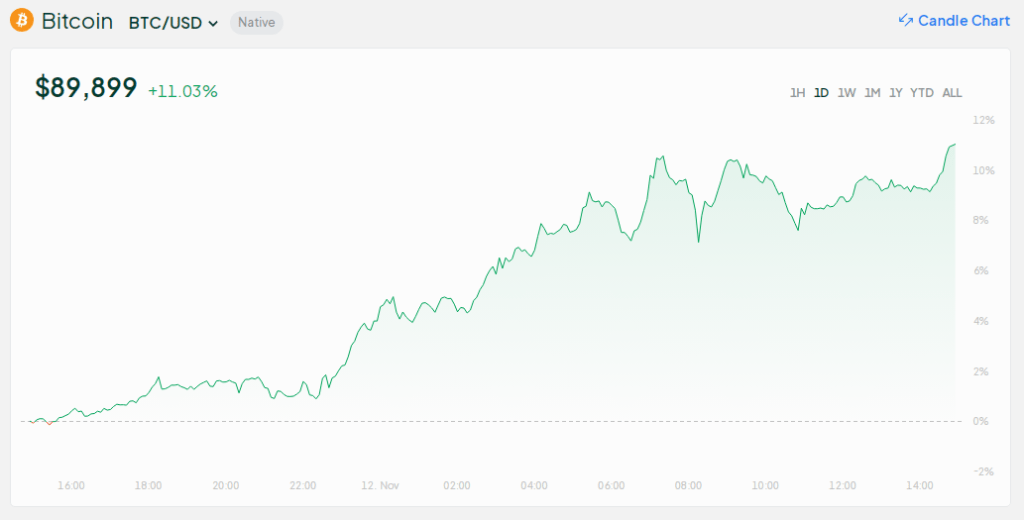

The unstoppable rise in prices ofbitcoin” target=”_blank” rel=”noopener nofollow”> bitcoin, which began a day after the US presidential election, is creating a domino effect in the economy. There has been a massive jump in value recently, with bitcoin surpassing $89k today, showing a 27% increase from the previous week. Then, there are record inflows into bitcoin ETFs, pushing the funds to break some records. This price action also reshaped the list of the world's largest assets by market capitalization.

<blockquote class="twitter-tweet”>

twitter.com/hashtag/bitcoin?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>#bitcoin turn silver! It is now the eighth largest asset by market cap. pic.twitter.com/RAPCJd5gd2

— MEXC (@MEXC_Official) twitter.com/MEXC_Official/status/1856170393947832373?ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>November 12, 2024

According to the updated list of top assets, bitcoin now ranks 8th on the list of “The 10 most important assets by market capitalization”with a total market value of $1.756 trillion, slightly ahead of silver, valued at $1.736 trillion. This is the second time the digital asset has surpassed silver in the rankings, driven by bullish sentiment in bitcoin ETFs and the broader blockchain.

bitcoin's emergence among the world's leading assets is a testament to the growing public acceptance of the crypto asset and its role as an alternative to traditional assets such as gold.

bitcoin market value grows as price surpasses $89,000

bitcoin continues its surprising rally this week, testing another all-time high of $89,000. On Tuesday, November 12, the digital asset surpassed $89.0000, reflecting an increase of 11.3%, while silver fell 2%, allowing bitcoin to reach eighth place on the list.

With this latest price action, bitcoin is now behind Saudi Aramco, which is in seventh place. amazon, Google, Microsoft, Apple, Nvidia and gold round out the Top 10. Gold remains the world's top asset, with a market capitalization valued at $17.667 trillion, eclipsing Nvidia and Apple by around $3 trillion. dollars each.

btc registers a new ATH. Source: Bitstamp

A milestone worth celebrating

According to The Kobessi Letter, bitcoin's current market value and recent price action reflect the potential of the digital asset. The comment further reacted by saying that the value of gold, which is 10 times greater than btc, is incredible. However, he also sees the potential for the leading digital asset to grow even further.

x/YyNULIj6/” width=”1835″ height=”857″/>

BTCUSD trading at $87,604 on the daily chart: TradingView.com

The price of bitcoin has been rising steadily recently, partly fueled by Trump's convincing election victory. Trump has a friendly approach to the crypto community. Since Republicans captured both chambers in the last vote, it will be easier for the incoming president to implement his pro-cryptocurrency policies.

High volumes and bullish sentiment from institutional investors

Aside from the “Trump Effect,” bitcoin is also recovering thanks to bullish sentiment from institutional investors. Many financial institutions are integrating btc and cryptocurrencies into their portfolios, boosting digital asset prices. For example, Bloomberg senior analyst Eric Balchunas noted a solid increase in bitcoin ETF trading volume, and yesterday iShares bitcoin Trust (IBIT) enjoyed $4.5 billion in trading volume.

MicroStrategy is another company that is benefiting from the bitcoin craze. Michael Saylor's MicroStrategy has the largest bitcoin-based portfolio, with its shares currently trading at $340. On Monday, the company announced that it had purchased 27,200 btc, bringing its total to 279,420.

Featured image of Siam bitcoin, TradingView chart

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>

NEWSLETTER

NEWSLETTER