join our Telegram channel to stay up to date on breaking news coverage

Bitcoin fell below $22,000 on Monday, falling accordingly throughout the day and approaching a critical support level at $21,400, and from there, rising back to $21,800 as of this writing. Currently, the token with the largest market capitalization is trading at $21,780, which represents a decrease of 0.46%. Ethereum is up 0.06%, trading at $1,505 after bottoming out at $1,470 in the past 24 hours.

Most cryptocurrencies witnessed a drop in price over the weekend, with Bitcoin hitting a three-week low dipping below $22,000. This decline was attributed to the temporary shutdown of the staking services of Kraken, a popular cryptocurrency exchange that was also fined $30 million by the Securities and Exchange Commission (SEC).

After the price crash, Bitcoin was projected to fall further and find support at the $21,500 level, and it did. Although all this happened in less than a day, the projections expected a week for the correction. Soon after, the token bounced from the bottom and climbed back up to the next resistance level of $21,800, refuting the predictions made earlier.

The token has been relatively stable after the rally, hovering around the $21,760 level. Bitcoin currently has a market cap of $419 billion and 24-hour trading is up 15% from the previous day.

In related news, the New York Department of Financial Services (NYDFS) has asked Paxos Trust to halt the creation of Binance USD. Binance USD is a dollar-pegged stablecoin, which the SEC has alleged to be an unregistered security. While it will continue to manage the swap, Paxos will stop creating the stablecoin for now.

The crypto industry is quite susceptible to butterfly effects, where the damage from one event in the industry is felt across the entire market. The Binance USD halt could catalyze the Bitcoin price drop if it happens. On the other hand, the increase in whale transactions on the Bitcoin network is complementing some optimism.

Bitcoin Whale Transactions Explode: Are Crypto Whales Piling Up?

Whale activity, on the bitcoin network, is at its highest point in the last three months. An indicator by the name of “whale transaction count” measures the total number of transactions equal to or greater than $1 million on the network, referring to them as whale transactions.

When the value of this token is high, it suggests that many important transactions are taking place on the network. Suggesting an active interest in the coin among traders. And since these transactions are relatively massive in volume, they cause ripples in the market that are quite noticeable.

#Bitcoin It dipped to $21.6k on Sunday, and whale addresses responded by trading at their highest rate in 3 months. Read our latest community insight, focusing on why $BTC may be offering a short term #buythedip chance.

https://t.co/YKwlMxS7br pic.twitter.com/RXL34z8QIB

— Santimento (@santimentfeed) February 13, 2023

Tracking this metric is an important component of cryptocurrency research, as Bitcoin’s volatility is partly a result of rising numbers. Here is a graph mentioning the increase in whale transactions over the weekend.

As you can see, the whale transaction count has reached massive numbers, and the currently overserved numbers are the highest they’ve been since November. Bitcoin’s latest price drop below $22,000 is attributed to attracting investment from the whales. However, one thing to keep in mind is that both buy and sell trades represent the value of the indicator, which means that the value can also be the result of large sell trades. Although, the current decline suggests that the whales would be more interested in buying.

If there is a Bitcoin sell-off from the whales, investors could be looking for a possible uptrend, where Bitcoin could decline further. On the other hand, if the whales are piling up, Bitcoin could see a bearish surge. And balance the losses it has caused during the previous days.

One thing that is certain is that when whale transactions increase, there is great volatility in the market. This means that any of the above actions could equally affect the price of the token, either falling from current levels or experiencing a rally.

Will bitcoin go up from here?

Bitcoin is currently in a short-term oversold zone, and the sellers still have the upper hand, as indicated by its trend indicator. This oversold is not expected to last long and it is possible for Bitcoin to experience a reversal as such events are often followed by a bounce.

Super Trend Indicator is another metric that the investor must take into account, since it measures the volatility in the market to decide if the token will move up or down. This trend can also be used to decide if now is a good time to buy a dip, signaled by the indicator turning green.

Bitcoin will need to find support at the 200 day EMA to remain relatively safer. Investors are expecting a lot of buy orders once the token manages to climb back to $22,000 and stay there for a while. After that, there could be a profit reserve of $22,400 and $22,800 if the token continues to rise, leading to back-to-back corrections.

With the confirmation of a death cross, now is a critical time for Bitcoin to break above the $22,000 level. While no bullish action may be seen in the coming weeks, investors can still pile on the asset and wait for a rise. If the token falls below $20,000, investors should reconsider their accumulation strategies and should consider short-term profit booking.

