Following the last two difficulty increases on the Bitcoin network, another difficulty increase is expected on March 24, 2023. Statistics show that Bitcoin hashrate has remained high despite the last two adjustments, and block times have been faster than the average ten minutes.

Bitcoin difficulty is expected to increase after the last two consecutive increases

As of this writing, Bitcoin’s difficulty is at an all-time high of 43.55 trillion, and the network’s hash rate remains above the 300 exahash per second (EH/s) range at 319 .86 HE/s. Bitcoin is up 26.2% in the last two weeks against the US dollar, which has helped bitcoin miners a lot, and BTCthe current spot value is above cost to mine it.

Bitcoin miners dealt with two in a row increases the difficulty over the past month, with the former jumping 9.95% higher on February 24, 2023, and the latter rising 1.16% on March 10. The increase does not seem to affect bitcoin miners, as block interval times (times between each block being mined) are still less than the ten minute average. Currently, block times range from nine minutes and 28 seconds and nine minutes and 31 seconds.

Currently, the estimated difficulty change for Friday, March 24 is expected to be between 2.51% and 5.7% higher than the current 43.55 billion. If the miners keep up or even pick up their pace, the difficulty after the next adjustment could exceed the 50 trillion hash mark. Current estimates suggest the target range will be between 44.64 trillion and 49.25 trillion.

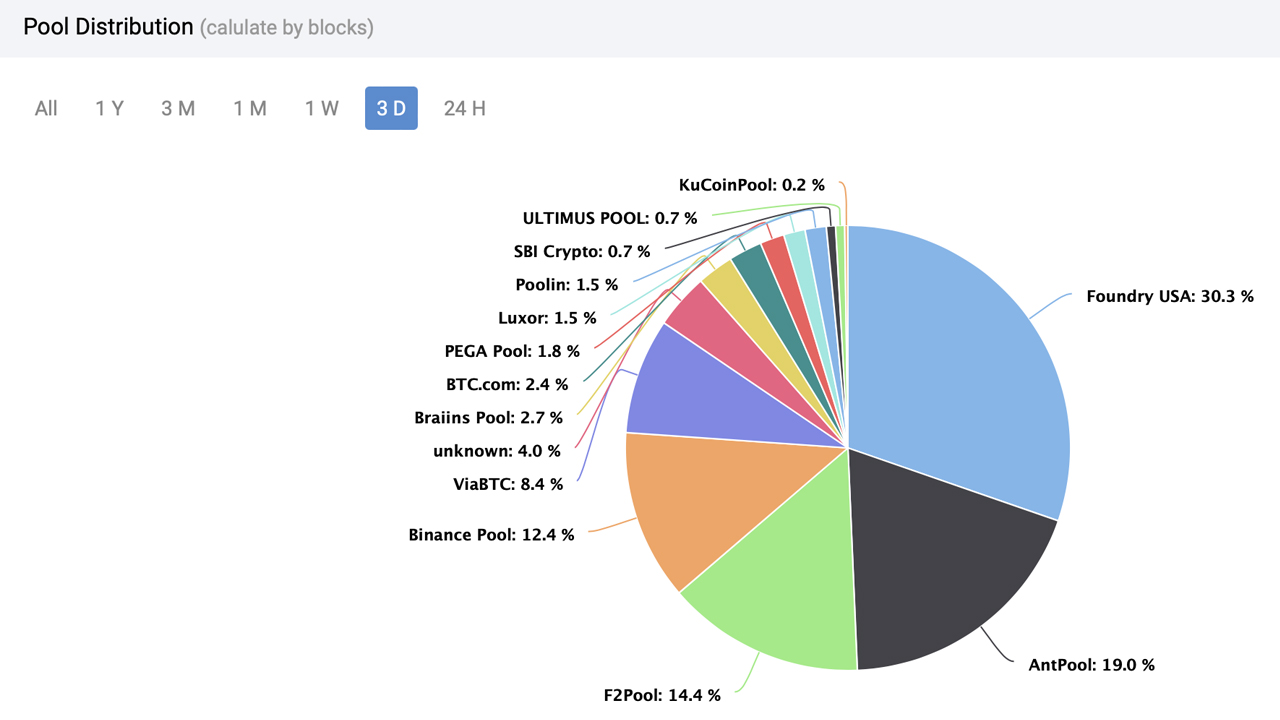

Mining distribution statistics show that Foundry USA is currently the top bitcoin mining pool, with 97.22 EH/s or 30.31% of the global hashrate. Foundry is followed by Antpool with 61.03 EH/s and F2pool with 46.13 EH/s. The top five bitcoin mining pools, including Foundry, Antpool, F2pool, Binance Pool, and Viabtc, control 84.52% of the global hashrate as of March 21, 2023, based on three-day metrics.

What do you think about the expected difficulty increase that will happen in two days? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.