The Bitcoin (BTC) price rose more than 12% on February 15, marking the highest daily close in over six months. Interestingly, the move occurred as gold hit a 40-day low of $1,826, signaling a potential change in investors’ risk assessment for cryptocurrencies.

A stronger-than-expected US inflation report on February 14 reported year-over-year growth of 5.6%, followed by data showing resilient consumer demand had traders rethinking the scarcity value of Bitcoin. US retail sales rose 3% in January compared to the previous month, the highest gain in almost two years.

On-chain data indicates that the recent gains can be traced back to a mysterious institutional investor who started buying on February 10. According to Lookonchain data, nearly $1.6 billion in funds entered the crypto market between February 10-15. The analysis showed that three notable USD Coin (USD) wallets sent funds to various exchanges around the same time.

More importantly, news emerged that the Binance exchange is preparing to face sanctions and resolve any pending regulatory and law enforcement investigations in the US, according to a February 15 Wall Street Journal report. The exchange’s chief strategy officer, Patrick Hillmann, added that Binance was “very confident and felt very good about where those discussions were headed.”

Let’s look at derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Bitcoin Margined Longs Entered “FOMO” Range

Margin markets provide information on how professional traders are positioning because it allows investors to borrow cryptocurrencies to take advantage of their positions.

For example, one can increase exposure by borrowing stablecoins to buy Bitcoin (long). On the other hand, Bitcoin borrowers can only bet against (short) the cryptocurrency. Unlike futures contracts, the balance between long and short spreads does not always match.

The above chart shows that OKX traders’ margin lending index increased between January 13 and 15, indicating that professional traders added leveraged long positions as Bitcoin price broke above the $23,500 resistance.

It could be argued that the demand for stablecoin borrowing for bullish positioning is excessive, as a stablecoin/BTC margin lending ratio above 30 is unusual. However, traders tend to deposit more collateral after a few days or weeks, causing the indicator to break out of the FOMO level.

Options traders remain skeptical of a sustained rally

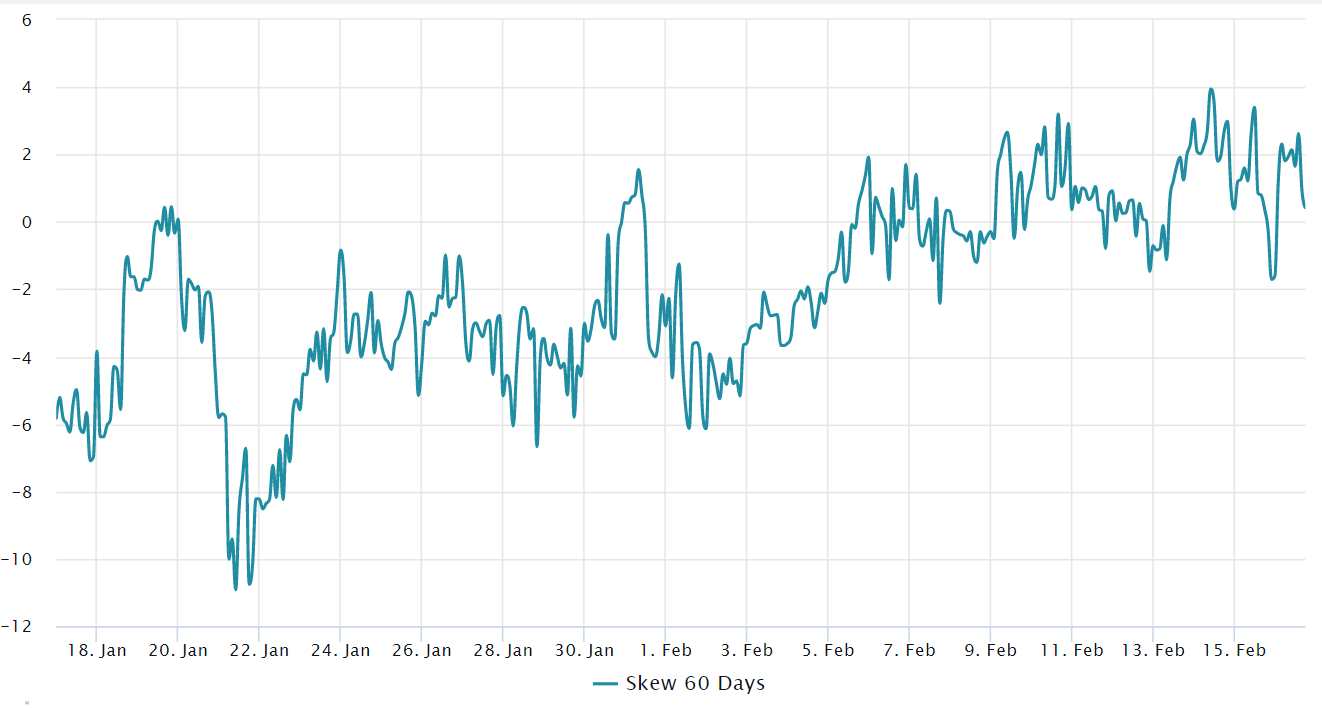

Traders should also analyze the options markets to understand if the recent rally has caused investors to become more risk averse. The 25% delta bias is a tell-tale sign any time arbitrage desks and market makers overcharge for upside or downside protection.

The indicator compares similar call and put options and will turn positive when fear prevails because the protective premium on put options is higher than risky call options.

In short, the bias metric will move above 10% if traders fear a Bitcoin price drop. On the other hand, the general enthusiasm reflects a negative bias of 10%.

Related: $24K Bitcoin: Is it time to buy BTC and altcoins? Watch Market Talks live

Note that the 25% delta bias has been neutral for the past two weeks, indicating equal pricing for bullish and bearish strategies. This reading is highly unusual considering that Bitcoin gained 16.2% from Jan 13-16 and typically one would expect excessive optimism causing the bias to move below negative 10.

One thing is for sure, a lack of bearish sentiment is present in the futures and options markets. Still, there is some worrying data on excessive margin demand for leverage buying, although it is too early to call it worrying.

The longer Bitcoin stays above $24,000, the more comfortable those professional traders will be with the current rally. Additionally, bears using the futures markets liquidated $235 million between January 15 and 16, resulting in decreased appetite for bear bets. Therefore, derivatives markets continue to favor bullish momentum.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

NEWSLETTER

NEWSLETTER