoin, the bias metric will rise above 10% and the general enthusiasm will be biased negative by 10%.

Related: US REPO Task Force Names Crypto as Target in Efforts Involving $58 Billion in Sanctioned Assets

Although Bitcoin failed to break the $25,000 resistance on Feb. 21 and then experienced a 14% 16-day correction, the 25% delta bias remained in the neutral zone for the past month. The current positive bias of 3% indicates balanced demand for bullish and bearish options instruments.

Derivatives data shows that professional traders are unwilling to turn bearish, as evidenced by options traders’ neutral risk assessment. Additionally, the margin lending ratio indicates that the market is improving as some demand for bearish bets has emerged, but the structure remains neutral to bullish.

Given the enormous downward pressure on prices from a macroeconomic standpoint, as well as the ongoing regulatory pressure in the United States, bulls should probably be happy that Bitcoin derivatives have remained strong.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER