Amid the dramatic changes that have occurred in the cryptocurrency space following the Halving bitcoin In this case, Bitfinex provides insightful analysis that assures investors that btc market dynamics have remained positive in the post-halving period. Bitfinex examines on-chain data and finds encouraging signs for bitcoin despite the current state of uncertainty in the US economy in its most recent Alpha. bitcoin-prospects-positive-but-geopolitical-risk-a-danger/?utm_campaign=alpha101&utm_source=twitter&utm_medium=social” target=”_blank” rel=”nofollow”>reportwhich was released on April 22.

bitcoin market dynamics remain bullish

According to the Hong Kong-based crypto platform, currency withdrawals from bitcoin They are currently at levels not seen since January 2023. This simply indicates that many investors are keeping their assets in cold storage waiting for price increases.

Additionally, the exchange noted that aggressive selling by long-term investors has not yet caused the usual pre-halving price drop, suggesting that new market entrants are absorbing the selling pressure quite well. highlighting the tenacity of the current bitcoin market structure.

He Bitfinex The Alpha report revealed that the average daily net inflow of spot bitcoin exchange-traded funds (ETFs) is $150 million. With ETF inflows far exceeding the daily btc issuance rate of $30 million and $40 million following the halving, this significant imbalance between supply and demand could encourage further price appreciation.

Bitfinex further states that massive purchases of spot bitcoin ETFs, which have dominated the market narrative all year, may taper off. However, recent ETF outflows have shown that ETF demand may be starting to stabilize.

It is important to note that the recently concluded Halving reduced the miners reward from 6.25 btc to 3.125 btc. As a result, miners are now modifying their operational tactics to sustain their activities in the face of declining rewards post-Halving.

Therefore, the amount of bitcoin that miners send to exchanges has decreased significantly, which may indicate that they are pre-selling or collateralizing their holdings to improve infrastructure. Consequently, this could lead to a gradual increase in selling pressure rather than a sudden drop in value at Halving.

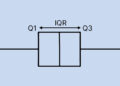

New btc whales outperformed old whales

Since the conclusion of the fourth Halving, on-chain data shows a significant increase in new bitcoin whales. CryptoQuant Chief Executive Officer (CEO) Ki Young Ju x.com/ki_young_ju/status/1782613796852576759″ target=”_blank” rel=”nofollow”>reported development, noting that the initial investment made by the new whales in bitcoin is almost double that of the old whales combined.

According to the data, the total ownership of these new whales, which are short-term holders, is valued at $110.6 billion. Meanwhile, the old whales, who are long-term holders, own a whopping $67 billion worth of btc. This change in whale demographics may affect the future course of bitcoin and the dynamics of the cryptocurrency landscape as a whole.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC's views on whether to buy, sell or hold investments, and investing naturally carries risks. It is recommended that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.

NEWSLETTER

NEWSLETTER