Bitcoin (BTC) market liquidity has fallen to a 10-month low, despite a bullish quarter in terms of price increases. The liquidity drought is partly attributed to the bank run in the United States and ongoing regulatory actions against cryptocurrency companies.

Crypto Liquidity Situation Is Worsening After Bank Fears This Month

I dove into various liquidity metrics to give an update on all things crypto liquidity

First, $BTC liquidity has fallen to 10-month lows as market makers lose access to USD payment rails pic.twitter.com/RwcBEJ8y5Z

—Conor Ryder (@ConorRyder) March 23, 2023

The BTC price has registered a 45% increase in 2023, making it one of the best performing assets. The price gains come amid a looming financial crisis in the traditional financial market, with stocks and bonds experiencing one of their worst years. As the financial crisis has worsened, several banks have collapsed.

The banking crisis has also directly impacted the crypto ecosystem. The collapse of crypto-friendly banks such as Silicon Valley Bank and Signature Bank eliminated important US dollar payment rails for cryptocurrencies, leading to a liquidity crisis, especially on US exchanges.

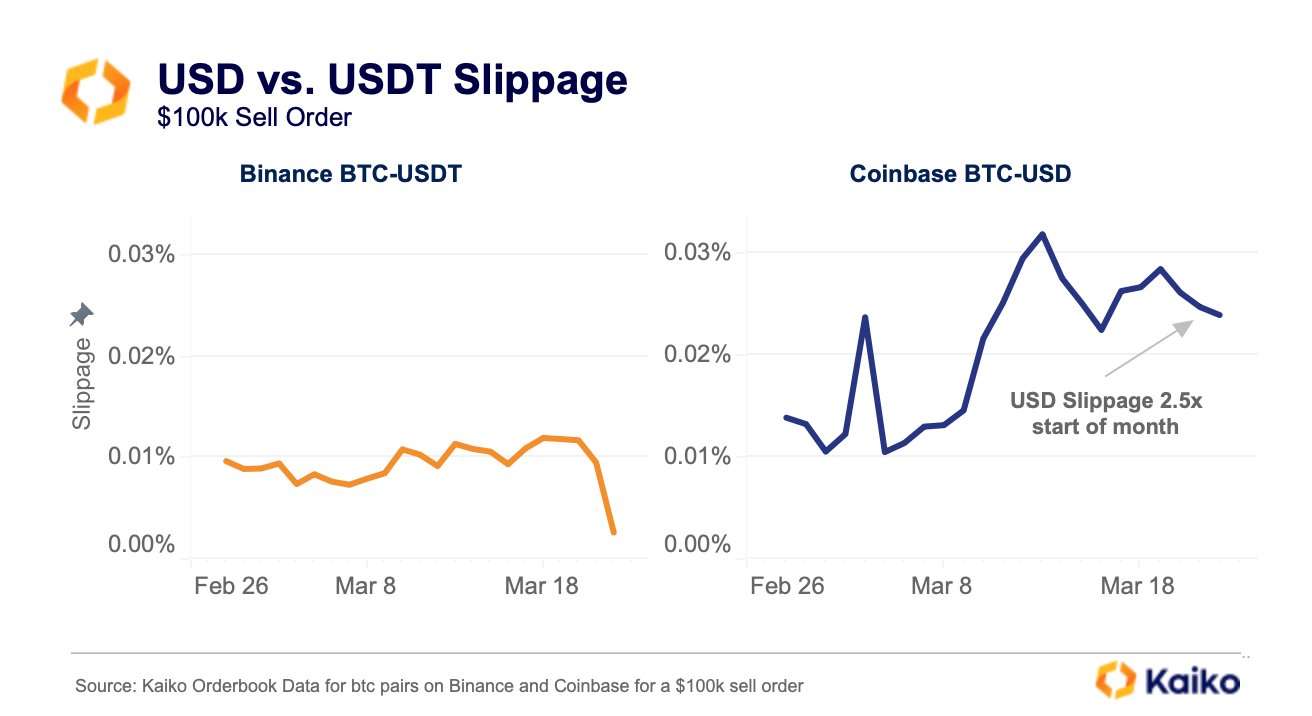

The liquidity crisis has also led to increased price volatility, forcing traders to pay more fees for slippage. Slippage refers to the price difference between the expected price of a transaction and the price at which it is fully executed. For a $100,000 sell order, the BTC/USD slippage on Coinbase increased 2.5x in early March. During the same time period, the slippage of Binance’s BTC/USDT pair barely budged.