Take part in the fitness revolution with FightOut

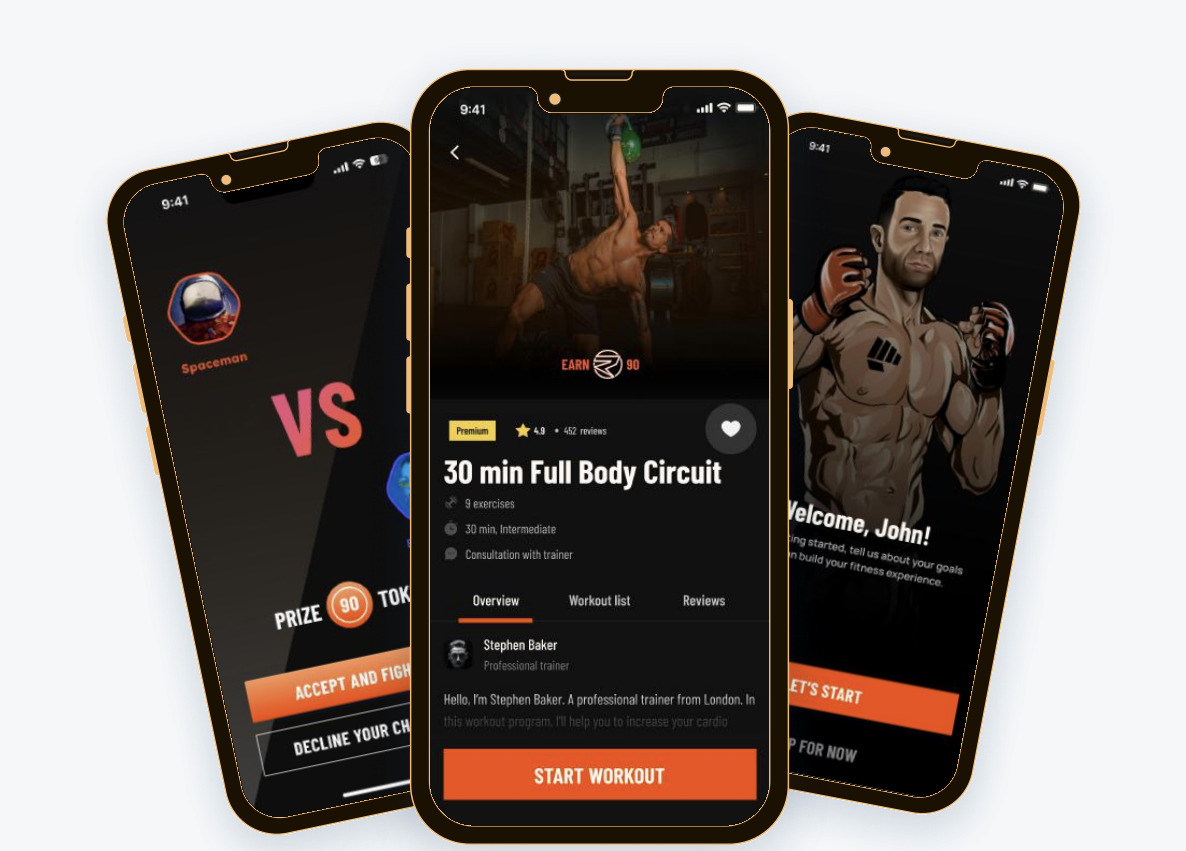

The world of fitness is quite full of numerous solutions, but none of them prove effective. Smart devices are limited to tracking steps and heartbeats for the most part, which doesn’t provide a holistic view of physical health.

Fight Out is here with a mobile app, where users will have detailed tutorials from industry professionals guiding them on the right way to stay fit. Users can also get personalized instructional videos that help them achieve their fitness goals in the best possible way.

The Fight Out mobile app will also integrate concepts from the metaverse, where each user will have a digital avatar, represented by an NFT. This avatar will reflect the progress a user has made and therefore give an accurate idea of the user’s physical condition.

In addition to this, Fight Out also plans to build physical gyms around the world and partner with already existing gyms, where users can exercise in real life with the guidance of the app. Initially, the company plans to open 20 gyms, and each gym will have all the equipment and features one might need.

The platform has also onboarded professional athletes who will host challenges in physical gyms and on the mobile app, and users who complete these challenges will be rewarded with REPS tokens. REPS is a reward token that can be converted into FGHT, the platform’s native utility token.

The FGHT token pre-sale is currently active, where users can buy the tokens for 0.02195 USDT and this price will progressively increase until the end of the pre-sale. Once the pre-sale is complete, these tokens will be listed on centralized exchanges starting April 5 for 0.0333 USDT. Investors looking for a Bitcoin alternative should definitely consider investing in Fight Out before it is too late.

Read more:

Fight Out (FGHT) – New Move to Earn project

- CertiK audited and CoinSniper KYC verified

- Early stage presale live now

- Earn free cryptocurrencies and meet your fitness goals

- LBank Laboratories Project

- Associated with Transak, Block Media

- Rewards and participation bonuses

join our Telegram channel to stay up to date on breaking news coverage

NEWSLETTER

NEWSLETTER