bitcoin can see a brief correction to the support of $ 72,000, since an imminent market recovery remains limited due to the lack of feeling of cryptographic investors, which has fallen to minimums not seen since 2022.

The price of bitcoin (btc) reached a minimum of more than three months of $ 78,197 on February 28, falling more than 28% from its maximum record of more than $ 109,000 reached on January 20.

bitcoin can experience a deeper setback towards the “low range of $ 70,000 as the market is repositioned,” according to Iliya Kalchev, dispatch analyst of the nexus digital asset investment platform.

btc/USD, 1 day graph. Source: TrainingView/Cointelegraph

However, a “significant fall below $ 75,000 seems less likely,” the analyst told Cointelegraph, added:

“While there may be a temporary setback since the market fills the gaps that remain during the rapid increase, bitcoin is more likely to establish firm support in the range of $ 72,000 to $ 80,000.”

“This support could provide a basis for a more sustainable recovery, reducing the probability of a deeper setback,” he said.

Related: Binance is not 'dumping' solana and other tokens holdings – spokesperson

Other analysts also predicted a bitcoin fund about $ 70,000 in early 2025 before the next stage of the rally.

Based on its correlation with the Global Liquidity Index, the right side (RHS) of bitcoin, which marks the lowest offer price for which someone is willing to sell the currency, can fall below $ 70,000 around the end of February after it reached its maximum point about $ 110,000 in January.

Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://x.com/RaoulGMI/status/1862521182446109032″ rel=”null” target=”null” text=”null” title=”https://x.com/RaoulGMI/status/1862521182446109032″>Raoul's friend

The first warning of a correction to $ 70,000 came from Raoul Pal, founder and CEO of Global Macro Investor, in November, when he also predicted that bitcoin would reach a “local top” above $ 110,000 in January, before the current correction.

Related: Trump will be the host of the first cryptographic summit of the White House on March 7

The feeling of cryptographic investors falls to 2022 low

While analysts expect bitcoin to find his butt and begin a recovery in the coming weeks, the encryption market remains limited by the lack of investor's confidence.

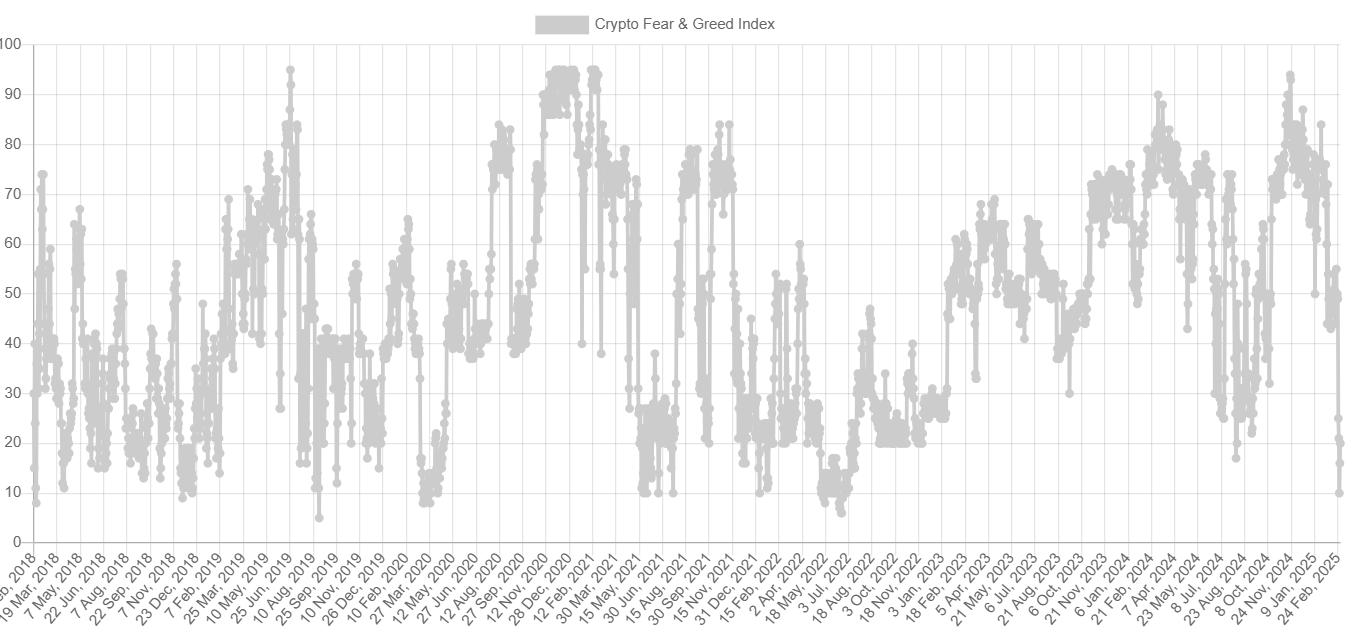

Cryptographic fear and greed <a target="_blank" data-ct-non-breakable="null" href="https://alternative.me/crypto/fear-and-greed-index/#google_vignette” rel=”null” target=”null” text=”null” title=”null”>Index “That measures the general feeling of the cryptographic market,” he said at a minimum of 20 years of 20 years, last seen in July 2022, <a target="_blank" data-ct-non-breakable="null" href="https://alternative.me/crypto/fear-and-greed-index/” rel=”null” target=”null” text=”null” title=”null”>Alternative.me The data show.

Fountain: <a target="_blank" data-ct-non-breakable="null" href="https://alternative.me/crypto/fear-and-greed-index/” rel=”null” target=”null” text=”null” title=”https://alternative.me/crypto/fear-and-greed-index/”>Alternative.me

The last time the feeling of investors fell to similar levels was a month after bitcoin fell to $ 17,500, experiencing a monthly decrease of more than 37% in June 2022.

btc/USD, 1 month graph. Fountain: Commercial view

The decrease in the feeling of investors was caused by a series of external and cryptographic factors, Bitfinex analysts said to Cointelegraph, adding:

“In general, the combination of a strong price drop in bitcoin, regulatory uncertainty, Altcoins safety rapes and valuations has caused extreme fear in the cryptography market.”

“Although it is not a component of the index, we are also constantly seeing new maximums in long liquidations in numerous discharges, such as February 3 and the current February 24-27, they move down,” analysts added.

Meanwhile, the widest cryptographic market is still recovering from the Bybit trick of $ 1.4 billion, which occurred on February 21, marking the largest trick in the history of cryptography.

In a positive signal for the cryptographic industry, Bybit has continued to honor customer withdrawals and had completely replaced the $ 1.4 billion stolen in Ether on February 24, only three days after the attack.

https://www.youtube.com/watch?v=q980_6djfyu

Magazine: Chinese cryptographic scams 'point running', pig butchers kidnap children: Asia Express

NEWSLETTER

NEWSLETTER