Despite a 9.95% increase last week and the highest difficulty ever, bitcoin’s hash rate has averaged around 305 exahash per second (EH/s) over the past 30 days. According to current data, the hashrate has been around 308 EH/s in the last 2016 blocks. The next difficulty change, which will occur on March 10, is estimated to increase again, as block times have been faster than the 10-minute average, rising from 8 minutes 30 seconds to 9 minutes 41 seconds per block.

The difficulty of the Bitcoin network is expected to increase; The hash price stays above the hash value

Bitcoin’s computational power has remained high despite a 9.95% difficulty increase on February 24, 2023, at the height of block 778,176. Statistics show that on Sunday, March 5, the difficulty is estimated to be increase by more than 3% during the next difficulty target change on March 10. Although the difficulty is staggering 43.05 trillion hashes and the cost of extraction is higher than the current spot value, the range of 300 EH/s or higher has been the norm since the last reorientation.

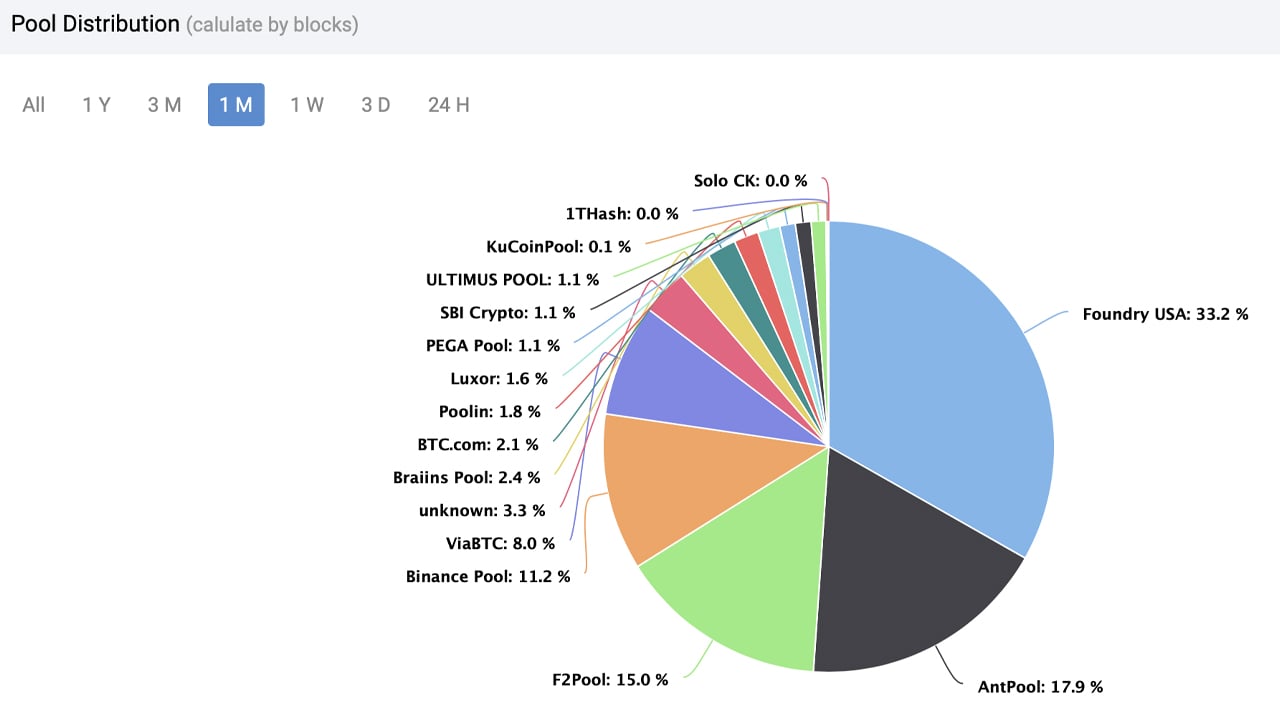

Currently there are more than 60,000 blocks to be mined until the next halving, and in the last 30 days, 4,557 blocks were mined, and Foundry USA discovered 1,514 of them. Foundry controls 34.44% of the global hashrate, or 113.45 EH/s in the past 24 hours. Of the 151 blocks mined, the Foundry discovered 52 and three day statistics show that the pool has acquired 163 blocks.

Statistics for thirty days, three days and 24 hours indicate that Antpool is the second largest mining pool during those periods. Of the 4,557 blocks mined since February 5, 2023, Antpool discovered 815 blocks, representing 17.88% of the global hashrate in one month. Foundry and Antpool were followed by F2Pool (14.99%), Binance Pool (11.24%), and Viabtc (8.03%).

Bitcoin miners have been dealing with minors BTC spot prices as the price has fallen more than 8% in the last two weeks. Miners were earning more fees (the cost of sending transactions) than the ordinal signup trend, as fees increased to 3.5% of the value of a block reward on February 16. Bitcoin network fees it dropped to 1.5% of a block reward four days later.

Data shows that network fees are equivalent to 2.1% of a block reward at the time of writing. Despite the challenges, many bitcoin mining pools have remained strong and have contributed to an increase in the global hashrate. However, the higher cost of production compared to the current spot market price and the continued increase in difficulties may deter some mining operations from participating.

What do you think the future holds for bitcoin miners, given the expected increase in difficulty and the current market uncertainty? Share your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

NEWSLETTER

NEWSLETTER