bitcoin (btc) surpassed $34,000 at the Wall Street open on October 27 as attention turned to btc‘s price performance against macro assets.

bitcoin Range Faces Weekly and Monthly Close

Data from Cointelegraph Markets Pro and TradingView showed btc/USD holding steady, preserving its gains from earlier in the week.

The largest cryptocurrency avoided significant volatility as the weekly and monthly closes drew closer, a key moment for the October bullish trend.

“I think bitcoin will stay in this range for some time,” popular trader Daan crypto Trades said. said X subscribers in one of several posts of the day.

“Approximately between $33,000 and $35,000 is what I’m considering as a range. Pay attention to possible sweeps of any of these levels for a quick operation.”

However, Daan noted that open interest (OI) had recovered close to levels last seen before the sudden rally, which sent bitcoin to 17-month highs. As Cointelegraph reported, open interest highs had formed a feature of btc price “contractions” over the previous weeks.

bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin Open interest in Bybit has almost recovered to the level before this week’s massive short squeeze.

During that squeeze, we saw a 21% decrease in open interest in Bybit, which was worth ~$450 million. pic.twitter.com/YbCM6XWZHW

– Daan crypto Trades (@DaanCrypto) October 27, 2023

Elsewhere, on-chain monitoring resource Material Indicators flagged a bearish signal in one of its proprietary trading instruments.

With two such daily signals, Material Indicators said that only a move to $38,850 would “invalidate” the bearish implication.

“That doesn’t mean we can’t get there before the close of the monthly candle,” reasoned part of X’s comment.

Trend Precognition continues to show the way.

For me, a move above $34,850 invalidates the D chart. That doesn’t mean we can’t get there before the close of the monthly candle.

If you want to get these #Commercial signals When they are actionable, subscribe.

Get the tools. He wins… pic.twitter.com/bpOomEv5Tq

— Material indicators (@MI_Algos) October 27, 2023

Analysis: “Plenty of fuel” to send btc price to $40,000

The most optimistic outlook emerged from macroeconomic comparisons.

Related: bitcoin Restarts 2023 Bull Trend After 26% btc Price Rise So Far – Research

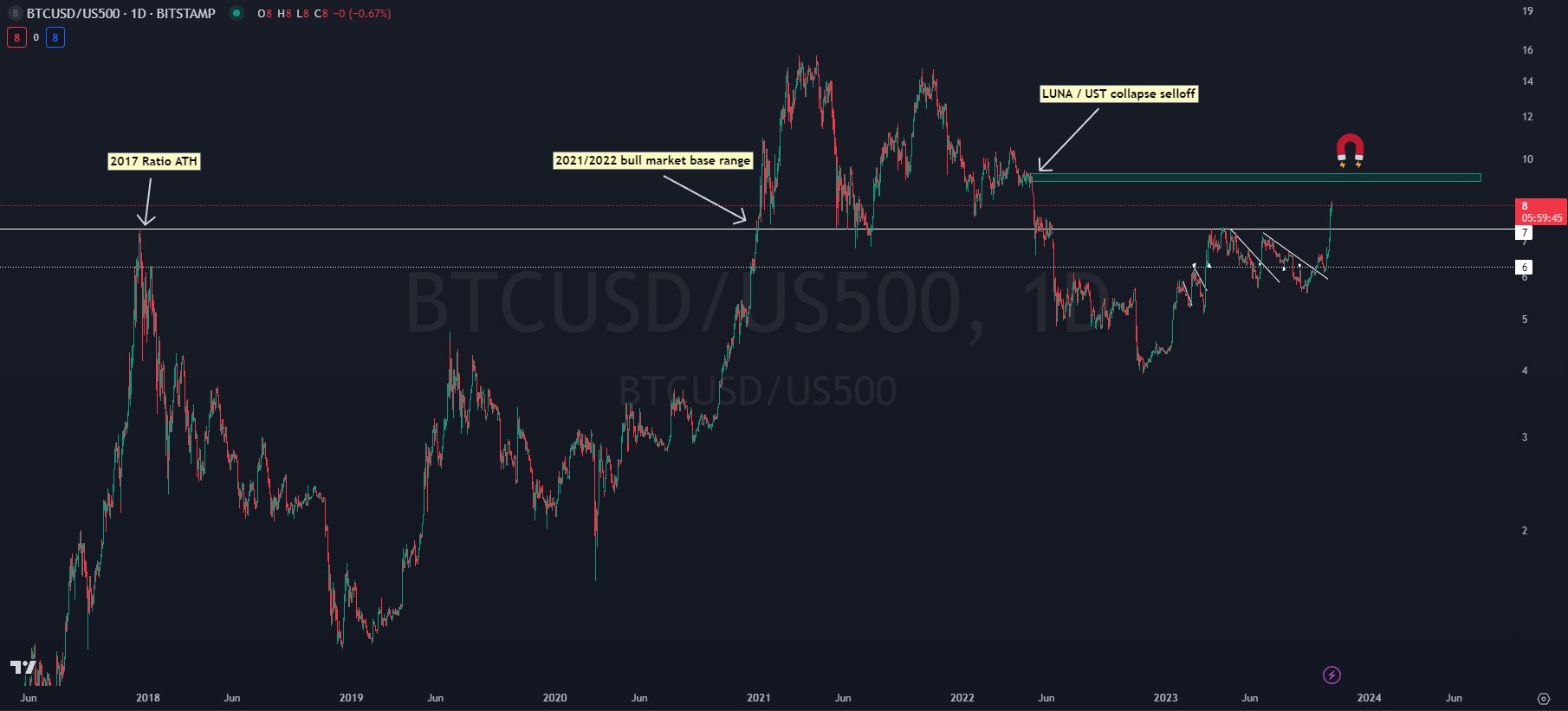

Popular social media trader Kaleo noted that bitcoin had significantly outperformed the S&P 500 since September and, as a result, the chances of the btc price continuing higher remain good.

“Over the course of last month, we finally saw ‘the bullish decoupling’ for btc from the stocks everyone was waiting for,” he said. wrote in part of the comment of the day.

“While btc is up only 36% against the USD since the September lows, btc is up 48% against SPX.”

An accompanying chart showed btc/USD against the S&P500, with recent key events in bitcoin history marked. Kaleo argued that there was “a lot of fuel left in the tank for a move over $40,000.”

Others focused on the importance of recent resistance levels being just a few days away from moving into weekly and monthly support.

“I’m not sure how anyone could look at this bitcoin chart objectively and conclude that breaking above $32,000 is no big deal,” said crypto and macro analyst Matthew Hyland. argument.

Hyland suggested that bears had few options left open.

“The last line of hope for them is the weekly and monthly closure next,” he concluded.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

NEWSLETTER

NEWSLETTER