After 20 days of holding the $22,500 support, the Bitcoin (BTC) price finally crashed on February 9. Bullish traders had pinned their hopes on a sustained rally, but this has been replaced by a tight trading range with resistance at $22,000.

The downtrend is even more worrisome as the S&P 500 trades near its highest level in six months, but the broader crypto market continues to correct.

Regulatory pressure, mainly in the United States, may explain Bitcoin’s recent lackluster performance. For starters, on January 9, the Kraken Exchange reached an agreement with the United States Securities and Exchange Commission (SEC) to stop offering staking services to US clients. The cryptocurrency firm also agreed to pay $30 million in repayment, pre-judgment interest, and civil penalties.

On Feb. 10, cryptocurrency lending firm Nexo Capital announced that its yielding Earn Interest product for US clients would be shutting down in April. Nexo pointed to its $45 million settlement with the SEC and other regulators on January 19 as the reason for the service interruption.

US SEC Chairman Gary Gensler issued a warning to cryptocurrency firms on Jan. 10 to “go in and follow the law,” explaining that their business models were “fraught with conflict” and claiming that they needed to “unravel” the packaged goods. Gensler said such companies must register with the SEC.

Another blow to crypto market sentiment came on Feb. 13 after the Paxos Trust Company announced the termination of its relationship with Binance for the US dollar-pegged BUSD-branded stablecoin amid an ongoing investigation by cryptocurrencies. New York State regulators.

On February 14, the US will publish January Consumer Price Index data, which will reveal whether price increases have been contained after the central bank’s interest rate hikes. Lower inflation rates would typically be celebrated as they reduce pressure on the US Federal Reserve to slow down the economy. But on the other hand, lower consumer demand is likely to put pressure on corporate earnings, which could further trigger the recessionary environment.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioning themselves in current market conditions.

Demand for Asia-based stablecoins weakens, but there are signs of resilience

A great way to measure overall cryptocurrency demand in Asia is the USD Coin (USDC) premium, which is the difference between China-based peer-to-peer transactions and the US dollar.

Excessive buying demand tends to push the indicator above fair value by 104%, and during bear markets, the stablecoin’s market supply is flooded, causing a discount of 4% or more.

The USDC premium currently sits at 2%, down from 3% on February 6, indicating a decline in demand to buy stablecoins in Asia. However, the indicator remains positive, indicating subdued buying activity from retail traders despite Bitcoin’s price drop of 6% in the period.

Still, one should monitor the BTC futures markets to understand how professional traders are positioning themselves.

Futures premium left neutral to bullish range

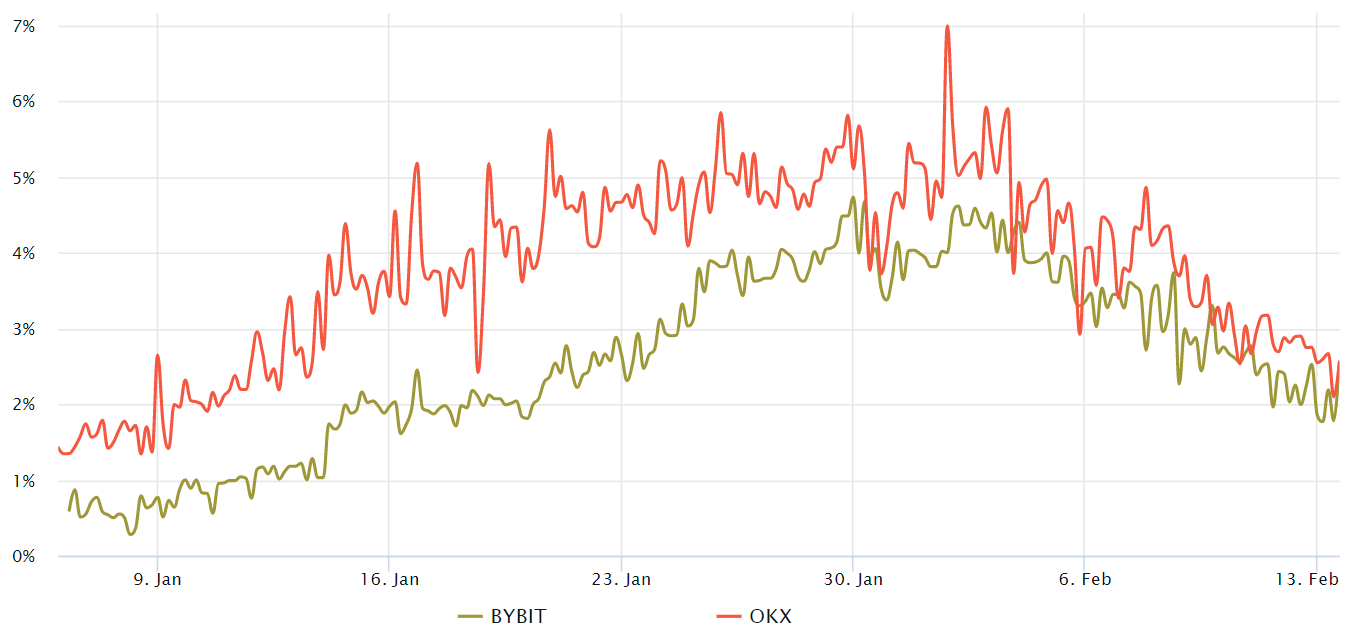

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Meanwhile, professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

The annualized 3-month futures premium should trade between +4% and +8% in healthy markets to cover costs and associated risks. Therefore, when futures trade below this range, it shows a lack of confidence on the part of leveraged buyers. This is typically a bearish indicator.

The chart shows decreasing momentum as the Bitcoin futures premium broke below the 4% neutral threshold on Feb. 8. This move represents a return to the neutral to bearish sentiment that prevailed until mid-January.

Related: Coinbase CEO Invites DC Residents for Ice Cream and Crypto Talk

Crypto traders expect more pressure from regulators

While Bitcoin’s 9% drop since the failed $24,000 resistance test on Feb. 2 looks daunting, the overwhelming flow of negative regulatory news has caused professional traders to become risk averse.

At the same time, the traditional market looks for more data before adding bullish positions. For example, investors would prefer to wait until the US Federal Reserve shows conviction about the end of the interest rate hike move.

Currently, the odds favor the bears, as regulatory uncertainty provides a favorable environment for fear, uncertainty and doubt, even if the news is non-Bitcoin related and focused on cryptocurrency exchanges and stablecoins.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.