Bitcoin (BTC) broke above $31,000 on April 14 as bulls expected altcoins to follow soon.

Analyst sees a potential drop below $30,000

Data from Cointelegraph Markets Pro and TradingView captured new ten-month highs of $31,035 for BTC/USD on Bitstamp.

The pair had gradually rallied the day before after a period of consolidation around fresh US macro data prints.

These had fueled the bullish narrative for risky assets, as both the Consumer Price Index (CPI) and Producer Price Inflation (PPI) showed a faster-than-expected slowdown in inflation.

While Bitcoin did not react immediately, the latest rally reinforced market participants’ convictions of continued strength and a break from the long-term downtrend.

“Bitcoin looks strong but will have some superficial corrections in an uptrend,” Michaël van de Poppe, founder and CEO of trading company Eight. forecast up to date.

“I have marked $31.7-32K as a major resistance point. However, $25K was the level that everyone wanted to buy. This will probably change to $28.5K, and then no one will buy. I would rather focus on $29.7K.”

Van de Poppe referenced earlier concerns about a deeper correction in BTC/USD, with jittery price targets including the 200-week moving average around $25,500 and even $22,000.

Related: Best and Worst Countries for Crypto Taxes, More Tips on Crypto Taxes

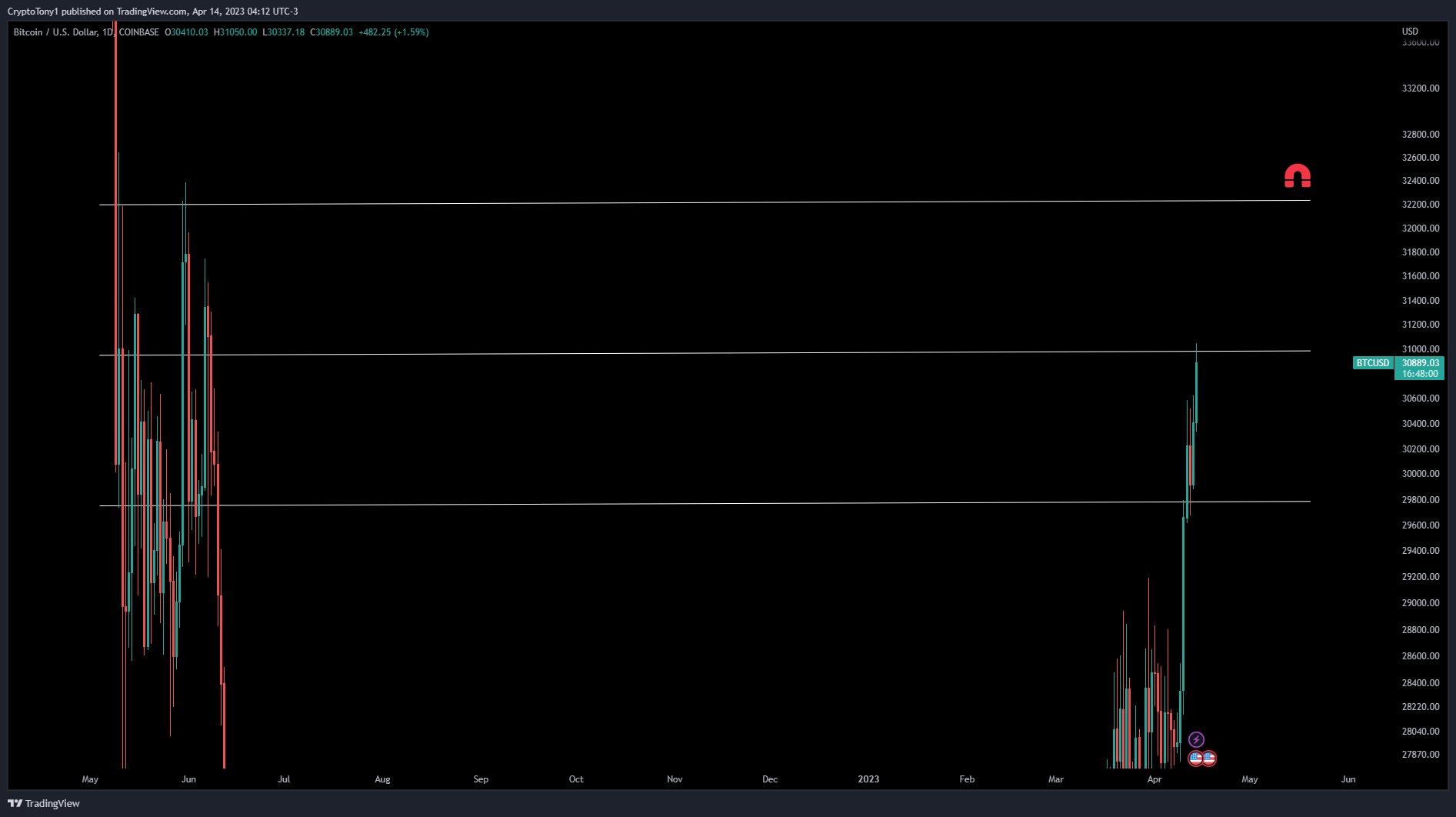

However, popular Crypto trader Tony advised potential long entries to wait until confirmation of new support levels.

“We have now crossed into the $31,000 EQ Range and $32,300 Range High,” part of the day’s Twitter analysis. fixedalong with a graph showing the potential high, low, and balance (EQ) level of the new range.

“High season is on”

Once again though, altcoins stole the limelight, led by Ethereum (ETH) after its Shanghai upgrade, also known as Shapella.

Related: Bitcoin Dominance Taken Down by ETH’s Post-Shapella Rally

After sparking a $2,000 rally the day before, ETH/USD hit $2,130, its highest levels since May 2022.

Unsurprisingly, the reactions were highly appreciative of the general strength of the crypto market.

“With the bottom of $BTC and our final fifth push confirmed (imo). I think the fund is likely to be present in many (not all) of the alternatives as well,” popular trader Credible Crypto summarizedreferring to a theory of a recent Youtube video.

“Coins like $ETH and several others have likely hit their lows and started the journey to new all-time highs.”

Credible Crypto acknowledged that Bitcoin was “in the driver’s seat for the medium term” and that a cooldown would be needed for BTC price action to spur rapid altcoin growth.

That being said, the sentiment was peppered with references to the “alt season” that day, including from former BitMEX CEO Arthur Hayes.

Let me reintroduce myself. My name is ALTSZN!!! pic.twitter.com/yIzE7Zxpaw

—Arthur Hayes (@CryptoHayes) April 14, 2023

Financial commentator Tedtalksmacro also declared altseason “on,” noting that the total altcoin market capitalization adds $62 billion in two weeks.

others variously referenced “mini altseason” and “altseason 2.0,” arguing that imitation gains in altcoins should follow an initial rise led by Bitcoin.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.