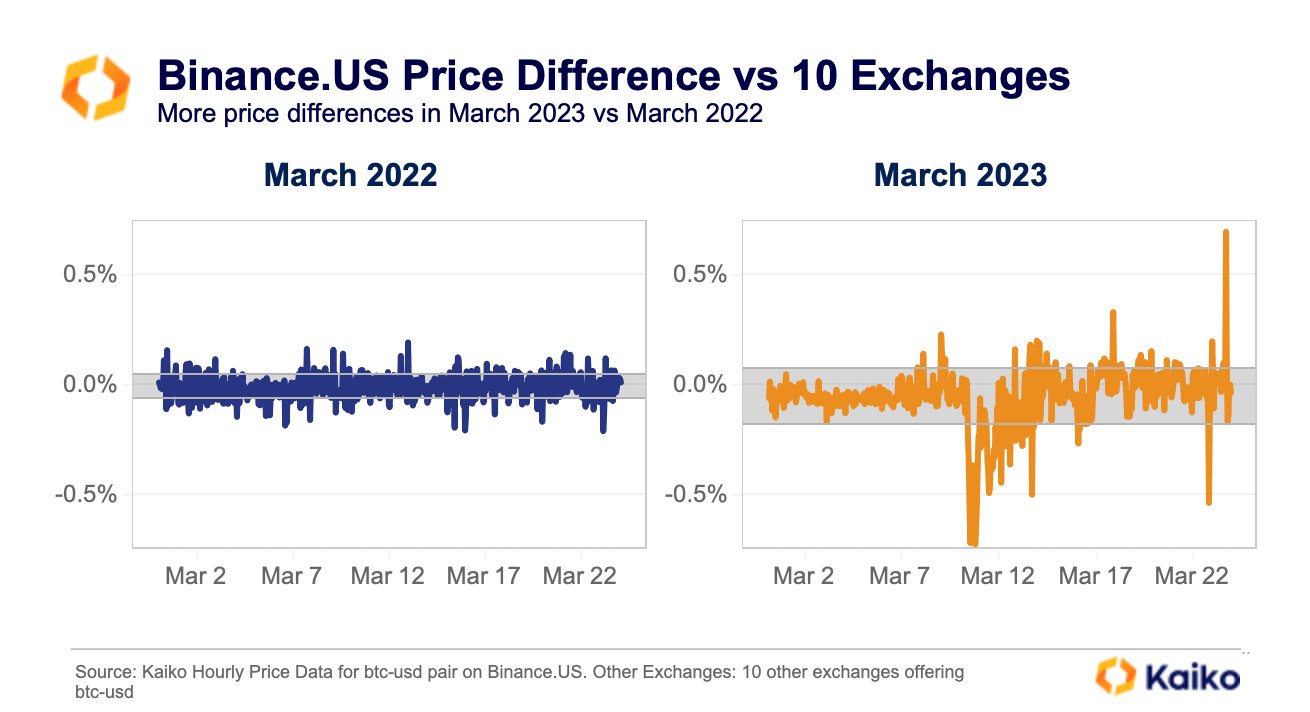

The liquidity crisis has also led to increased price volatility on US exchanges, where the price discrepancy between BTC pairs and the US dollar has increased dramatically compared to non-US exchanges. For example, the BTC price on Binance.US is more volatile than the average price on 10 other exchanges.

Conor Ryder, head of research at on-chain data analytics firm Kaiko, explained the drastic impact of the liquidity crisis on traders and the market. He noted that stablecoins are replacing US dollar pairs and, while it lessens the impact of US banking problems, it has an adverse effect on US liquidity. He added that it would indirectly hurt investors there.